This article is adapted from AQ’s special report on supply chains | Leer en español | Ler em português

Globalization has been the watchword of the last 40 years, credited with boosting economic growth and bringing hundreds of millions out of poverty—while also charged with increasing inequality and destroying jobs and communities. Yet as trade, services, data, people and ideas internationalized, they didn’t do so uniformly or consistently. Some countries and regions did better than others. Latin America, unfortunately, has been one of the losers.

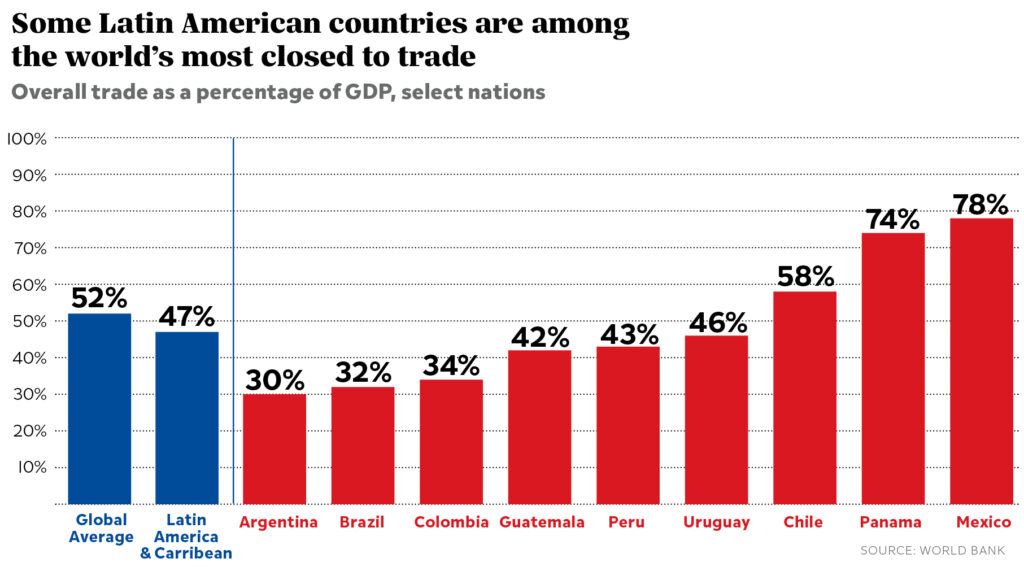

Most of Latin America hasn’t really “globalized” or even internationalized. Brazil and Argentina remain two of the most closed economies in the world, with trade amounting to less than 30% of GDP. Latin America and the Caribbean as a region is a full 11 percentage points below the global average (45% versus 56%) in terms of the importance of trade for their economies, and far from emerging market stars and commercial competitors where trade flows can rival overall GDP in size.

To be fair, only about two dozen nations around the world have truly opened up over the last 40 years, with trade to GDP doubling or more. Still, few of these are in the region: Mexico and Paraguay made this jump, as did Argentina (but only because it started from such a low base). Meanwhile, Colombia, Chile, Guatemala, Costa Rica and much of the Caribbean saw little change in trade’s economic importance. And in Panama, Peru and Venezuela, trade as a percentage of the economy actually shrank during that period.

The international exchanges aren’t particularly inclusive or sophisticated. Over the last 30 years Latin American economies have, on average, gotten less diverse in terms of what they produce. Outside of Mexico, manufactured goods in particular have been hit by what economists call “premature deindustrialization,” or the shrinking of manufacturing as a percentage of the economy and workforce before per capita incomes have adequately risen. Instead, exports from these nations increasingly tend to come from a handful of industries that are less productive or less technologically driven: mining, agriculture and other raw materials (as opposed to processed goods or advanced manufacturing). Even Chile, which has developed significant fish, fresh fruit and wine exports, hasn’t been able to diversify away from minerals and in particular from copper, which still represents over half of what it sends out to the world (though it has managed commodity booms and busts better than its peers).

These economic doldrums stand in stark contrast to nations that were once its peers. Mexico, Brazil and Argentina have been lapped by South Korea, Singapore, Malaysia and Hong Kong, as well as many Eastern European nations. Not coincidentally, many of these countries have closed the wealth gap with the developed world, while Latin America as a whole has remained stagnant.

So what happened? Why hasn’t Latin America been able to thrive in a more connected world? There are lots of reasons, to be sure. Weak governance, inequality, informality and insecurity all play a part. Still, a vital but overlooked factor is the lack of regionalization—the exchange of trade, money and knowledge within Latin America itself. This is where today’s opportunity lies. If Latin American countries can build and expand their links to one another in the new global context that is taking shape in the 2020s, they may yet be able to capture the economic and commercial dynamism that has helped drive growth and prosperity in other parts of the world. But doing so will require significant changes in areas like education, automation and public investments, and in some countries, a change in mentality.

Weak intraregional ties

Scholars of global supply chains, or as they call them “global value chains,” show how being part of international manufacturing and production attracts investment and technology, teaches workers new skills, and enhances managerial capacity. It opens space for local factories and companies to upgrade their processes and make more sophisticated and higher-priced components or goods.

These studies also show that without strong commercial ties to nearby nations, workers and consumers tend to be left on the less productive and less valuable ends of global supply chains, limited to sending out raw materials and bringing in finished products—a reality that sounds all too familiar to Latin American ears. When regional supply chains are limited, these imports tend to have little local content. They compete with, rather than support, domestic suppliers and companies. This diminishes national output and in the longer term caps potential economic growth.

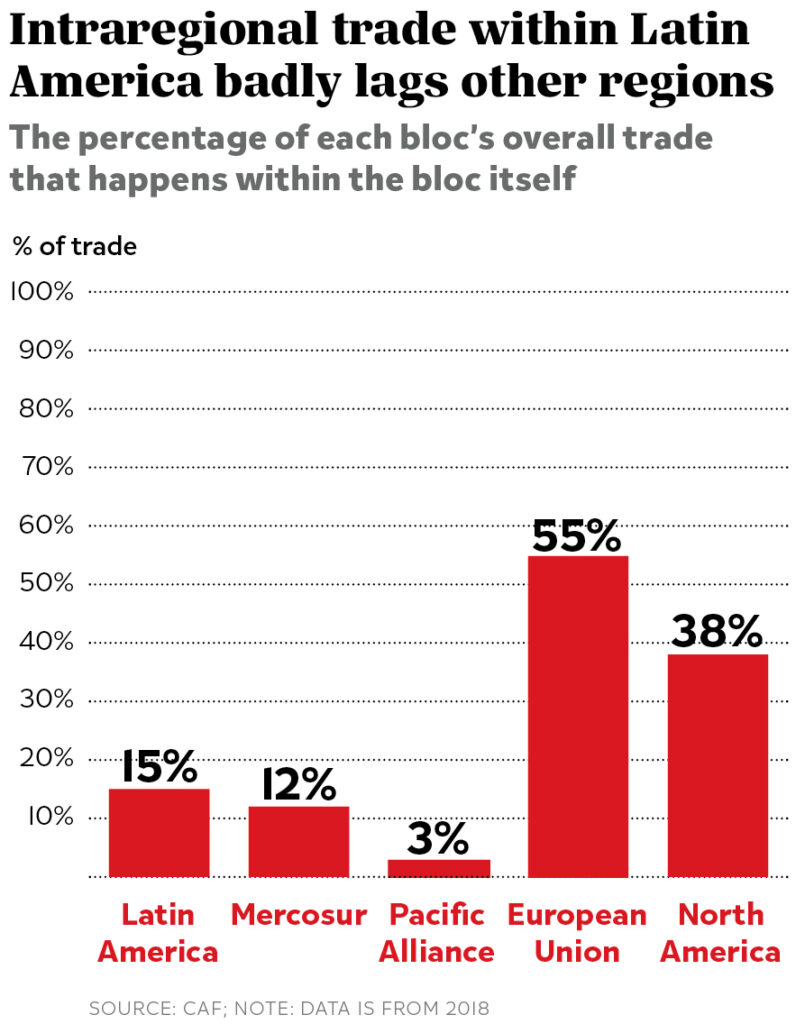

In Latin America, less than a fifth of trade takes place within the region itself. Not coincidentally, these countries have grown more slowly than many other emerging markets with stronger commercial links to their neighbors.

Many reasons keep these economies and businesses siloed and separate. Politics is an important one. Latin America’s leaders have long lauded regional integration, over the years creating well over a dozen multilateral organizations to tout this lofty goal. Yet after decades of photo ops, little has changed on the ground, as leaders have remained too politically divided or too internally focused to put into place policies to nurture a more regional economic approach. Integration remains rhetoric, not reality.

The region’s free trade agreements (FTAs) are too weak or riddled with exceptions to deepen regional flows. When the U.S. signed FTAs, trade with its new partners rose overall and relative to non-treaty countries. Europe, too, saw its regional trade jump after forming the European Economic Community and then later the European Union. Yet in Latin America, trade agreements have done little to increase regional commercial ties in absolute terms or relative to that with other nations.

Mercosur, fashioned as a customs union between Brazil, Argentina, Uruguay and Paraguay, had a decent start in the 1990s, when trade and investment at first outpaced the rest of the world. But by the start of the 21st century, currency devaluations had taken a toll and a proliferation of exceptions, exemptions and non-tariff barriers drastically diminished trade among the partners even as their trade with the rest of the world rose.

The Pacific Alliance, too, stated big integration ambitions. The 2011 agreement between Chile, Colombia, Mexico and Peru eliminated visas and most tariffs, and pushed financial integration by tying together each nation’s stock exchanges. But now, over a decade later, little has changed; trade, financial and community ties haven’t grown apace. The Central American Common Market, Andean Community of Nations and Caribbean Community all similarly failed to spur commercial integration as tariffs and non-tariff barriers remained relatively high, leaving trade and investment ties largely stagnant.

Physical barriers and bureaucratic costs are another set of problems. It is expensive if not infeasible to move things easily between Latin America’s nations. There are just four crossings along the 3,300-mile border between Argentina and Chile, with the only train passing through the northern Socompa Pass. Just one major highway connects the Atlantic to the Pacific in South America through Brazil and Peru. And the Panamerican Highway, which runs from Argentina to Alaska, is fit more for adventurers than cargo carriers, with many stretches unpaved or virtually impassable.

The skies, too, provide limited commercial connections. According to a study by the Development Bank of Latin America (CAF), just one-third of flights connect Latin America’s cities to one another, curbing available cargo space in aircraft holds for regional trade. Logistical hubs around airports often lack warehousing and cold storage facilities, raising costs and limiting the types and amount of goods in transit. Overall, Latin America’s air freight lags all but Sub-Saharan Africa in weight.

Ports, which dot both the Atlantic and Pacific coasts, could help solve some of these problems. But many facilities have been slow to upgrade. Berths are too small for the bigger ships coming through the wider Panama Canal, and cranes too few to load and unload containers speedily. Shipping companies are much more likely to sail in and out of the region than to ports in between, as that extra day or more at dock costs money. Fewer calls at ports make it harder and more expensive to link nations commercially.

Burdensome customs paperwork, sanitary and health checks, and numerous other certifications and inspections layer on further expenses for regional trade. Overall, a report from the Inter-American Development Bank found Latin America’s logistics cost twice as much in time and money as they do in higher-income OECD countries. And, over time, it has become more rather than less expensive to trade with one another, particularly in South America. For companies in the region that do export, it is usually more profitable to go elsewhere.

Mexico is the proverbial exception that proves the rule. Its economy has globalized—trade as a percentage of GDP rose from 22% to 78% between 1980 and 2020. And it has diversified, with advanced manufactured goods such as vehicles, electrical machinery and electronics making up the lion’s share of what it sends out into the world today, avoiding the deindustrialization plaguing South America. Unlike the rest of Latin America, it has indeed regionalized, turning to its North American neighbors.

Latin America has another chance

Many of the forces that left Latin America on the economic sidelines during the last round of globalization are now shifting. Automation is making low-cost labor less of a draw in many sectors, even as aging demographics in China, especially, and Asia more broadly, are raising wages across the Pacific. The pandemic highlighted the vulnerabilities of far-flung supply chains as logistics expenses skyrocketed and unexpected delays multiplied. Climate change, too, is shaking up established transportation hubs and channels as weather events and natural disasters increase in numbers and intensity. Climate pledges are changing business as usual, making the higher emissions of lengthy supply chains costly for multinational companies looking to go carbon neutral. Meanwhile, consumer expectations of ever faster delivery raise the cost of the extra week or weeks of even uninterrupted cross-ocean voyages. Covid-19 and the logistical snarls that ensued during the pandemic accelerated and added to these shifts already underway by driving home the cost and uncertainty of distance.

Just as important, geopolitical tensions are threatening existing production and trading networks. U.S.-China divisions in particular are opening up space for other countries to gain manufacturing market share as multinationals search for alternative suppliers. Russia’s invasion of Ukraine and consequent financial sanctions abruptly cut off a whole set of commercial exchanges, forcing companies to quickly shift sourcing and suppliers.

More broadly, globalization was always a choice, and many nations are no longer embracing it. A good number of policymakers, including those across the political spectrum in the United States, are turning away from free markets, looking to actively shape their economies through a mix of industrial policies including tariffs, export controls, and all sorts of subsidies for sectors deemed strategic. Finding themselves unable to do everything domestically, governments and companies will search for allied alternatives.

As companies and suppliers look for new commercial options, Latin America has advantages that could and should be a big draw. Proximity to the United States is the first, Latin America enjoying a Goldilocks middle for those nervous about spread-out international production: Not too close but not too far.

Add to that preferential access. The United States doesn’t have a lot of FTAs, but those it does have are mostly in the Western Hemisphere. Thirteen nations have the advantage not just of fewer tariffs but also other lowered trade barriers and established rules of the road for intellectual property and arbitration that make it easier and more attractive for international companies to come and invest.

While not what it once was, Latin America also still has a demographic advantage. In China, already more workers are leaving than entering the labor market each year, and the drop-off is accelerating; the government estimates the workforce will shrink by 100 million by 2035. While Argentina, Brazil and Chile have spent much of their “demographic dividend,” working age populations as a part of the whole population on the decline, they don’t face as steep a cliff as many Asian rivals. Others, including Mexico, Peru, Colombia, Bolivia and Central America, still have some years of labor market growth ahead.

And the region starts in a strong initial position in the green transition. Over half of the electricity produced already comes from clean sources, and many nations are blessed with abundant sun, wind and geothermal reserves. The next commodity super cycle will lean green and the region is bountiful in lithium, copper, graphite, cobalt, nickel, manganese and other minerals essential for these technologies. Latin America has the potential to be an answer for multinationals looking to meet climate pledges and reduce their global carbon footprints.

Yet the region has work to do to turn the current possibilities into realities. To start, it needs a fundamental shift in mindset. This means moving away from 20th century resource nationalism and embracing the 21st century green transition. It means upgrading traditional industry and industrial relations to encompass and promote technological adoption, adaptation and innovation. It means leaving behind protectionism and opening to the world. And it means finally deepening commercial and business ties within the region.

This should start by protecting and building upon its clean energy bonafides. At the moment, Latin America’s two biggest economies are going in environmental reverse. Mexico is doubling down on fossil fuels unlike almost any other nation around the globe, including OPEC members, ensuring its electricity supplies will be dirtier and less reliable for consumers and manufacturers in the future. Brazil’s deforestation has made it an international ESG pariah, leading many existing investors and companies to cut financial ties and end commercial sourcing, and discouraging others from coming. To attract businesses and buyers, this has to change.

Whether on the shop floor, in the warehouse or at the office, Latin America needs to automate. As mechanization sweeps across global factories, those in Latin America need to do the same. Here the region lags far behind: Mexico, Argentina and Brazil count just tens of thousands of robots in action, mostly in automotive and machinery industries, while their economic rivals boast many times more across many more industrial and commercial sectors. In South Korea and Singapore, robots now add 5% or more to the overall workforce.

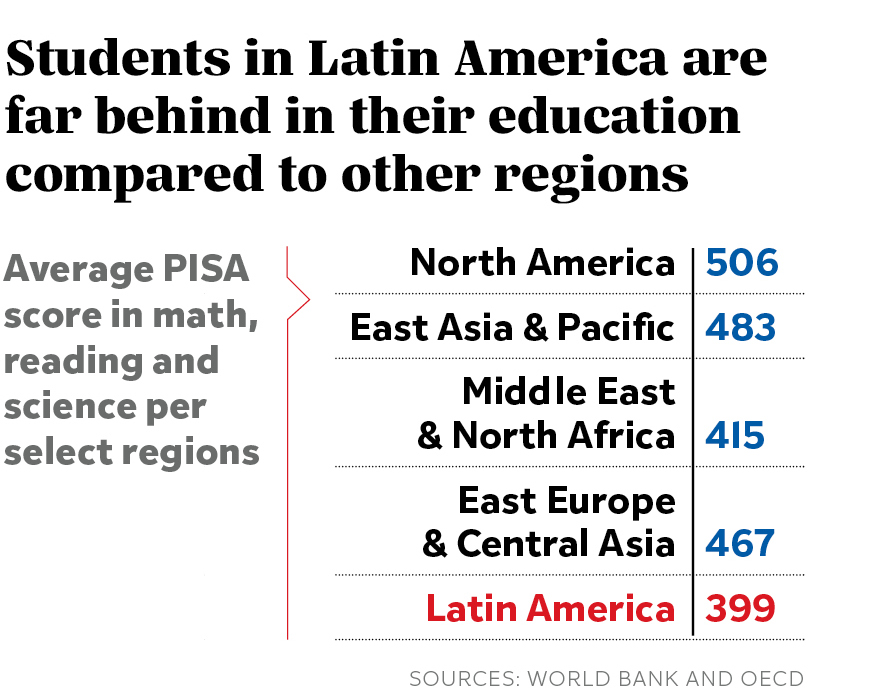

Schooling, too, needs to change to meet the needs of a 21st century workforce. Despite significant setbacks during the pandemic, over the last 30 years Latin American nations did a good job of getting kids into schools and keeping them there longer. The challenge remains what they are, or are not, learning. On international tests such as the Programme for International Student Assessment (PISA) administered by the OECD, students in the region trail those in Asia, Eastern Europe and the Middle East in math, science and reading.

World Bank surveys show the skills gap between employer needs and worker capacity is the worst in the world, with a particular scarcity of engineers and production technicians, as well as those working in manual trades and sales. These are categories multinationals looking to relocate a portion of their supply chains will need to fill. They are also skills domestic firms need to make more sophisticated inputs and components to feed into international production chains. A lack of local talent pools will limit international corporations from relocating and national ones from supplying them.

Strengthening regional ties

Overall, governments need to encourage trade. Numerous studies by the World Bank and International Monetary Fund calculate that increasing international commerce boosts economic growth. For more closed economies, including Brazil and Argentina, GDP could grow by over 1 percentage point a year if their economies opened more.

Only 24,000 of Brazil’s 4 million legal firms send goods or services abroad. In the rest of South America, the numbers are just as stark. Mexico is only slightly better, with far less than 1% of its businesses connected internationally.

Firms that export tend to pay better, last longer and be more productive—economic and commercial qualities in too short supply today in Latin America. And Latin America has niches to exploit, including more processing of the minerals and other commodities it mines, expanding into organic vegetables and prepared foods, and forging specialized alloys and steels. Many nations have strong chemical, pharmaceutical, manufacturing and software bases to build upon and scale.

As they look outward, they shouldn’t look only to faraway shores. Latin America suffers from weak regional networks of manufacturers, parts makers, service providers and logistics operators. But by buying and selling more from and to each other, Latin American companies would help ensure more production and jobs are created within the region rather than outside of it. That would also increase the chances of technological adoption and adaptation, of labor specialization and advancement, of industrial learning and innovation, and of economic diversification and development. Regionalization has helped many Asian and Eastern European nations climb the socioeconomic ladder; it could do the same for Latin America.

At a recent high-level international economic forum in Panama, panelist after panelist laid out the once-in-a-generation opportunity to reform, revive and revitalize Latin American economies and workplaces that the current fluidity in global sourcing and production offers. But few saw Latin America doing much to grasp the moment. Without big investments in infrastructure, skills and training, without a push to automate and green their economies, and without significant actions to deepen regional commercial ties, this round of global change will also pass Latin America by.