BOGOTÁ— Colombia’s Congress is discussing a sweeping constitutional reform that would increase revenue transfers to municipalities and departments, fulfilling a long-sought aspiration by mayors and governors for further autonomy and decentralization in the country. Most lawmakers and local authorities support the proposal, but despite the enthusiasm, the reform risks placing the nation’s fiscal accounts on an unsustainable path.

The bill, proposed by a coalition of senators earlier this year, has already passed seven of the eight debates required under Colombia’s constitution. Barring unforeseeable issues, it will probably be approved soon, representing a much-needed political victory for embattled President Gustavo Petro and his administration. The government is also working with lawmakers on additional proposals such as health, fiscal, and political reforms, which are also advancing toward potential legislative approval.

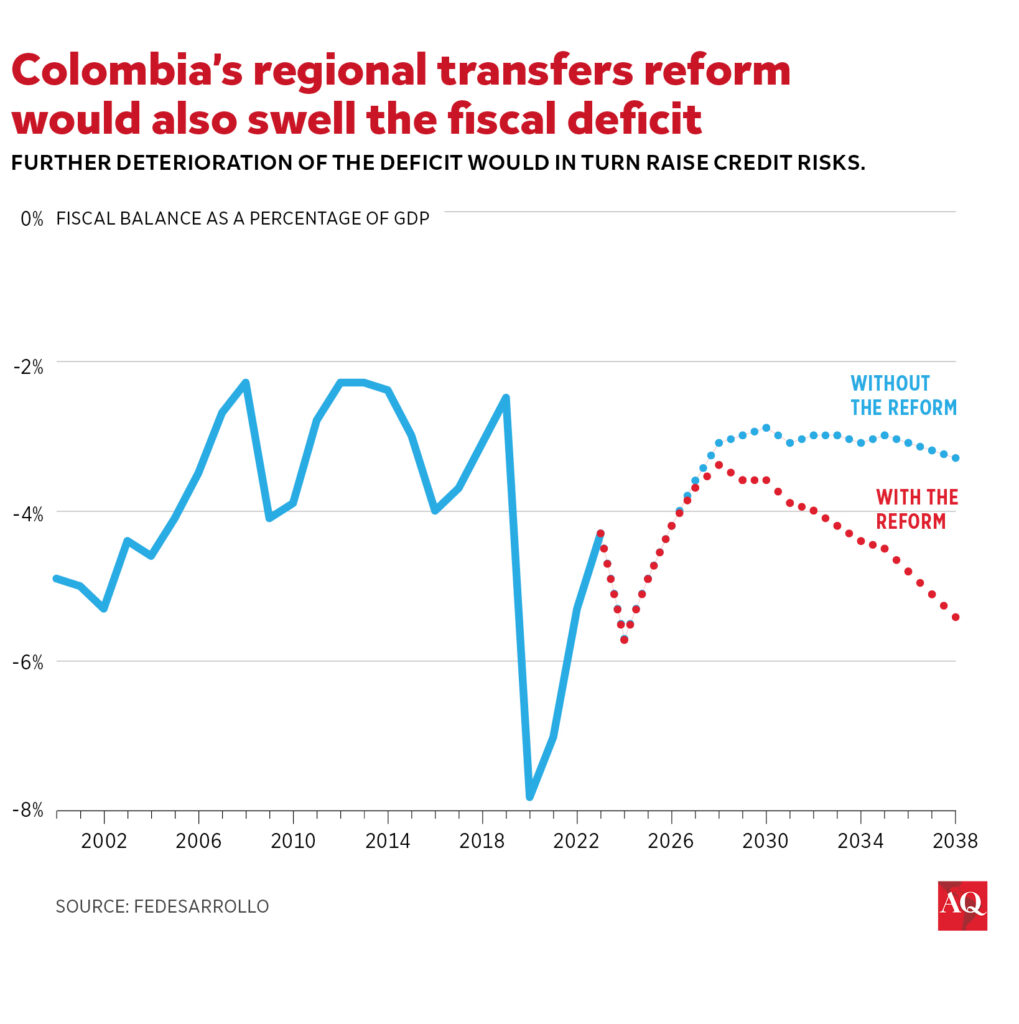

In a nutshell, the proposal seeks to increase transfers from 23.8% of current government revenues to 39.5% over the next 12 years, bringing Colombia closer to Brazil and Argentina, the nations with the largest subnational government spending in Latin America and the Caribbean. But this substantial increase will imply an additional expenditure of 2.1% of GDP on top of a baseline increase of 1% already programmed for the medium term.

Petro’s government, particularly the Interior Minister Juan Fernando Cristo, has openly supported the reform under discussion. In late October, to defuse the growing criticism of the bill, Cristo argued that “people are fed up with centralism” and blamed technocrats as “centralizers” who are out of touch with the reality of the regions.

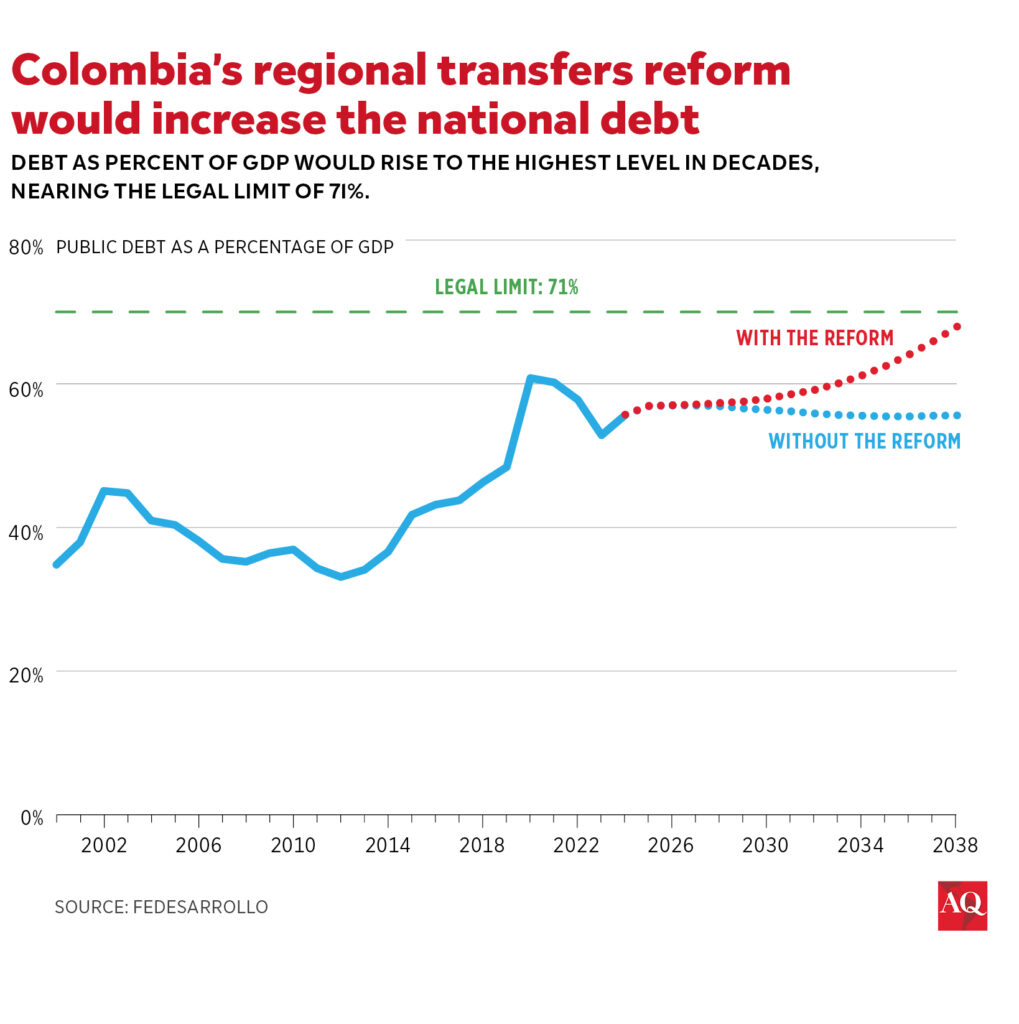

However, the reality of Colombia’s fiscal arithmetic is inescapable. A gradual 2.1% increase in government expenditures would expand the budgetary deficit progressively, reaching 5.4% of GDP—up from 3.3% in the baseline scenario. Meanwhile, the public debt, rather than stabilizing at around 55% of gross domestic product in the medium term, would increase to approximately 68%, nearing Colombia’s fiscal rule limit of 71% of the nation’s GDP.

This adds further strain to an already fragile fiscal position. Colombia lost its coveted investment grade rating in July 2021; from that year to 2024, the budgetary deficit averaged 5.6% of GDP. As reflected in its credit default swaps, nowadays, the country faces a higher risk perception than Brazil, Chile, Mexico, and Peru. Before COVID-19, Colombia’s credit risk was comparable to Mexico’s, significantly lower than Brazil’s, and only higher than Chile and Peru’s. In short, markets have taken note of Colombia’s slow pace in fiscal adjustment and are likely to react further if this reform passes in its current form.

To make matters worse, fiscal pressures are mounting rapidly. Tax revenues have declined by 13% in real terms this year, the largest drop in decades. Additional pressures are also weighing on the health system, partly due to a poorly designed health reform that has been partially implemented through administrative measures. This year’s pension reform will take effect in 2025, further constraining an already limited fiscal space. The swift progression of the transfers reform has led to currency depreciation and an increase in interest rates.

What Should Be Done?

Governors and mayors have a legitimate claim regarding the insufficiency of current transfers. Their responsibilities in areas such as education, health, and infrastructure investment, among others, have grown, while transfers have decreased in recent years. These issues must be addressed without jeopardizing the sustainability of public finances.

A recent analysis by Fedesarrollo estimates that around 1.2% of GDP in national government expenditures—particularly in health and education—could be reassigned to local governments without negatively affecting the central government’s fiscal balance. This suggests that a transfer share of about 30% of current revenues, while challenging, would likely be manageable within the current fiscal space. Any amount higher than that would put undue pressure on the public finances.

However, increasing transfers alone is not enough. The reform overlooks key issues such as boosting local governments’ revenue generation, building institutional capacity, and enhancing transparency in executing local budgets.

Regarding fiscal autonomy, the average share of transfers as a percentage of total revenues is 75% across Colombia’s 1,102 municipalities. In contrast, Bogotá, the nation’s capital, has a transfer share of only 25%, primarily due to local property taxes. This suggests that there is significant room for improvement in local tax collections. This will require streamlining existing local tax instruments and delegating most of the national cadaster agency’s responsibilities to local authorities, as is the case in Bogotá.

This also ties into local institutional capacity. Delegating national responsibilities to local authorities requires a differentiated framework: Some responsibilities should be immediately transferred to high-capacity municipalities, such as the main capitals, while others should be transferred only upon meeting specific capacity-building criteria, which the national government should, in part, support.

Improving transparency

Finally, strengthening transparency in public procurement is crucial. Allocating more resources without enhanced transparency and proper checks and balances could result in corruption and wasteful spending. This issue affects both local and national governments. What truly matters to local citizens is not simply the size of the transfers but whether taxpayer money is being spent efficiently and effectively.

The constitutional reform on territorial transfers has sparked a vital debate about decentralization and local autonomy in Colombia. However, it started in reverse—defining a transfer share before assessing feasible expenditures for reassignment to local authorities. Reducing the proposed transfer share from 39.5% to 30% would still increase transfers by approximately 1.2% of GDP, addressing regional needs while safeguarding fiscal health.

As Congress continues this discussion, prioritizing measures to improve local capacity and revenue generation alongside carefully calibrated decentralization would enhance the reform’s fiscal sustainability. Lawmakers should heed these warnings and responsibly balance the decentralization goals with the fiscal sustainability of a country needing cautious management amid an ever-changing global environment.