MEXICO CITY — Despite widespread concerns, President Andrés Manuel López Obrador’s judicial reform was enacted and is here to stay. Beyond its troubling domestic implications—particularly regarding the erosion of the separation of powers—the new law casts a looming shadow over Mexico’s bilateral relationship with the U.S. It also presents a significant and immediate challenge for President-elect Claudia Sheinbaum.

This will hardly be a fresh start. The specter of the judicial reform led U.S. companies to freeze an estimated $35 billion in investment projects, and Ken Salazar, the U.S. ambassador to Mexico, voiced concerns about the potential negative impact on the nation’s democracy and the $807 billion bilateral trade. Several international and local banks cautioned about the potential adverse effects on investments in the country and the overall economy. These collective expressions underscore broader apprehension that the reform could drag U.S.-Mexico relations when Sheinbaum’s term begins on October 1. Also relevant is López Obrador’s decision last month to put ties with the U.S. embassy on “pause,” an ambiguous maneuver that signals deeper tensions while devoid of formal diplomatic meaning.

For Sheinbaum, steering Mexico through these complex waters is not just a matter of governance but a pressing necessity. As she inherits a bilateral relationship fraught with uncertainty, clear and decisive actions at the outset of her term will set the tone for her leadership. As Sheinbaum will seek to preserve economic stability and Mexico’s standing as a vital and reliable trade partner for its northern neighbor, her administration’s success may depend on this crucial relationship.

While technically not a renegotiation, the upcoming review of the USMCA in 2026 introduces an additional layer of complexity. The legal uncertainty arising from an unpredictable judicial system that might be influenced by domestic political maneuvers conflicts with the trilateral trade agreement. Equally troubling are other constitutional amendments still to be discussed, such as the dissolution of Mexico’s autonomous agencies, which threaten to further erode the nation’s democratic path. Institutions tasked with overseeing economic competition (COFECE) and telecommunications (COFETEL) will be front and center in pending reforms. How President-elect Sheinbaum intends to address these delicate issues remains uncertain.

To be sure, additional tension is coming from across the border. Nationalist rhetoric in U.S. presidential campaigns signals a potential shift in the country’s trade policy. Republican and Democratic candidates have shown a tendency toward protectionism, which could impact trade and the investment environment. Vice President Kamala Harris, who previously voted against the USMCA, is likely to prioritize labor and environmental standards, while former President Donald Trump advocates for reshoring and threatens to impose tariffs on Mexican products.

A stormy horizon, positive future

In the middle of the current tensions, the “nearshoring” that Sheinbaum and her close advisors have often touted as a crucial strategy for Mexico’s economic growth could quickly turn into “reshoring,” relocating supply chains back to the U.S. Such a shift could result in higher operational costs, reducing the competitiveness of American finished goods in global markets and potentially driving up inflation in the U.S. There will be an internal debate between the future U.S. administration and the American productive sector. Washington will want to prioritize local investment, while companies will focus on competitiveness. Although governments may not directly control corporate investment, they can erect trade barriers and provide fiscal incentives for companies to remain on U.S. soil.

For Mexico, this should be a wake-up call to the importance of the stability and predictability that investors seek. Stabilizing and strengthening the bilateral relationship is essential for Mexico’s interests and pivotal to Sheinbaum’s political success.

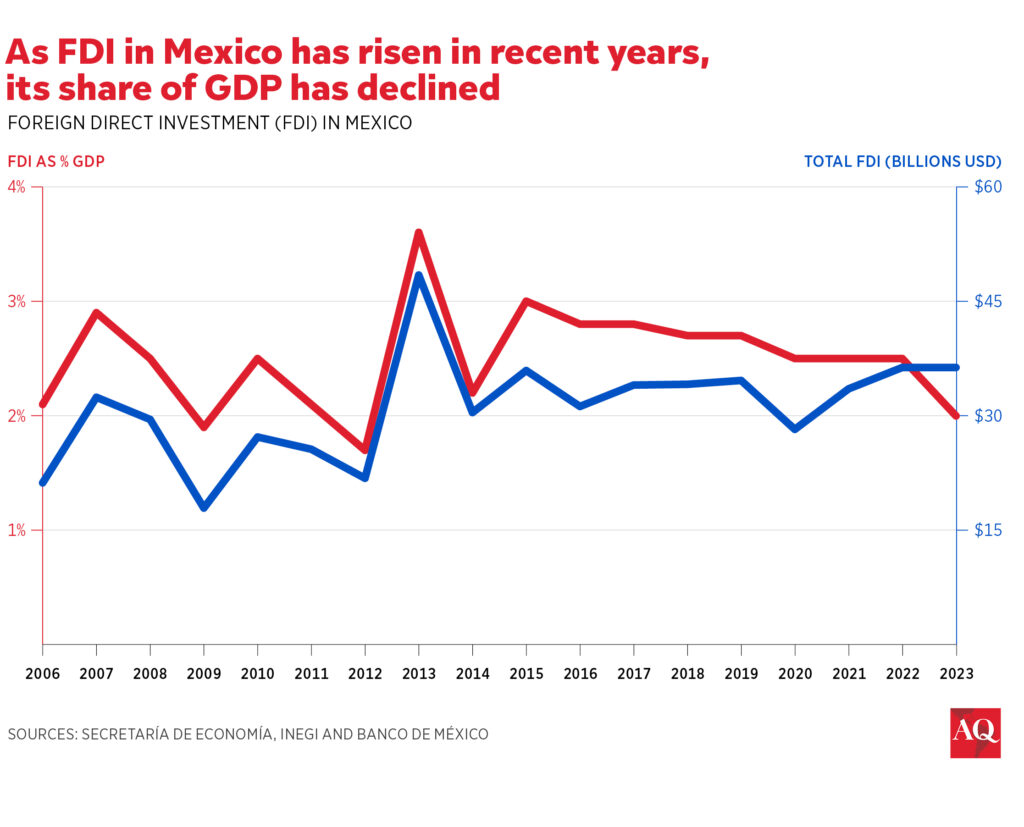

While 44% of Mexico’s FDI comes from the U.S., 36% of this investment goes to manufacturing, the most significant sector in the Mexican economy. Additionally, millions of jobs on both sides of the border depend, directly or indirectly, on bilateral trade.

Even though trade between Mexico and the U.S. is at an all-time high, the current political landscape pressures bilateral trade. Beyond the rhetoric, the reality is that the U.S., as Mexico’s largest trading partner, cannot afford to sever economic ties without risking significant disruption. The tightly interwoven supply chains that define North American trade are essential to the region’s economic well-being. This interdependence is particularly crucial as the U.S. faces increasing competition from China, making the stability of the U.S.-Mexico relationship vital for both nations’ strategic interests.

Despite the current storm clouds, the case for a positive future in Mexico-U.S. relations remains compelling. Both economies are deeply intertwined: Mexico became the top trading partner for the U.S. in 2023. The mutual benefits of this integration cannot be overstated: approximately 80% of Mexico’s exports to the U.S. are intermediate goods crucial to American manufacturing’s global competitiveness, and a significant proportion of these are produced by U.S.-owned companies operating in Mexico.

The ongoing Otay Mesa II port of entry project at the U.S.-Mexico border is a highly positive development for the region. Also relevant are recent investments by companies like AWS in Querétaro, showing confidence in Mexico’s role as a continental hub for technology and nearshoring. The $5 billion data cluster project, set to begin operations in 2025, exemplifies how Mexico can leverage its geographical advantage and trade agreements to attract significant foreign investment.

Sheinbaum’s strategic choices

Amid ongoing bilateral tensions and regardless of the outcome of the upcoming U.S. election, Sheinbaum will significantly strengthen Mexico-U.S. relations to protect and promote strategic interests. While she has consistently emphasized the importance of FDI and has appointed experienced individuals in her cabinet, this alone will not suffice to reassure trade partners.

The first female president of Mexico needs to distinguish her administration from that of her predecessor; secondary laws related to judicial reform could play a crucial role in this differentiation. However, she will also need to make additional efforts to address investor concerns, send clear signals of stability, and align more closely with international trade obligations. Prioritizing diplomatic engagement, built on mutual respect and trust, will be vital in sending the right message.

Mexico is exceptionally positioned to capitalize on today’s global geopolitical turbulence. Apart from Canada, no other nation can access the U.S. market without crossing an ocean or traversing Mexican or Canadian territory. However, what seemed merely weeks ago to be a promising start for the Sheinbaum administration has now been undermined by López Obrador’s end-of-term revanchist maneuvers.

In a world where global alignments are in flux, and the pressures of national politics often threaten to disrupt longstanding partnerships, Sheinbaum’s challenge is clear: to steer Mexico toward a path of stability and growth, ensuring that the clouds of uncertainty do not overshadow the shared benefits of cooperation. As she charts her course, Sheinbaum has the potential to redefine Mexico’s role on the global stage, fostering a future where Mexican interests prevail over political posturing and where the U.S.-Mexico relationship continues to thrive amid changing times.