This article is adapted from AQ’s special report on food security in Latin America

SANTIAGO — Nearshoring has been front of mind for investors and policymakers in Latin America for a few years now. But we are still in the process of figuring out which countries are best suited to take advantage of the historic opportunity presented by this renewed fragmentation, or “regionalization,” of the global economy.

Early evidence suggests the following: Distance is a key consideration—but even countries relatively far from the United States are poised to benefit. Other factors, such as respect for property rights, stability of the financial system and overall political stability, are also of paramount importance. As a result, countries such as Uruguay, Chile, Costa Rica and Brazil may have an underrated opportunity to participate in nearshoring, illustrated by a “ranking” table we have included later in this article.

First, a look at recent history helps explain why the current opportunities are so tantalizing—if our countries can seize the moment.

The ebbs and flows of global trade

Globalization surged during the decades following World War II, with trade increasing from 20% of global GDP in the postwar era to nearly 60% just before the global financial crisis of 2008-09. That crisis marked the onset of a stagnation in trade growth, and initiated a trend of deglobalization. By 2018, global trade still hovered below 60% of GDP, but escalating U.S.-China tensions further slowed trade volumes as tariffs surpassed 20% by late 2019.

The COVID-19 pandemic added new disruptions. The resulting drop in global trade (-5.3%) was less severe than in 2009 (-12.6%) and the recovery was quicker. However, the crisis exposed vulnerabilities in global supply chains, as delays, shortages, and higher costs drove companies to reassess sourcing strategies. Post-pandemic recovery was quickly complicated by geopolitical conflicts, such as the Russia-Ukraine war, the crisis in the Red Sea, the conflicts between Hamas and Israel and Iran and Israel, and tensions between China and Taiwan. These conflicts not only created humanitarian crises, but also disrupted global supply chains, affecting the availability and prices of essential goods.

The Russia-Ukraine war, involving two of the world’s largest wheat exporters, led to an over 80% surge in wheat prices and a 25% rise in corn prices between December 2021 and May 2022. Conflicts in energy-producing regions, such as the Middle East and Eastern Europe, also raised oil prices and their volatility. The Russian invasion of Ukraine drove Brent crude to its highest price in seven years, while Hamas’ attack on Israel led to a 4% price increase in a single weekend.

These events also disrupted global trade routes. Attacks in the Red Sea reduced traffic through the Suez Canal, which handles around 15% of global maritime trade. Consequently, several shipping companies rerouted vessels around the Cape of Good Hope, increasing delivery times by an average of 10 days or more and impacting companies with limited inventories. Rising transport costs made shipping goods from distant locations more expensive and less predictable. The need to use more costly and less efficient alternative routes has increased maritime shipping costs, as evidenced by the Drewry WCI index for 40-foot containers. This remains 43% below the pandemic peak in September 2021 but 318% above the average rates of 2019 (pre-pandemic).

Geopolitical conflicts have amplified economic fragmentation and reshaped trade dynamics. Pandemic-driven product shortages fueled calls for relocating or renationalizing supply chains. Recent conflicts have emphasized the need for resilience over cost efficiency and advocating strategies like reshoring and nearshoring. This shift poses critical questions about who will bear the brunt of these trends and how they will specifically impact Latin American countries.

Reshoring, nearshoring

In a global landscape increasingly defined by geopolitical uncertainty and the vulnerability of supply chains, reshoring and nearshoring strategies have emerged with unprecedented significance. These approaches aim to redefine the production and distribution of goods by relocating industrial operations either back to the home country (reshoring) or to nearby countries (nearshoring). Their objectives include mitigating risks, enhancing resilience, and streamlining response times to global market disruptions.

Reshoring involves relocating business operations back to the company’s home country. It can therefore raise costs related to labor, production inputs, and regulatory compliance, potentially reducing efficiency and competitiveness despite savings in transportation. Meanwhile, nearshoring involves relocating business operations to a nearby country, generally within the same region or continent as the company’s home country. This strategy leverages geographical proximity to enhance efficiency, improve communication and coordination, reduce costs, and mitigate offshoring risks. Geographical proximity facilitates supply chain management by reducing transit times, transport costs, and political or economic instability risks in far-off regions. It also allows for better supervision and quicker production adjustments in response to market changes.

However, while transport costs decrease, labor and production costs in nearby countries can be higher compared to more distant ones, potentially sacrificing competitive advantages associated with overseas production. The success of nearshoring heavily depends on nearby countries’ labor, infrastructure, regulations, bureaucracy, and stability—social, economic and political.

Unlike reshoring, nearshoring affects both the company’s home country and potential nearby destinations. Thus, this strategy offers Latin America a unique chance to become a competitive alternative for companies seeking to diversify their supply chains.

Which countries could benefit most from nearshoring?

Nearshoring could offer the advantages of lower production costs compared to domestic markets, without the drawbacks of long-distance offshoring. Furthermore, the growing focus on building resilient value chains and geopolitical shifts in many advanced economies is likely to diversify supplier locations. But which countries are attractive as nearshoring destinations?

LATIN AMERICA’S NEARSHORING RANKING

Geographic proximity to industrial centers is crucial in this strategy. Thus, several Latin American countries are emerging as prime destinations for nearshoring. The Inter-American Development Bank (IDB) estimates that nearshoring could boost annual exports of goods and services in Latin America and the Caribbean by close to $78 billion in the medium term. The automotive, textiles, pharmaceutical, and renewable energy industries, among others, have strong potential.

According to the IDB, Mexico emerges as the leading destination due to its proximity to North America—with $35 billion of that expected boost potentially set for Mexico. But while the projected volume for Mexico is substantial, countries like Brazil, Argentina, Chile, and Colombia also show potential as nearshoring destinations. As indicated by IDB data, they are projected to reap one-quarter of the total wins, equivalent to almost $20 billion.

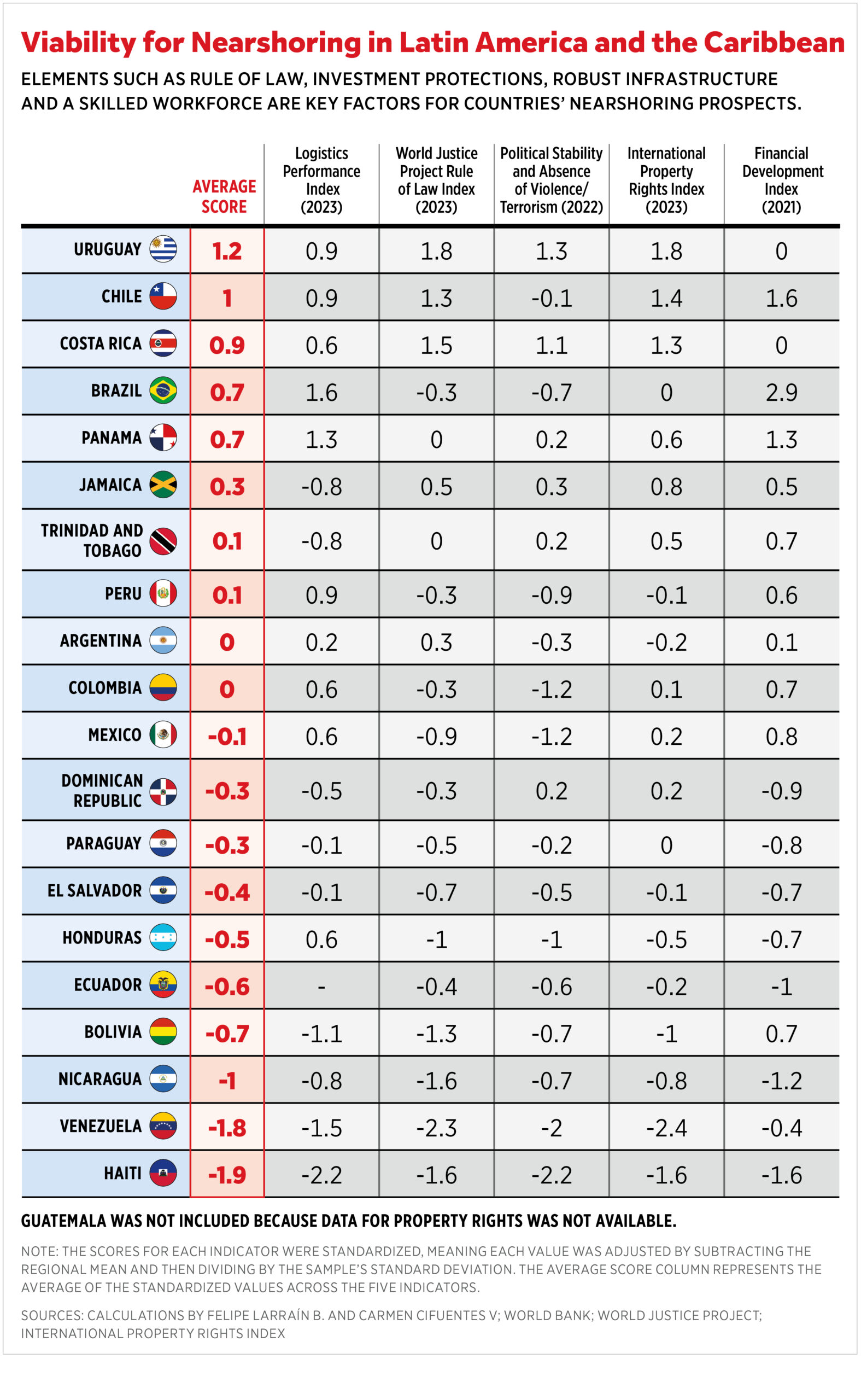

While proximity to a major consumer market like the U.S. is a significant advantage, it is not the sole factor that determines a country’s appeal for nearshoring. Critical elements such as rule of law, investment protections, robust infrastructure, and a skilled workforce are critical in relocation decisions.

We gathered a variety of data to try to quantify which countries in Latin America offer the best opportunities for nearshoring. The inputs came from publicly available indices and other sources, including the World Bank and the World Justice Project. We standardized the scores for each indicator, and then divided by the sample’s standard deviation to come up with an average score for 20 countries in the Western Hemisphere.

The results, visible above, highlight how countries relatively distant from the United States are still attractive nearshoring destinations. For example, Chile ranks among the top five nearshoring prospects. Its strengths include better adherence to the rule of law, greater property rights protection, and a more developed financial system compared to Mexico and the regional average, making it a competitive nearshoring option. Other countries that also perform better than Mexico in these key factors include Brazil, Argentina and Colombia.

The countries mentioned also boast strong competitive advantages in high-potential industries. Brazil’s automotive sector, bolstered by a large domestic market and Mercosur membership, is a prime nearshoring hub for automakers seeking proximity to North America. Its leadership in biofuels and expanding renewable energy sectors further aligns with global shifts toward greener technologies, enhancing Brazil’s position as a major energy exporter. Argentina’s vast “Vaca Muerta” shale reserves make it a top choice for nearshoring natural gas production, strengthened by its trade agreements with North America. Similarly, Colombia’s rising natural gas output and strategic location provide direct access to North American markets, reducing reliance on distant suppliers.

Potential benefits from nearshoring

Nearshoring reduces reliance on international suppliers, shortens delivery times, cuts transportation costs and risks, and enables more efficient oversight of production processes. However, what are the benefits for the host country?

The foremost advantage is the attraction of foreign direct investment (FDI), which can significantly boost infrastructure, technology and human capital. Indeed, the current nearshoring trend has already driven a substantial increase in FDI across Latin America. Many industrial companies expect demand to rise between 2024 and 2025, with benefits fully realized after 2026. This is a reasonable timeline, as relocating industrial production lines is a complex and time-intensive process, involving infrastructure development, plant construction, securing permits, workforce acquisition, company registration, and other preparatory steps.

Nearshoring’s impact extends beyond a single country, promoting regional trade and economic growth.

Nearshoring also creates new employment opportunities across sectors like manufacturing, technology and specialized services. It also integrates host countries into global supply chains, enhancing their significance in international trade. Additionally, nearshoring introduces advanced technologies and management practices, enabling host countries to build their own production capabilities. This often leads to investment in critical infrastructure such as ports, airports, roads and telecommunications.

Nearshoring’s impact extends beyond a single country, promoting regional trade and economic growth. For example, Mexico’s increased manufacturing could boost demand for raw materials and inputs from countries like Brazil, Chile or Argentina. Additionally, success in one country could inspire others in the region to improve their business environments, infrastructure, and regulatory frameworks to attract investment. This would foster competition, driving up standards across the region.

How to take advantage of nearshoring?

Proximity to the U.S. and North America alone will not guarantee that Latin American countries fully capitalize on future relocation opportunities. To attract FDI and strengthen their global position, the region must foster a more favorable business environment and improved commercial infrastructure.

To take advantage of this trend, countries should enhance their business climate, as each dollar spent on investment promotion yields nearly $42 in FDI, according to the IDB. Also, modernizing regional integration to reduce trade frictions and enhance competitiveness is essential. Despite numerous trade agreements among LAC countries, the region’s integration into international trade and global value chains remains limited. Harmonizing the more than 33 preferential trade agreements within the Americas could increase intraregional trade by more than 10%.

In addition, elements like the rule of law, investment protections, and tax considerations are crucial in determining relocation decisions, providing the certainty investors seek (and need). To enhance long-term attractiveness, the region must also ensure a qualified labor force through appropriate education and training policies. This is key to maximizing the benefits of incoming investments.

Host countries must also assure foreign investors that their intellectual property, business interests, and operational investments will be protected and effectively managed. Nearshoring, as part of the deglobalization process, is likely to reduce overall economic efficiency and growth. Nonetheless, some regions can significantly win from this. If appropriately complemented by domestic and regional policies, Latin America is likely to be one of them.