As a foreign correspondent in Brazil, I have spent most of the past year talking about a handful of issues that dominate the headlines.

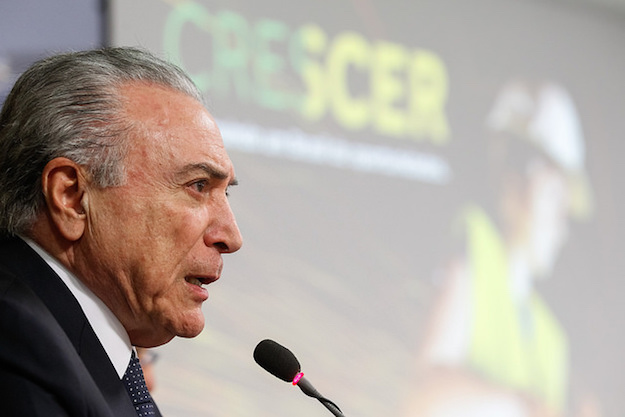

There is an enormous appetite – both abroad and domestically – for news about the “Car Wash” corruption probe and its impact on President Michel Temer’s government. Who will go to jail? Can Temer survive in office? Who might emerge from the political wreckage to succeed him in 2018?

These are hugely relevant topics and they deserve to be at the top of the news agenda. But the truth is that as Temer faces scandals, he is also pushing a variety of ambitious reforms to Brazil’s still-struggling economy. These have not received nearly as much international media attention – but, taken together, they could radically change the way Brazil trades with the world, how it produces energy, how it extracts mineral wealth from the ground, and more.

Here is a rundown, by sector of the economy:

Energy

The reform in the energy sector perhaps stands out as the most challenging one currently underway.

Temer’s government has taken a U-turn on many energy policies adopted by his predecessors: Petrobras, the state-run oil company at the center of the Car Wash scandal, is no longer required to have a substantial stake in projects. New bidding rules have reduced the obligation of local content requirements.

Brazil’s National Petroleum Agency will start public consultations next month to extend those rules to old contracts awarded before 2013. Local content requirements are used to foster national technology, but critics say they can significantly increase the costs of projects.

In September, Brazil will hold a new round of oil and gas tenders which will serve as a test to the new policies the government is pursuing.

The downsizing of Petrobras is also shifting logistics costs from the state oil giant to fuel distributing companies and liquefied gas firms. Yet it is not quite clear what Brazil’s new oil and gas sector will look like – and that is causing some apprehension among investors.

In electricity, too, there are many changes on the way. The government this month ended its a public consultation round and promises to publish a new presidential decree in October.

Again it seeks to reduce the role of the state by privatizing Eletrobras and other energy providers. It wants to move gradually to a market where consumers are more free to connect with their own providers.

The electricity sector in Brazil is in disarray. An attempt in 2012 to lower consumer fares and bring down inflation resulted in highly indebted companies and legal uncertainty in the market.

Right now there is a heated debate on ways to fix the problem – but little consensus on what would actually work.

Environment and mining

Brazil’s attempts to fix its electricity problems delayed some of its efforts on the environmental front. Last year the government canceled a tender for renewable energy projects – due to lower demand for electricity.

But four new rounds have been announced – two to be held in December and two in 2018.

Brazil’s ethanol sector – also damaged by recent stimulus policies to oil (again, policies that aimed to counter inflation) – has its eyes on the RenovaBio program. The government is looking for ways to increase biofuel production as part of Brazil’s commitment to the UN’s Sustainable Development Goals.

The RenovaBio plan needs to be drafted either as a presidential decree or as a bill for Congress and is expected to provide stimulus for 80 new ethanol factories to be built until 2030.

These reforms have the potential to pit two powerful sectors against each other: Brazil’s oil industry against the sugarcane enterprises. Petrobras has been keen to stress that it does not oppose biofuel-friendly legislation – although it has presented its own suggestions on the matter.

Three new presidential decrees (MP 789, 790 and 791) will also reform Brazil’s mining sector, creating a new regulatory agency and potentially charging more royalties from mining companies.

The government’s announcement last week that it will allow mining in parts of the Amazon – stripping away protection from a national reserve – caused an outcry from environmental groups worldwide, as not much in terms of public consultation was done ahead of the move.

Foreign trade

Internationally Brazil has made some headlines with its new, tougher stance on Venezuela. But there are some significant changes on the way on other fronts.

Brazil has signaled it is willing to engage in debates it had been refraining to take part in previously. In June 2016, the country asked to join the Trade in Services Agreement (TiSA) negotiations. Last week the government took steps to join discussions in the WTO regarding the Agreement on Government Procurement. In May this year it also began a process to become a member the OECD.

All these international initiatives take time to produce results – and could easily be undone by a new president in 2019 – but they signal a modest opening of Brazil’s economy to international trade and investment.

More pressing are the changes to car industry subsidies. The WTO has long criticized Brazil for what it calls unfair advantages to carmakers in the country – especially the Inovar-Auto program, which expires this year and was recently considered illegal by the global trade body. Brazilian carmaking has been one of the worst-hit sectors of the economy, despite the helping hand it’s had from the government.

The government has a new plan for the sector – called Rota 2030 – in the works that it promises will benefit the sector while fully complying to WTO standards. The government seems to be behind schedule in this initiative, but it is still expected to come before the end of the year.

Financing projects

The government of Michel Temer is often seen as being pro-business – but there are two issues in which it is having to face fierce opposition from the private sector.

First there is the heated debate about the future of its development bank BNDES, which plays a crucial role in financing all sorts of projects both domestically and abroad.

The Brazilian private sector has relied heavily on BNDES during the country’s boom years, but that took a toll on the government’s budget – as some of the cheap credit available was funded by the Treasury.

A presidential decree (MP 777) drafted by Temer’s economics team – and going through its final hurdles in Congress – aims to change the interest rate charged for BNDES loans. The government says the new rate will make loans more predictable and economically viable.

But the decree has managed to unite workers’ unions and powerful business associations against it. They complain that BNDES’ new interest rate will not be competitive enough and would not offer much of an edge in new projects.

The second point of contention is regarding firms’ debts. Companies with large debts with the government can join a program called Refis and renegotiate what they owe.

As the government needs revenues to balance its budget, it is proposing a new Refis that could potentially bring in 13 billion reais ($4.2 billion) from the private sector. But businesses and a vocal part of Congress want substantial changes to the program to lower fines (one proposal would scrap over 90 percent of fines – if 20 percent of past debt payments were made). They argue that the private sector cannot cope with paying its debts at a time when unemployment is high and economic recovery is still in doubt.

Infrastructure

Brazil is preparing major changes in infrastructure for coming years. It announced last week that it plans to privatize a large number of airports – some very profitable, but most of them in the red. Other state-owned companies and projects would be put up for sale or concession as well.

Concessions in infrastructure are not particularly new. Even the previous government – which had a markedly anti-privatization stance – used them in some cases.

But businesspeople are wary about the fine print in the contracts. In July, the company that won the bid for Campinas’ Viracopos airport announced it wants to give its concession back, as it is losing money. Predictions made a few years ago of how many Brazilians would be flying by 2017 turned out to be wildly optimistic.

The government is also drafting a new decree that will extend the deadline (from five to 14 years) for companies to invest in roads they had won in previous bid rounds. Again the companies’ predictions of how much money they would be making by now turned out to be wrong due to recession – and the price of tolls needed to make a profit was grossly miscalculated. Also BNDES is offering less credit than in the boom years – which left many construction companies exposed to losses.

In both cases concessions seemed much more attractive in theory than in practice, so Brazil will want to get its new contracts right this time.

Pension reforms

No reform is considered more crucial than the one on pensions – it is therefore the issue investors tend to follow closely. Brazil’s severe crisis has been blamed on its ballooning public debt, and pension is the one item where the government believes it can make substantial savings.

Temer’s economics team also argues Brazil’s system is unfair. It allows some people to retire in their early 50s. Public sector workers are entitled to earn their last salary before retirement for the rest of their lives.

The government wants to create a minimum retirement age of 65 for men and 62 for women and make the system more equal in its treatment of public and private sector workers. Unions have held strikes and protests claiming the government is simply making workers pay for the country’s mismanaged finances.

The path to reform has been bumpy. Before Temer’s government was hit by a series of scandals in May, pension reform seemed like a sure win for the president. Since then, there has been much talk of a watered-down version or even no reform whatsoever, as Temer was fighting for his political survival. Only in the past few weeks did Finance Minister Henrique Meirelles start to talk up prospects of it being approved in Congress.

—

Gallas is a journalist based in São Paulo