In September 2021, El Salvador became the first country to adopt Bitcoin as legal tender. At that time, President Nayib Bukele argued that the bold decision would promote financial inclusion, increase the efficiency of remittances, and boost private investments, particularly those tied to new technologies. However, the measure also sparked valid concerns about implementation and macroeconomic issues. After the experiment ended two months ago, many wondered what was left of the initiative and what would happen next.

The change of heart for El Salvador’s government came from the conditions imposed by the International Monetary Fund (IMF) as part of a new $1.4 billion financial assistance program granted to the country. Facing the opposition of the multilateral lender, the government and the Legislative Assembly opted to abolish Bitcoin’s status as legal tender in January, limiting its “voluntary” use to the private sector. The law set clear boundaries to “confine” Bitcoin-related transactions. With this limitation, for example, a person won’t be able to pay taxes with the crypto asset.

Even so, this doesn’t mean the experiment is over. El Salvador still aims to become a technological and logistical hub by promoting crypto assets and new technologies. In January, the country hosted PLANB Forum 2025, the largest crypto assets conference in Central America, and the government is increasing its Bitcoin reserves. In a move closely watched by multilaterals and crypto enthusiasts, the government bought more Bitcoin in March to bring the total of its Strategic Bitcoin Reserve Fund to 6,102 coins, or about $500 million.

Losing the legal tender status changes the scope and flair of the experiment. Looking back, the failure of the Bitcoin trial illustrates the benefits of institutional innovations tied to new technologies—but also the challenges of Latin America’s pervasive state fragility. If the proper lessons are learned, the experiment could still pay dividends.

A rocky start

From the beginning, Bitcoin use in El Salvador encountered practical challenges. Most people were reluctant to support the government’s spending to promote it, and the lack of trust toward the crypto asset significantly reduced its use in business, maintaining the U.S. dollar as the preferred currency. Data collected last year showed that eight of 10 Salvadorans did not use Bitcoin, and remittances via the government’s e-wallet, Chivo, were also slow, explaining why only 1% of total remittances involved crypto assets.

When the IMF announced an initial agreement for an Extended Fund Facility with Bukele’s administration in December, one of its key conditions was that Bitcoin’s use be rolled back. El Salvador was at a clear crossroads: either receive IMF support or maintain Bitcoin as legal tender. The Extended Fund Facility promised to enhance El Salvador’s public finances as well as bolster governance, transparency, and anti-money laundering and terrorist financing (AML/CFT) efforts. Given the limited success of its Bitcoin adoption policy, sacrificing the legal tender status was the logical choice.

Innovation and state capacity

The first lesson from El Salvador’s experience is the necessity of implementing bold policies to drive innovation and experimentation. Latin America requires innovation to foster economic growth, particularly in its administrative institutions. Innovation, in turn, requires experimentation and a trial-and-error approach. While its legal tender gambit was unsuccessful, the government is now better positioned to lead efforts to create effective regulatory frameworks that facilitate the safe use of Bitcoin and other cryptocurrencies. By alleviating worries related to legal tender, El Salvador could concentrate on establishing solid regulations and fostering citizens’ trust, ultimately aiming to use Bitcoin to enhance financial inclusion.

The second lesson is that sustainable innovation requires both state and private sector capacity. Progress using new technologies like artificial intelligence and blockchain, for example, demand access to information and communication technologies (ICTs). In El Salvador—and Latin America in general—a sharp digital divide based on inequality obstructs access to and the development of new technologies.

El Salvador has the region’s lowest ranking in the 2023 Broadband Development Index from the Inter-American Development Bank. This reflects deep-rooted structural issues obstructing internet access and create barriers to using Bitcoin.

Regulatory innovation can help close this gap. El Salvador is leading in these efforts, per its frequent use of regulatory sandboxes—temporary suspensions of regulation to allow for experimentation—as well as policies to improve regulation. For example, the country has tailored its regulatory frameworks through its Law to Facilitate Financial Inclusion to encourage the adoption of new financial technologies.

This kind of financial inclusion is key to reducing inequality and exemplifies the third lesson: regulation and crypto assets are not rivals but complement each other. Without sound financial regulation, Bitcoin is viewed as more volatile, thus reducing its use. At the same time, innovation in crypto can spur regulatory innovation and thereby help build state capacity.

Societal trust

El Salvador’s case shows that the use of cryptocurrency for payments should not be legally mandated; instead, it must arise from societal trust. On a de jure level, Bitcoin was legal tender in the country, but it was only rarely used. Rather than trying to force Bitcoin’s use through top-down lawmaking, proponents should pursue a bottom-up strategy that would more effectively foster public confidence. From the top, the government can shore up regulations to build additional trust.

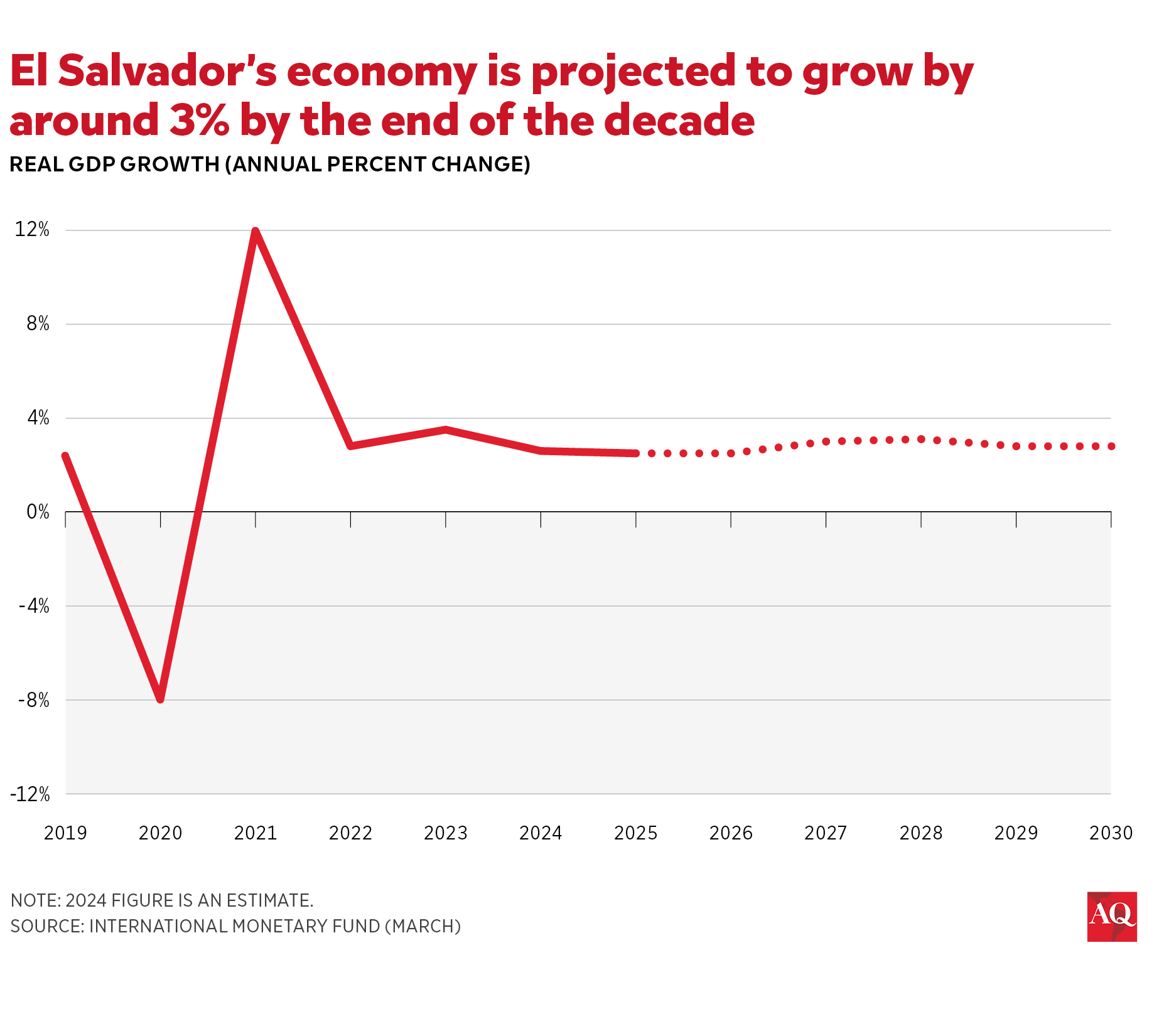

Currently, El Salvador is positioned to benefit from the financial reform mandated by the IMF. This reform aims to enhance transparency and accountability in the financial sector while effectively regulating crypto assets by addressing their associated risks and opportunities, as recognized by the IMF. Bitcoin’s use will remain voluntary, and this mutual understanding with the IMF could pave the way for regulating crypto assets in other countries.

The new regulations are likely to boost trust in Bitcoin, so the country now has an opportunity to innovate in this field, establish trust in the use of crypto assets, and help close the digital divide. In the meantime, it has continued to receive support from the Inter-American Development Bank for digital infrastructure development.

If the government and its multilateral partners can tackle associated risks, particularly concerning financial intelligence, the Bitcoin saga in El Salvador will not be a failure. Instead, it will represent the trial-and-error process essential for fostering innovation and enhancing financial inclusion.