This article is adapted from AQ’s special report on China and Latin America

MEXICO CITY—Few companies in Latin America embody the glamour and volatility of the entertainment business as vividly as Corporación Interamericana de Entretenimiento (CIE). Founded in 1990 as Operadora de Centro de Espectáculos S.A. (OCESA), the Mexican company has evolved from a bold bet on concerts and live events into one of the top four entertainment powerhouses in the world by number of ticket sales, controlling arenas, convention centers, racetracks, food sales, advertising, ticketing platforms, and major cultural festivals.

Today, the company has made Mexico a key stop on the touring circuit for Latin American superstars like Bad Bunny, and since 2015, has positioned the Formula 1 Mexico City Grand Prix as a top destination for racing enthusiasts. The British band Coldplay performed eight shows in 2022 across three Mexican cities, prompting a running joke that they could be moving in permanently. Taylor Swift brought her Eras Tour to a sold-out Foro Sol in 2023, later writing on Instagram: “After years of wanting to play in Mexico City, just got to play 4 of the most unforgettable shows for the most beautiful and generous fans.”

Reaching this level of success took CIE years of experimentation and learning curves with various entertainment formats in a country where both the government and society were long wary of largescale live events.

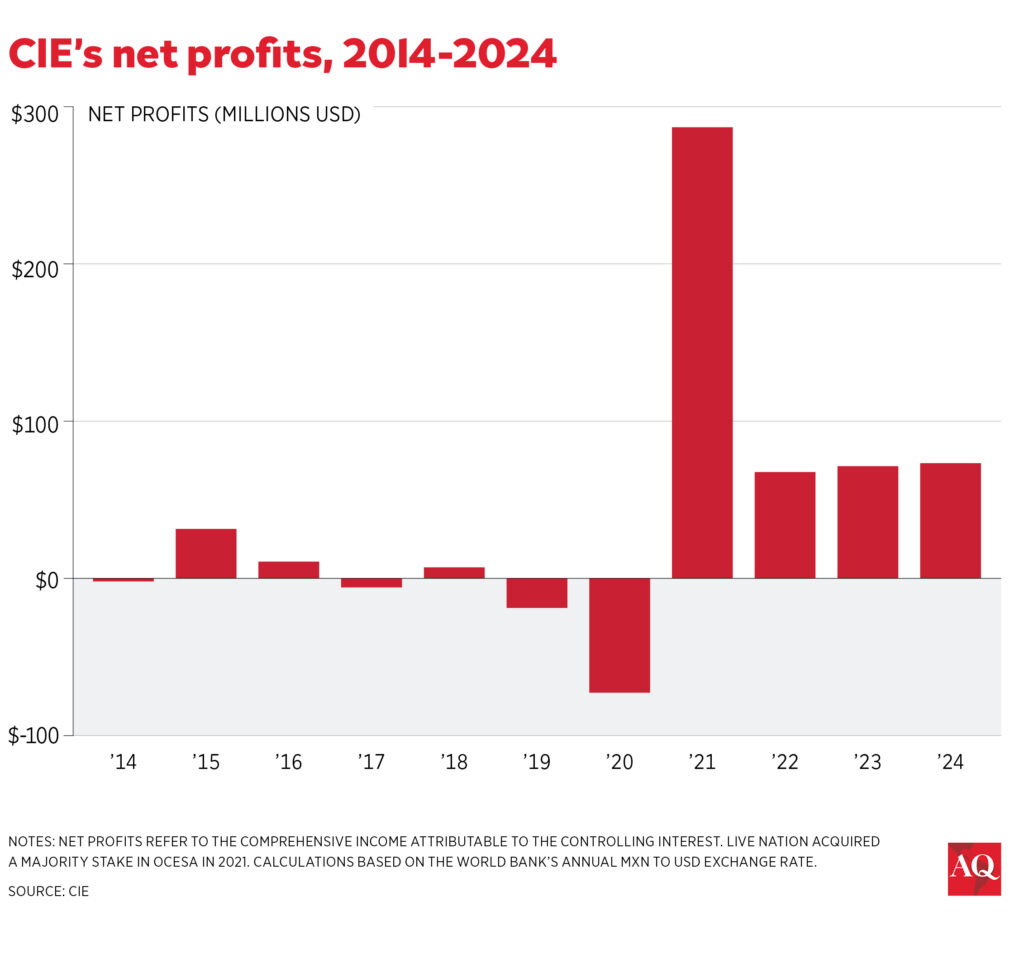

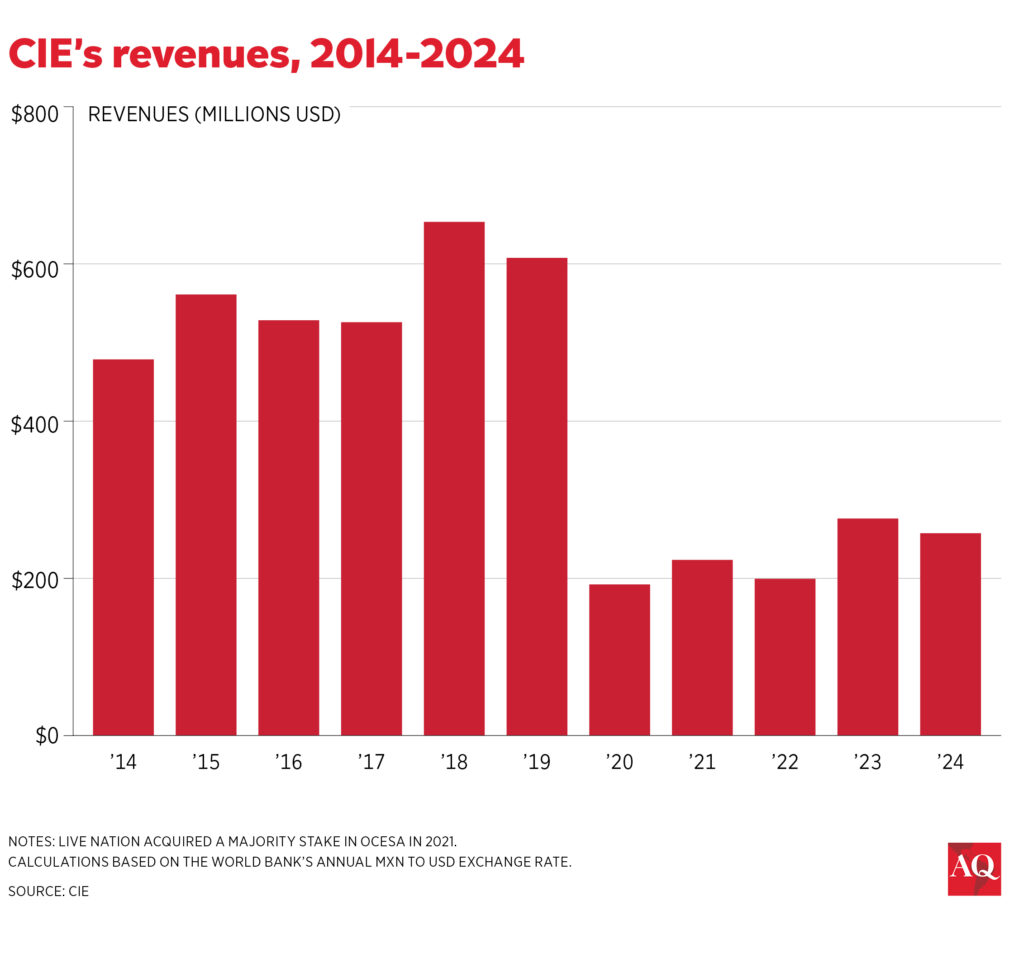

Today, the company mainly focuses on Mexico, whose entertainment and media sectors were labeled as “fast-growing” by global consultancy firm PwC in July. Operating 14 venues in Mexico City, one in Monterrey, and two in Guadalajara, with a total capacity exceeding 312,000 visitors, CIE is currently one of the most prominent players in a competitive field, with several companies vying to be at the forefront to profit from improving conditions. PwC forecasts that Mexico’s total entertainment and media revenue in the advertising and consumer sectors may reach a compound annual growth rate (CAGR) of 6.26% over the next five years, totaling $33.5 billion by 2029. Despite the enticing perspective and increasing appetite for live events and concerts, CIE’s revenue was around $226 million last year, a 3.9% decline from 2023.

Where it all began

In the 1970s and 1980s, Mexico faced significant challenges in hosting live concerts and other events. When legendary rock band Queen performed in Monterrey and Puebla, it was marked by chaos, as unruly crowds hurled shoes on stage. In 1989, unable to secure a venue in Mexico City, Rod Stewart sang in Querétaro, a two-hour drive from the capital, drawing more than 50,000 fans eager to pay for international acts. The massive crowd overwhelmed security, breaking through barriers in a frenzy to get closer to the stage, forcing police to deploy tear gas to restore order.

By then, it was clear that Mexico was ready to open its stages to larger and more ambitious live performances. Alejandro Soberón Kuri, CIE’s founder, recognized the moment and moved to professionalize the country’s live entertainment industry. The company’s first two concerts, held in 1991, featured Australian rock band INXS at the Palacio de los Deportes, a venue originally built for the 1968 Olympics with a capacity of over 15,000. CIE secured permits from a cautious local government, proving that large-scale, well-managed events could be successfully staged in Mexico City.

The following year, U2 performed at the same location, although under a different promoter. But CIE soon notched a major milestone: In 1993, the company booked Paul McCartney, a global superstar with an enduring cross-generational appeal.

There was just one problem: There was no suitable venue for the former Beatle to perform. The only location capable of accommodating the expected throngs was Estadio Azteca, the iconic facility that had hosted two FIFA World Cups. But its owner, Televisa, then the dominant force in Spanish-language broadcasting, refused to lease it.

Taking advice from McCartney’s legendary tour promoter Barrie Marshall, Soberón and his team made a bold decision: to build a stadium themselves. They raced against the clock to prepare a section of an auto racing track with metal structures to install seating. It wasn’t ideal, but it was good enough, and around 120,000 tickets were sold for McCartney’s first two shows in Mexico.

Just weeks later, Madonna brought her Girlie Show tour to the same venue, despite attempts by conservative groups to censor the performance due to its sexual and religious content. She had decided to play in Mexico after hearing from McCartney himself about his first gig in Mexico City.

CIE’s rapid rise faced a serious challenge in December 1994, when the Tequila Crisis triggered a financial collapse and the peso lost over half its value almost overnight. The funds earmarked to pay the Rolling Stones and dozens of other acts evaporated in days, throwing the company into an instant crisis.

The IPO lifesaver

In need of capital to honor existing commitments, and fuel further growth, CIE turned to the stock market. In December 1995, the company launched its initial public offering in the local market, breaking through a listing drought in the wake of one of Mexico’s worst economic crises. The following 13 years were a period of aggressive expansion across Mexico and parts of South America. CIE partnered with Disney to bring Broadway productions such as The Lion King to local audiences, acquired a stake in Mexico City’s horse racing track from a Carlos Slim investment vehicle, and bought amusement parks in both Mexico and the U.S. The company also managed radio stations in Argentina, hosted major trade fairs, and operated one of the region’s largest convention centers, Centro Banamex.

Later on, CIE further diversified into gaming, securing licenses to operate sportsbooks and bingo halls. In a notable move, it even struck a deal with rival Televisa, which in 2002 invested $107 million for a 40% stake in OCESA Entretenimiento, CIE’s live entertainment unit.

But CIE’s rapid expansion came at a cost. By December 2009, the company was burdened with debt and announced a $400 million restructuring plan. To stabilize its finances, it began divesting non-core assets and refocused on its primary strength: concerts, theater plays and festivals. The streamlined operation allowed CIE to access new loans in local currency and repay debt, moves that were well received by the market.

The poisoned golden ticket

In 2019, CIE caught the attention of global entertainment giant Live Nation, which offered to acquire a 51% stake in OCESA Entretenimiento, including the 40% previously held by Televisa. The proposed $400 million deal promised to reshape the landscape of live events in Latin America.

However, the COVID-19 pandemic brought the concert industry to a standstill and put that transaction on hold. CIE even resorted to building a temporary hospital inside its convention center in the capital, bringing partial relief to a collapsed national health care system in a country that recorded over 600,000 COVID-19 deaths, one of the highest tolls during the pandemic.

Live Nation sought to renegotiate key terms and delay the cash payment portion of the deal. When no agreement was reached, the U.S.-based company terminated the purchase, leading to arbitration proceedings. The dispute lingered until late 2021, when all three parties reached a new agreement and Live Nation ultimately completed the acquisition.

As restrictions were lifted and audiences returned, OCESA hit the ground running. Major festivals like Vive Latino and Corona Capital resumed much stronger as global superstars once again filled stadiums across the region.

And Live Nation came back for more. Earlier this year, the company bought from CIE an additional stake in OCESA, boosting its ownership to 75% and cementing its grip in the region. CIE declined an interview request with CEO Soberón, citing a tight schedule. In a report to investors published in June, analysts Elizabeth Martinez, Pablo Franco and Heinz Cederborg, of Mexico City-based credit company HR Ratings, see a stabilization and annual growth in CIE’s revenues of 2% between 2025 and 2028, supported by a “normalization of the special events and the constant expansion of the Formula 1 Mexico City Grand Prix related sales.”

In the future, CIE is expected to emphasize car races, aligning the Mexico City Grand Prix with weekend-long Day of the Dead celebrations throughout the country’s capital. The event will continue to be part of the international calendar through 2028. The company has not publicly shared any other expansion projects with investors.