QUITO — Ecuador’s President Daniel Noboa is set to begin his first full term on May 24 with a strong mandate after winning reelection by a wider-than-expected margin. Even if his Acción Democrática Nacional (ADN) party did not win a majority in the National Assembly, it appears to have already formed the necessary alliances to advance its own legislation. While the economy is benefiting from favorable conditions that could promote faster growth, his government will face significant short-term challenges.

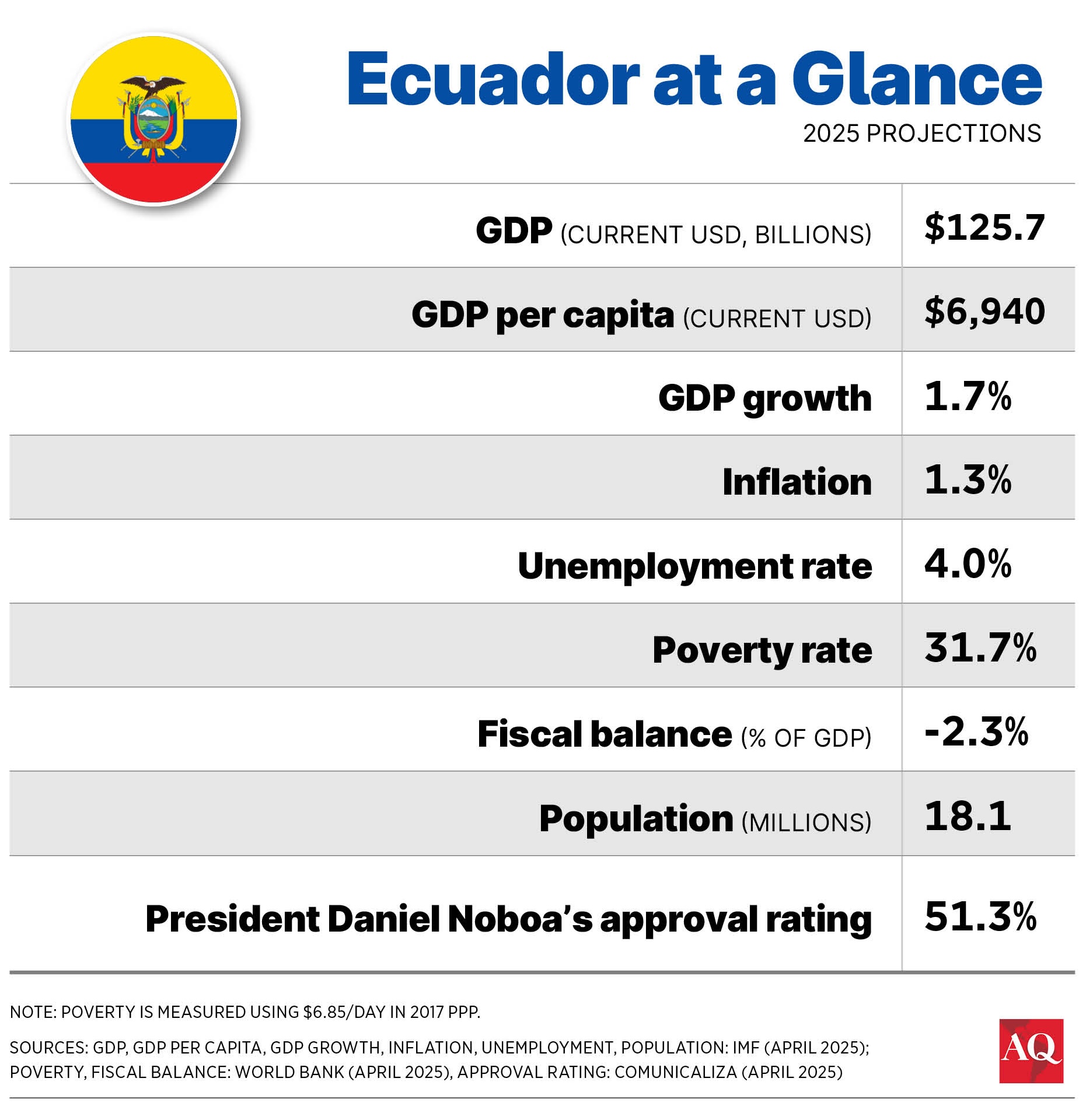

The economy is expected to rebound this year, following a 2% contraction in 2024 due to tight domestic liquidity conditions and an electricity crisis that resulted in power rationing and costly blackouts. The IMF projects that the economy will grow by 1.7% in 2025, with annual expansion reaching 2.5% by 2030. Our estimates are slightly more conservative, predicting a 1.5% GDP expansion this year, as slower global growth due to the U.S. tariffs uncertainty hinders a quicker recovery.

But domestically, several factors are helping. Electricity conditions, which plagued the country last year, have improved, as river flows into Ecuador’s main hydroelectric projects appear to have normalized after last year’s long drought. So far this year, economic activity has not been interrupted by blackouts. Meanwhile, domestic liquidity conditions have improved dramatically as external capital flows into Ecuador strengthened, leading to a sharp decline in interest rates. The signing of a new IMF program in mid-2024 triggered a wave of multilateral disbursements during the second half of last year, and the country’s exports are surging on the back of higher cocoa prices and the structural development of Ecuador’s mining and shrimp industries in recent years.

While all this seems auspicious, the country is grappling with a significant surge in violence, fueled by organized crime and drug cartels fighting to control the country’s ports. At 44.5 homicides per 100,000 people, Ecuador’s homicide rate surpasses those of Mexico, El Salvador, and Honduras, and is the highest in South America.

Noboa is starting his new government with a strong mandate and a working majority in the legislature. If external conditions improve and the private sector capitalizes on domestic investment opportunities, the tailwinds could strengthen his mandate further. Better electricity production in the short term, abundant domestic liquidity, lower interest rates, and the conclusion of the election process all create a favorable environment for growth to accelerate. However, critical macroeconomic challenges still loom.

A hostile external environment

The broad tariffs implemented by the Trump administration affect Ecuador in multiple ways, and must be understood as both a balance of payments shock and—because the economy is dollarized—a monetary shock. Ecuador, with a small, open, dollarized economy, depends partly on an export base composed of largely commodities such as oil, shrimp, minerals, bananas, and cocoa. Its two largest trading partners are China and the U.S., both of which now face risks of lower growth. If the simmering trade conflict between the two global powers intensifies, this could harm both economies and their demand for Ecuador’s exports.

Regionally, Ecuador may find itself at a significant disadvantage compared to its non-dollarized neighbors if tariffs disrupt global trade. The week after Trump’s April 2 “Liberation Day” tariffs announcement, Latin America’s currencies depreciated by 5-8% against the U.S. dollar, making their exports cheaper and challenging Ecuador’s manufacturing sector, both in terms of exports and domestic competition against less expensive imports. Even if regional currencies have since appreciated following some announcements of de-escalation between the U.S. and China, it is crucial to understand the risks Ecuador faces in this constantly shifting global environment.

Globally, tariffs increased uncertainty and fueled expectations of lower global growth and potentially tighter monetary conditions, adversely affecting the spreads of riskier assets, such as Ecuador’s bonds. Oil spot prices fell, as did futures, creating pressure on Ecuador’s fiscal accounts. This makes access to external financing more challenging.

Uninterrupted external financing

Ecuador still needs to finance a large fiscal deficit. According to our estimate, the government deficit is on track to reach $4 billion this year, and beginning in 2026, it will face a series of maturities from both multilateral and market sources. Consequently, securing uninterrupted external financing is crucial for the new administration.

Newly appointed Economy Minister Sariha Moya has already met with multilateral counterparts. A swift agreement on the IMF program’s second review should help normalize debt inflows from the IMF and other multilateral institutions in the coming weeks, following the conclusion of the first review in December. However, the IMF targets, a consolidation path, structural benchmarks, and financing assumptions must be solid and realistic to boost confidence in Ecuador’s ability to comply with the program and maintain uninterrupted financing flows.

Ecuador also needs to issue new international bonds. Once the election was over, the nation’s bond spreads compressed significantly. Even so, uncertain global conditions, which dampen appetite for risk in the market, mean that Ecuador must demonstrate an even stronger commitment to a reform agenda and fiscal sustainability to achieve nominal costs at levels low enough to issue international bonds.

Reforms and investment conditions

Ecuador’s challenges in the electricity sector are not over. The country faces a bottleneck of installed capacity that falls short of projected demand growth, making another round of blackouts a real risk when the dry season takes hold in the last quarter of the year. Although hydrological conditions have improved over the past year, installed capacity still needs to be ramped up annually to meet demand, which grows at an average pace of 4.5% per year. This, however, represents an opportunity to deploy investment over the coming years.

Security conditions also remain a challenge for the economy and living conditions as a whole given the high rate of violent deaths. Recently, the government submitted a bill seeking to dismantle the “criminal economy linked to the internal armed conflict.” The proposal was sent through the “fast track” mechanism, which would allow for a swift debate and approval process in the legislature. However, regional experience suggests that this problem may be resolved only over the medium term.

On the fiscal front, Noboa must strive to guarantee a credible and sustainable fiscal consolidation path to secure financing from multilateral partners and eventually open the doors to issuing international bonds. Some measures to strengthen fiscal accounts could include further cuts to fuel subsidies, such as those for diesel, or the continued optimization of tax expenditures.

The government may also push additional reforms to enhance the private sector’s ability to invest, as growth becomes a central part of its agenda. In a recent meeting with the business community, Noboa emphasized the need to increase competitiveness and trade openness, as well as the importance of passing legislation to facilitate foreign investment in strategic sectors, including oil, mining, and electricity.

To do this, Noboa will need to build a durable governing coalition in the legislature, where his ADN party controls 66 of 153 votes. Its most significant political rival, Revolución Ciudadana, holds virtually the same number. However, ADN managed to reach agreements with legislators from smaller parties to form a working majority, enabling the election of legislative authorities and commissions. ADN now holds the presidency and first vice presidency of the National Assembly, and controls 11 of 15 legislative commissions. The next test for this working majority will be the actual approval of bills, for which a simple majority of 77 votes is required.

Noboa will begin this new term with 18 months of experience under his belt. This should provide the benefit of continuity in policies that were already being implemented. However, continuity also means that a traditional “honeymoon period” for the new term will be absent. The government must deliver quickly to cement its social and political capital.