MEXICO CITY — How should Mexico respond to President-elect Donald Trump’s pledge to impose a 25% tariff on imports from its southern neighbor? While the first reaction may be plain retaliation, this decision risks painful escalation between countries that are already each other’s biggest trading partners. A more persuasive approach lies in refining the United States, Mexico, and Canada free trade agreement (USMCA), whose formal review is scheduled for July 2026 and is all but certain to come sooner.

The threat of tariffs on Mexican goods and services—and, by extension, Canadian exports to the U.S.—has prompted immediate diplomatic reactions. On November 27, Mexico’s president, Claudia Sheinbaum, and Trump discussed the matter over the phone. A couple of days later, Canada’s Prime Minister Justin Trudeau flew to Florida to meet Trump at Mar-a-Lago to discuss the opening salvo ahead of the inauguration of the president-elect on January 20. Both countries have high stakes in their future relationship with the White House, but Mexico’s case has an additional wrinkle: its increasing connection with China.

At the crossroads of U.S. protectionism and China’s expansion, Mexico should leverage its position within the USMCA to advocate for regional solutions focusing on innovation and trade diversification. Rather than relying on tariffs, which risk exacerbating inflation, Mexico can strengthen its economic ties with the U.S. and Canada by promoting innovative and competitive industries. This move could find support; Senator Marco Rubio, the president-elect’s choice to lead the U.S. Department of State, has suggested that a more assertive U.S. strategy in Latin America is needed to counter China’s growing regional influence.

An illustrative example of Mexico’s trade vulnerabilities was the 2022 suspension of avocado exports to the U.S. following cartel threats. The incident underscored the complexity of trade relations, which are shaped by intertwined issues like human rights, security, and governance.

As Mexico navigates between U.S. economic dominance and China’s emerging role, it must address weak institutions to manage these external influences effectively. The opportunity to try a new strategy—implementing a customs union for USMCA—may have come disguised in Trump’s latest threat.

The future of the trade relationship

Looking ahead, the U.S.-Mexico trade relationship will evolve in response to various factors: lobbying, trade regulations, labor relations, border security, migration, and broader global dynamics. As an academic effort to evaluate the current environment of this bilateral relationship, earlier this year, I wrote a chapter on Forecasting Trade Relations Between United States and Mexico. The article presented four possible scenarios to shape policies that support long-term stability.

In a nutshell, the U.S. and Mexico can choose to “Maintain the Status Quo” by focusing on established priorities within the USMCA framework. While tensions may arise in areas like steel, genetically modified corn production, illegal logging, and divergent energy policies, all countries in the agreement have a mutual interest in preserving economic stability. However, targeted compliance challenges, like the recent energy policy disputes and judiciary reform in Mexico, could strain relations even further.

A second “Optimistic Scenario” envisions closer cooperation between the three countries, positioning North America as a critical economic bloc in a rapidly changing world. Enhanced collaboration could spur infrastructure development, sustainability initiatives, and a stronger economic partnership, benefiting all parties.

In a “Pessimistic Scenario,” escalating political tensions, migration disputes, and USMCA challenges could unravel progress. The U.S. could potentially withdraw from trade agreements, severely impacting Mexico’s economy and destabilizing regional cooperation. Furthermore, the U.S. could put national guard or reservist troops on its southern border to manage the customs services and points of entry between the U.S. and Mexico.

In the most “Transformative Scenario,” the three countries could forge a new agreement—a customs union—that goes beyond traditional trade relations. This framework would integrate migration, labor rights, and environmental policies into trade discussions, fostering deeper cooperation across multiple sectors and reinforcing the region’s collective strength. A customs union establishes a common external tariff (CET) for trade with non-members, as seen in the evolution of the EC to the EU.

Toward a customs union

The evolving migration and labor landscape calls for a shift toward a customs union. Such an agreement would improve trade and address pressing issues like labor rights and migration. By recognizing immigrants’ contributions and promoting immigration as a driver of economic growth, both nations can benefit from a more diverse and skilled workforce. Moreover, a renewed focus on labor standards could foster fair wages and greater competitiveness across North America.

The avocado export disruption powerfully reminds us of how intertwined human rights, drug trafficking, trade regulations, and environmental protection are in the global trade system. The U.S. and Mexico must cooperate more closely on these challenges to ensure a stable and prosperous future. Focusing on regional collaboration, innovative trade policies, and adaptive frameworks, such as a customs union, can help strengthen North American trade while addressing the evolving complexities of global trade dynamics.

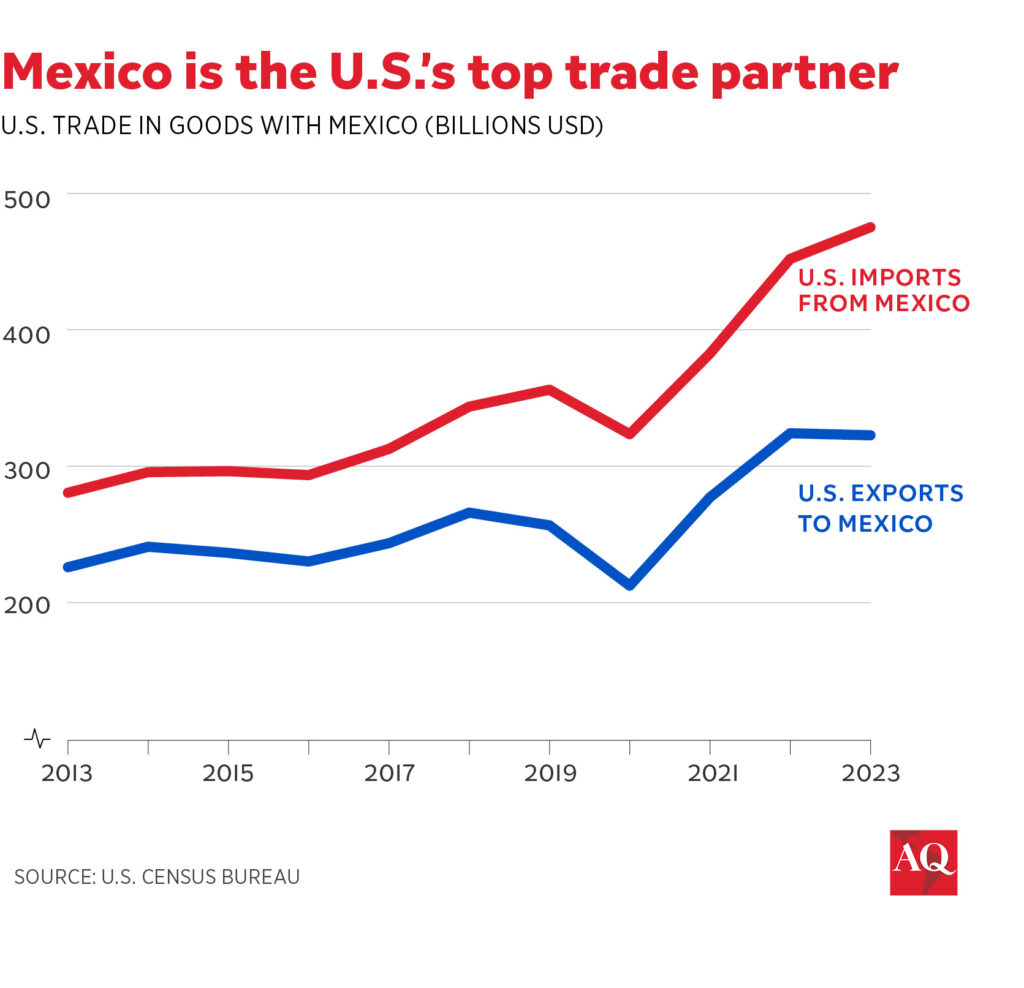

Canada and Mexico hold significant leverage over the U.S. through their critical role in shared trade, security, and migration dynamics. Economically, Mexico is the U.S.’s largest trading partner, with deeply integrated supply chains in the automotive manufacturing and agriculture sectors. Canada has tight supply chains with the U.S. in its logging and extractive industries.

Mexico could push for simplifying North American trade codes and aligning tax systems, such as transitioning the U.S. toward a value-added tax (VAT)—a system most of the world, including Canada and Mexico, already use—to create efficiency in cross-border trade. A revamped USMCA or a North American customs union would require synchronized policies to avoid inefficiencies and better integrate technology for trade operations and border security.

A need for cooperation

On security, Mexico can emphasize the joint responsibility to combat drug trafficking, particularly the flow of fentanyl, which contributes to a U.S. public health crisis. Mexico’s role as a migration buffer also strengthens its negotiating position, allowing it to demand reciprocal investments, such as development aid or infrastructure projects, to address regional challenges.

Furthermore, Mexico could advocate for regional cooperation to address overlapping trade and security issues, such as cartel-related violence disrupting supply chains and trade enforcement. By proposing a customs union, which increases interconnection by aligning governance and technology across North America, Mexico can strengthen its position as a pivotal partner. However, internal challenges, such as cartel violence and governance gaps, could hinder its ability to maximize this leverage. Addressing these issues and promoting closer U.S.-Mexico collaboration could transform the region into more integrated and resilient economic bloc.

Adopting a customs union would nurture regional collaboration, innovative trade policies, and adaptive frameworks that can help strengthen North American trade while addressing global trade’s evolving and treacherous complexities and geopolitical dynamics. As the U.S. appears set to embark on a new course, pulling in Mexico and Canada, the trilateral relationship will be put to the test.