Following concerted unilateral, regional and multilateral trade liberalization efforts in the 1990s and 2000s, Latin American countries have seen a significant increase in trade. Latin American exports grew by 9.8 percent annually from 1980 to 2010, compared to a world average of 8.5 percent. And from 1986 to 2010, the region’s share of world exports rose from 4.4 percent to 6.9 percent—a rise made more noteworthy when taking into account that this period includes the rise of China, India and other Asian countries in world trade. For example, exports from the Association of Southeast Asian Nations (ASEAN)—which does not include South Korea, Taiwan or China—grew from $72 billion in 1980 to $1 trillion in 2010. Even in relative numbers, ASEAN’s growth in trade outstripped Latin America’s, and by 2010, ASEAN exports had gone from 4 percent of world trade to 7 percent.

The difference in export growth did not stem from trade policy. Tariffs across the array of partners, both World Trade Organization (WTO) members and nonmembers, are relatively similar. By 2009, Latin America’s average tariff stood at around 8 percent, and East Asia’s average just below 5 percent. (In fact, this figure overstates the duties actually charged, as most Latin American and many East Asian countries are parties to numerous preferential trade agreements that eliminate or significantly lower the tariffs.)

However, as border barriers to trade have fallen, other factors have emerged as obstacles—in some cases even greater obstacles—to trade performance. In Latin America, inadequate transportation infrastructure has become an impediment to the region’s further integration in global commerce, and has prevented Latin American countries from taking advantage of the multitude of regional, bilateral and multilateral trade agreements signed in the past decade and a half.

Several comprehensive studies have found that infrastructure is a compelling factor in explaining the growth differential between these two regions. A 1996 study by Charles Hulten found that effective use of infrastructure could explain about a quarter of the growth differential between Latin America and East Asia and more than 40 percent of the differential between low- and high-growth countries.1 César Calderón and Luis Servén, in their seminal 2004 study on the subject, demonstrate that a significant determinant of Latin America’s trade and growth underperformance relative to East Asia in the 1980s and 1990s can be attributed to the region’s deficient investment in infrastructure.2

In contrast to Latin America, Asian regional trade arrangements have emphasized infrastructure upgrades and investments among the parties. This article explores whether the Asian experience in addressing transport infrastructure integration at the regional level holds any lessons for Latin America.

Connections

Under the right conditions, improvements in infrastructure can have a significant positive impact on trade, growth and development. Infrastructure affects the ability to move goods, services and ideas within countries and to pass goods and services from one country to another; the quality and quantity of investment, as well as investment outcomes; and the population’s access to health and education services essential for development. Infrastructure also has an important role to play in reducing rural poverty. By connecting rural farmers and/or small business owners in isolated geographic pockets to mainstream markets, infrastructure helps combat their social and economic exclusion.

Latin America’s main exports tend to be heavy (gold, copper, iron ore, and nickel) or perishable (fresh fruits and vegetables). Both categories of goods are highly sensitive to transportation costs. In addition, production of manufactured goods is increasingly segmented across countries and continents. The North American auto industry is a good example of this, as is textile production within the Dominican Republic–Central America–United States Free Trade Agreement (CAFTA–DR) countries. Sound infrastructure can reduce the cost of shipping heavy goods, expedite perishable ones and maintain the flow of parts within integrated supply chains.

In his 2007 study, “Calculating Tariff Equivalents for Time in Trade,” David Hummels concluded that “trading across borders […] takes longer in developing countries than in developed ones for a number of reasons, including the quality of infrastructure, procedural coordination and corruption.” Hummels calculates the ad valorem cost of import delays (the “tariff equivalents”) and finds that these costs exceed tariffs in every region. In Latin America the tariff equivalent for imports is 8.9 percent—1.9 percent greater than the average applied tariff rate of 7 percent. For Latin American exports, the tariff rate equivalent penalty is a hefty 7.1 percent, compared to the 3.9 percent tariff average for Latin American goods crossing borders—nearly double the cost! For East Asia the tariff equivalent for imports is 6.9 percent (compared to an applied tariff rate of 5.6 percent) and for exports it is 3.8 percent (compared to a 5.2 percent applied tariff rate).3

The Inter-American Development Bank (IDB) has recently built on this work and estimated that lowering transport costs by 10 percent would have a dramatically greater impact on export growth than would a commensurate reduction in tariffs.4

By improving access to social services and markets, Calderón and Servén demonstrated that better access to roads and sanitation lowers a country’s Gini coefficient (a measure of inequality) between 0.5 and 0.13 percent.5 At the upper end, such improvements could move a country from an income distribution similar to that of unequal Guatemala to the level of more egalitarian Uruguay—no small feat in a region marked by the world’s highest income inequality.

How Do Asia and Latin America Compare?

When comparing regions in terms of “hardware”—the roads, ports and air transport infrastructure necessary to physically get goods from one location to another—Latin America consistently scores below Asia [See Figure 1].

Figure 1 displays the aggregate regional results from the World Economic Forum’s Global Competitiveness Index (GCI) rankings, which range from 1 to 7, where 1 corresponds to the worst and 7 to the best possible outcome. The gap between Latin America and Asia is smallest in electricity and telephony and greatest in rail—an area in which Latin America has traditionally underinvested.

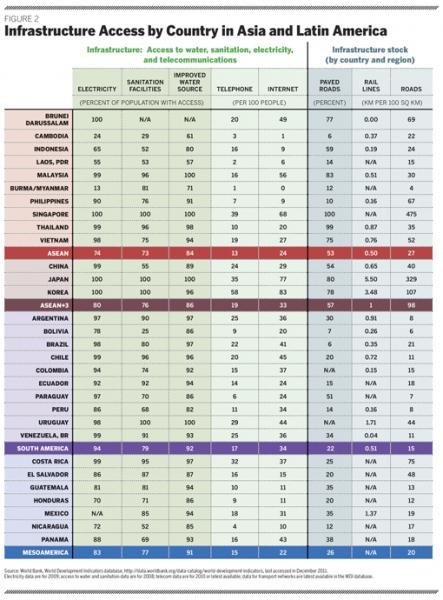

Figure 2 reveals the differences among countries within the region. Asia, Malaysia and Thailand—which have built up internationally competitive infrastructure networks—and Vietnam—which is rapidly integrating into Asia and whose 2007 WTO entry has increased its integration into the international trading system—score high in terms of the infrastructure stock indicators. Poorer and less integrated countries Cambodia, Laos and Burma/Myanmar, score lower and bring down the regional averages of the access indicators.

Differences across regions hold, however, at all income categories: when ranked according to per-capita GDP, Asian countries perform better than Latin American countries in the top, middle and lower thirds. Looking at the lower third of the income distribution, which includes countries with per-capita GDP below $3,000, all the Asian countries (Indonesia, Vietnam, Laos, and Cambodia), with the exception of the Philippines, perform higher than the Latin American average on at least one indicator. Of the Latin American countries at this end of the spectrum, only Paraguay outperforms the regional average on one indicator: percent of roads paved.

Latin America scores better when it comes to soft infrastructure—defined as procedures and institutions related to moving goods and services. Improving soft infrastructure is a main objective of trade facilitation, which aims to increase the bureaucratic and administrative efficiency of customs, ports and investment gateways and speed the movement of goods, services and investments.

While Latin American countries perform well in terms of the number of documents needed to trade and the time cost of trading, the greatest difference with East Asia is in the cost. It is almost twice as expensive to both export and import a container of goods from South America as it is from East Asia—one and a half more expensive from Mesoamerica [See Figure 3]. There are, of course, variations among countries: Panama is about on par with the ASEAN average, while Brazil and Colombia’s costs both exceed three times that of China.

Which Comes First: Trade or Transportation?

Infrastructure services are mostly provided through networks—webs of relationships—in which new investments extend a web of commercial and economic relations and allow for a better allocation of resources. Cooperating with neighboring countries—already partners in regional integration efforts—helps countries and investors share costs and expand network possibilities. The problem is, not all countries have developed the foundation for effectively mobilizing and allocating trade-related transportation investment.

Latin America should be a good candidate for coordinated transborder infrastructure projects. Since World War II, the region has developed an array of subregional groupings for both political and economic ends. The Andean Community and the Central American Common Market date to the 1950s and 1960s, and the Southern Common Market (MERCOSUR—at the time, Argentina, Brazil, Paraguay, and Uruguay)—began operations in 1991. Since all of these were customs unions, they were more institutionalized and had broader ambitions toward integration than free trade agreements. They are administered by a political hierarchy, supported by secretariats and negotiated by diplomats and technocrats. They aim for cooperation and harmonization. In theory these would serve as more fertile soil for growing regional transportation networks. But they haven’t—and the relative lack of trade among members that they generate provides a partial answer as to why.

In contrast, preferential trading arrangements have not historically played a major role in East Asian integration. ASEAN has existed since 1977, though intraregional trade remained around 18 percent from the 1970s to the early 1990s, until in 1992 the bloc formed the ASEAN Free Trade Area (AFTA). The real push for closer economic relations came from free trade agreements over the past two decades. In 2000, East Asia plus India—the region the Asian Development Bank (ADB) terms “integrating Asia”—had three free trade agreements; by 2009 this had risen to 54.6

Asia’s approach to integration has tended to be more business-driven, with regional integration initiatives endorsing and accelerating already-existing trade ties. Physical infrastructure and increasing trade flows have preceded more formal economic ties. The pattern for this in East Asia is what is often referred to as the “flying geese” model, in which a lead country first develops a particular industry that then relocates to more developing countries. This model of production diffusion helped establish and consolidate production networks throughout the region, with large-scale investments in infrastructure made by the leading country. A prominent example of this is the electronics industry, in which Japan diffused its production to industrializing countries South Korea, Singapore and Taiwan.

In these cases infrastructure investments were made to facilitate the development and consolidation of production supply chains.7 Recent economic or development corridors, such as the Greater Mekong Subregion and the East West Corridor, are following this pattern with a view to facilitating trade with China. These corridors are cooperative initiatives to stimulate economic activity in a particular geographic location, usually linking several urban areas or production facilities. Corridor programs generally involve the development or improvement of transportation infrastructure, coordination of trade facilitation activities, harmonization of logistics, and the development of related urban areas.

Figure 4 shows a number of regional trade arrangements (RTAs) in Asia and Latin America, their associated share of world trade (the proportion of that country’s exports plus imports in world exports) and intraregional trade (the amount that the member countries trade with one another) as a percentage of the RTA’s total trade with the world.

In Asia, intraregional trade is becoming increasingly important, largely geared toward the growing Chinese market. From 1990 to 2010 intraregional trade’s importance in total trade has grown from 18 to 26 percent for the ASEAN grouping and from 31 to 40 percent for the ASEAN+3, an agreement that adds the economies of China, Japan and South Korea to ASEAN.

The IDB estimates that Latin American intraregional trade has only reached 50 percent of its full potential. This shortfall is attributable at least in part to deficiencies in infrastructure investment (“hard infrastructure”) as well as trade facilitation (“soft infrastructure”). In its report on transportation costs in the region, “Unclogging the Arteries,” the IDB states that Latin American countries spend on average twice as much as the U.S. to import goods.8 If Latin America wants to compete with Asia in an increasingly integrated world market, it needs to address the infrastructure needs that are limiting its potential.

The most remarkable difference between the model of economic integration across the region is the countries’ growth rates [See Figure 5]. Most Asian countries have demonstrated strong growth performance in the past decade, with the average annual GDP growth rate for ASEAN in the past decade a remarkable 6 percent. In contrast, South America’s nearly 4 percent growth and Mesoamerica’s 3.5 percent, though high for the region, look anemic.

Another difference stands out: the high levels of public investment among Asian countries [See Figure 5]. ASEAN governments plus China, Japan and South Korea devoted on average 26.1 percent of GDP to investment and South Asia 29 percent, whereas South America averages only 19.9 percent and Mesoamerica, 22.8 percent.

Those higher levels of general public investment translate into higher levels of public infrastructure investment. Several East Asian countries invest more than 7 percent of GDP in infrastructure, according to the ADB. In contrast, an IDB study by Eduardo Lora and another by the World Bank place Latin American countries’ infrastructure investment at closer to 1 to 3 percent of GDP.9 As a recent World Bank publication pointed out, the region needs a 4- to 6-percent increase in annual infrastructure investment if it is to catch up or keep up with South Korea or China.

These differences in investment manifest themselves in terms of the state of countries’ infrastructure [Figure 1]. In Asia, Malaysia and Thailand have built up internationally competitive infrastructure networks, as has Panama, with its canal, in Latin America. Other countries’ infrastructure is less developed, but East Asian integration is helping move forward the infrastructure underpinnings for economic growth better than in other regions.10

Seeding Cross-National Networks

A look at what is going on in East Asia reveals a wide network of robust cooperation in infrastructure initiatives. For reasons of space, only transportation initiatives are detailed here; most of the listed initiatives also have projects on connectivity and other trans-border infrastructure initiatives. One key constant in these initiatives is the role of the ADB and the richer economies, which help fund many infrastructure projects [See Figure 6].

In a major study on regional infrastructure, “Infrastructure for a Seamless Asia,” the ADB staked out Asia’s important role in the international economy: “It is the world’s factory, its biggest saver, and an emerging giant in outsourced services.”11 Key to this role, it wrote, is infrastructure: “Physical connectivity is crucial to support complementarities in the production processes across the entire region.”

Asia now faces a second-order challenge: shifting from the concentration of infrastructure along the thriving maritime corridor to pull more remote regions from economic isolation into Asia’s buzz of economic activity. Doing so is necessary to further bolster the regional market and its ties to the global economy.12

Figure 7 sets out the main Latin American regional transport infrastructure initiatives. One of the two projects is the Iniciativa para la Integración de la Infraestructura Regional Suramericana (IIRSA), launched in 2000 and covering the 12 South American countries. Three major regional development banks are cooperating in financial and analytical assistance.

In Mesoamerica the Corredor Pacífico del Proyecto Mesoamerica (MP) replaced Plan Puebla Panama. This project, largely supported by the IDB, has galvanized cooperation among Central American countries and Mexico in building roads, coordinating the electrical grid and cooperating on this type of soft infrastructure. It has also been given a boost by the strong demand from East Asia. Central America’s Pacific infrastructure is relatively more developed than its Atlantic side. In the past this has been a disadvantage; the new realities of Asian demand are pushing for greater development of this Pacific corridor.

What Have We Learned?

Asia and Latin America are both currently working to bolster the infrastructure that undergirds international trade. Asia’s initiatives seem geared toward bolstering the internal market and even further increasing intraregional trade. Latin American initiatives also seem geared toward Asia—in Mesoamerica, largely to compete with Asian countries by lowering the costs of exporting; and in South America by enhancing the infrastructure that will allow countries to more efficiently send their goods to East Asia. In an effort to encourage this, it took China’s Export-Import Bank to start to establish an infastructure investment facility for Latin America at the IDB. But in the rush to link up with Asia, is the region leaving behind the gains to be had from laying the groundwork for greater regional trade? One of the lessons to draw from the Asia model is the tight set of production and commercial relations that first linked up the region and created comparative advantages as many of the countries were entering the global market.

Several lessons can be drawn from Asia’s relative success in infrastructure development.

One is to follow the money. Investors, both public and private, are more likely to invest in large-scale projects such as infrastructure when this will benefit already-present or emerging production patterns. In East Asia, infrastructure development was spurred by the need to develop or maintain production chains in sectors such as electronics. In contrast, until now, many of the efforts at subregional integration have put political ambitions of integration and institution-building ahead of the dynamics of investment and commerce.

Second is the important role of government. While private-sector participation is important, there is still a great need for public involvement. Many have pointed to the low level of public investment in infrastructure in Latin American countries. National commitment is essential to the success of national infrastructure development and cross-border initiatives.

Third is the need to provide a platform for private investment. One factor that needs to be taken into account is the political difficulties of cooperation in providing regional public goods. As Antonio Estache and Marianne Fay point out in their paper for the multilateral Commission on Growth and Development, the two main sticking points in regional infrastructure provisions are: 1) who should be in charge; and 2) who should pay.13 A sound outside guarantor such as the IDB or CAF is necessary to attract private investment. As noted by the 2009 ADB report, “Seamless Asia,” “Without effective policies and institutions, cooperation is likely to be haphazard, limited, sporadic, and ultimately ineffective.”14

In comparison to the ADB-supported initiatives in Asia, it is notable that the IDB in Latin America has taken a much smaller role in seeding cross-border projects.

Even if governments and multilaterals do step up to provide the leadership, direction and framework for the broader public good of regional infrastructure, such efforts will need to be guided by the demands of commerce and investment. Ultimately the driver as well as the beneficiary of any such efforts needs to be markets. The region’s economic and development potential depend on balanced, farsighted and economically rational initiatives that so far have been lacking in Latin America.

FIGURE 1:

FIGURE 2

FIGURE 3

FIGURE 4

FIGURE 5

FIGURE 6

FIGURE 7

ENDNOTES

1. Charles Hulten, “Infrastructure Capital and Economic Growth: How Well You Use it May be More Important than How Much You Have,” National Bureau of Economic Research (NBER) Working Paper No. 5847 (Cambridge, MA: NBER, 1996).

2. César A. Calderón and Luís Servén, “The Effects of Infrastructure Development on Growth and Income Distribution,” World Bank Policy Research Working Paper 3400 (Washington DC: World Bank, 2004).

3. David Hummels, “Calculating Tariff Equivalents for Time in Trade” (Washington DC: USAID, 2007).

4. Mauricio Mesquita Moreira, Christian Volpe, and Juan S. Blyde, “Unclogging the Arteries: the Impact of Transport Costs on Latin American and Caribbean Trade” (Washington DC: Inter-American Development Bank, 2008).

5. Calderón and Servén.

6. Razeen Sally, “Regional Economic Integration in Asia: the Track Record and Prospects,” ECIPE Occasional paper No 2.6 (Brussels: European Centre for International Political Economy, 2010).

7. Otaviano Canuto and Manu Sharma, “Asia and South America: A Quasi-Common Economy Approach,” World Bank – Economic Premise, September 2011, 1-8.

8. Mesquita Moreira, Volpe, and Blyde, 13.

9. Eduardo Lora, “Public Investment in Infrastructure in Latin America: Is Debt the Culprit?,” IDB Working Paper No. 498 (Washington DC: Inter-American Development Bank, 2007); Luis Carranza, Christian Daude and Ángel Melguizo, “Are public infrastructure investment and fiscal sustainability in Latin America incompatible?,” OECD Development Centre Working Paper No. 301 (Perugia, Italy: Organization for Economic Cooperation and Development, 2011); and César Calderón and Luís Servén, “Infrastructure in Latin America,” Policy Research Working Paper 5317 (Washington DC: World Bank, 2010).

10. Asian Development Bank, The International Bank for Reconstruction and Development / The World Bank, and Japan Bank for International Cooperation “Connecting East Asia: A New Framework for Infrastructure” ( Manila, Philippines: Asian Development Bank, 2005).

11. Asian Development Bank Institute and Asian Development Bank, “Infrastructure for a Seamless Asia” (Manila, Philippines: Asian Development Bank, 2009), 15.

12. Haruhiko Kuroda, Masahiro Kawai, and Rita Nangia, “Infrastructure and Regional Cooperation,” in Rethinking Infrastructure for Development, eds. F. Bourguignon and B. Pleskovic (Washington DC: World Bank, 2008).

13. Antonio Estache and Marianne Fay, “Current Debates on Infrastructure Policy,” Working Paper No. 49 (Washington DC: World Bank, 2009).

14. Asian Development Bank Institute and Asian Development Bank, 119.