A decade that saw Chinese infrastructure break new ground in Latin America ended, ironically, with a nostalgic nod to the old soft-power playbook.

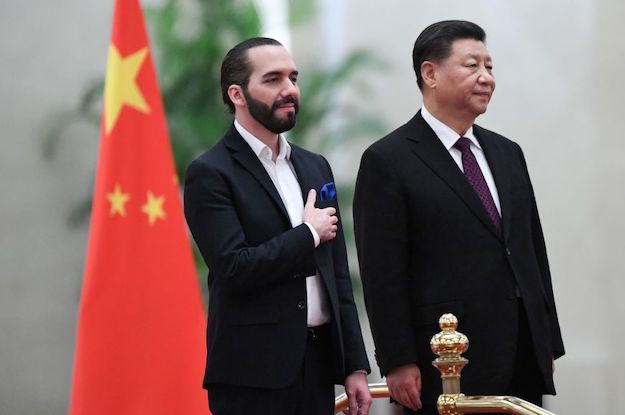

During a visit to Beijing in December, El Salvador’s President Nayib Bukele celebrated the announcement of “gigantic” and “non-refundable” Chinese financing for a sports arena, a water treatment plant and a public library back home. The actual amount of support was left undisclosed. Not since Costa Rica switched its allegiance from Taiwan to the People’s Republic in 2007, earning it the construction of the Estadio Nacional, has China’s so-called stadium diplomacy been so vividly reenacted.

Yet Bukele’s deals are a misleading indicator of contemporary Chinese infrastructure cooperation with Latin America. Though the politics remain, shifts in Latin American governments and weariness with Washington’s warnings about “debt-trap diplomacy” and the Belt and Road Initiative (BRI) have led China to shake up its approach. Instead of going it alone on symbolic projects, a range of Chinese institutional investors now see benefits in operating more like their international counterparts, working in partnerships and seeking long-term returns.

“We’re seeing movement in countries where we haven’t seen much movement in the past,” said Margaret Myers, Director of the Asia and Latin America program at the Inter-American Dialogue. For example, Myers told AQ that the decision by China Harbor Engineering Corporation and Xi’an Metro to partner with a Canadian company in their ultimately successful $4-billion bid for Bogotá’s subway project may have made their approach more attractive, given Colombia’s close ties with the U.S.

Chinese participation in consortia and increased equity investment, often through newly created funds, is replacing headline-grabbing turnkey contracts backed by China’s policy banks. Many of those marquee deals, agreed with national governments from Ecuador to Argentina, have progressed slowly. Instead, investors are seeking value from projects’ long-term operation, Myers said.

The BRI is undoubtedly advancing in Latin America, but investments by China’s policy and state-owned commercial banks made as part of the initiative don’t tell the whole story. Though the BRI has a big part to play in bridging Latin American infrastructure gaps and helping countries meet the sustainable development goals, three of the four largest economies in the region – Brazil, Colombia and Mexico – have resisted overtures to participate.

Belt and Road controversy

For China’s new Central American allies, public support for the BRI is par for the course. Bukele’s predecessor Salvador Sánchez Cerén proclaimed support for the One China policy, and a pledge from Beijing to cooperate on railways, roads, energy and telecommunications under the BRI framework soon followed. But Myers said the projects agreed by Sánchez Cerén’s FMLN government were more emblematic of the BRI than the deals Bukele recently agreed.

Álvaro Méndez, co-director of the Global South Unit at the London School of Economics and Political Science, said that Bukele “did not know what to ask for from China” and may have overestimated the significance of early declarations of support from Washington.

“Bukele has learned that a couple of tweets (from President Donald Trump) do not equal U.S. finance,” he said. Nor does a BRI agreement guarantee (or rule out) infrastructure investment. “It’s not a precondition,” said Méndez, again singling out Colombia, for whom he said signing a formal agreement would risk upsetting the U.S.

Shoujun Cui, director of the Center for Latin American Studies at Renmin University of China, said that continued Chinese engagement with countries that haven’t signed BRI agreements is not new. However, it could be a catalyst for deeper bilateral cooperation; Colombia has “great potential” to be a part of the initiative, said Cui.

Brazil, the second-biggest recipient of Chinese policy-bank finance since 2005 after Venezuela, according to the Inter-American Dialogue’s China-Latin America Finance Database, has also resisted officially supporting the BRI. Yet it continues to attract Chinese interest in major infrastructure works.

Sometimes Chinese companies focus on working with Brazilian state governments. Back in May, Bahia State Governor Rui Costa secured $7 billion in finance for an “integrated development project” including an industrial park and the revitalization of the Aratu port. He also attracted a further $1 billion for wind and solar projects. In November, Pará Governor Hélder Baralho signed a Memorandum of Understanding (MoU) with the China Communications Construction Corporation to begin feasibility studies for a proposed freight railway, also for $7 billion, that would stretch 300 miles from Marabá to Barcarena.

These are just a few of the many Chinese projects that Brazil attracted. With their focus on connectivity and industrial development, the port, rail and bridge contracts are BRI deals in all but name.

The Pará rail MoU was signed as President Xi Jinping arrived in Brasília for the 11th summit of the BRICS nations. On the same trip, Xi made $100 billion available for the development of Brazilian infrastructure. Méndez partially attributes China’s continued prominence in Latin American infrastructure to its leader’s busy diplomatic efforts. Xi has visited 12 countries during five separate trips to the region over the past 11 years, more than Trump and former President Barack Obama combined.

Multilateral cooperation

Other sources of funding and cooperation abound. Chinese institutions have paid in to a number of funds that have enabled Latin American countries’ access to development finance, for example, with mixed results. The China Co-Financing Fund for Latin America and the Caribbean partnered with the Inter-American Development Bank’s (IDB) private sector arm, IDB-Invest, on Colombia’s troubled Hidroituango dam.

Although details are scarce, the latest proposal by the China Development Bank promised financial cooperation with partners in Colombia, Mexico, Peru, Argentina, Panama and Ecuador. Cui called the move “an important step for future development finance cooperation.”

In November, Ecuador became the first Latin American country to join a China-led multilateral lender, the Asian Infrastructure Investment Bank (AIIB). Full membership – Argentina, Bolivia, Brazil, Chile, Peru, Uruguay and Venezuela are prospective members – requires a $5-million capital subscription, and although the bank’s charter prioritizes lending to Asia, it has supported a project in Egypt and could extend its reach to Latin America.

China-based or otherwise, multilateral banks are not exempt from geopolitical tensions. The U.S. and Japan initially lobbied countries not to join the AIIB after its launch in 2014, and last year the IDB found itself at the center of a row over Venezuelan representation at its annual general meeting, slated for Chengdu, China.

According to Méndez, the meeting’s eventual cancelation had more to do with U.S. displeasure at having China host the meeting in the first place.

“(The Chinese) won’t tell you they were upset, but they were upset. But it wouldn’t damage the relationship long-term because of pragmatism,” he said.

Beyond its own lending potential, the AAA-rated AIIB provides a seal of approval for projects and mobilizes vital private capital, Méndez added.

“Policy banks lend to whoever they want to for the benefit of China. The AIIB is different. Its charter is very similar to the World Bank and they have to follow very strict rules.”

Sustainable Development Goals

The broad potential impact of these diverse forms of cooperation is significant. A decade remains to achieve the UN’s Sustainable Development Goals (SDGs) and to bridge the necessary – and gaping – financing shortfall. At 2.5% of GDP, Latin America’s public spending on infrastructure outstrips only Sub-Saharan Africa, according to the IDB.

According to U.N. Secretary General António Guterres, the BRI is “intrinsically linked” to the SDGs, and in particular the need to mobilize finance for sustainable infrastructure in developing countries.

Méndez told AQ that the AIIB, which is professed to be “lean, clean and green,” could give private investors the confidence they need to back Latin American projects.

“To go from billions (of dollars) to trillions and get to where we need to by 2030, we need an actor to catalyze the system,” Méndez said.

—

Soutar is managing editor of Diálogo Chino (www.dialogochino.net), a multilingual journalism website dedicated to better understanding the China-Latin America relationship and its sustainability challenges.