On March 1, Yamandú Orsi of the left-wing Frente Amplio (FA) coalition will be inaugurated as Uruguay’s next president. The former mayor of Canelones, the country’s second-wealthiest district after Montevideo, ran on a pledge to reduce crime and maintain continuity in sound economic policy. Early in the campaign, Orsi chose the renowned and moderate economist Gabriel Oddone as his economy minister, helping to attract centrist and undecided voters in the runoff against the center-right coalition’s Álvaro Delgado.

Orsi’s coalition secured a narrow majority in the Senate (16 out of 30 seats) and fell just short of a majority in the House (48 out of 99)—a challenging outcome, especially considering that previous governments have had majorities in both chambers. To pass legislation, the FA will need to work diligently to build consensus among its various factions and persuade at least two lawmakers from opposing parties.

President Orsi’s primary governance challenge will be to manage expectations among his own coalition’s most radical wing and the powerful PIT-CNT labor confederation, whose members are loyal to the FA and provide the majority of its voters on election days. The confederation has mobilized to support legislation to reduce working hours from as many as 48 to 40 hours per week without losing current pay, lower the retirement age from 65 to 60, and increase the minimum old-age pension to the minimum wage. On February 20, the unions held a half-day strike to voice their priorities, alerting the new legislature and administration.

The last two demands were already put to a vote last year in a constitutional referendum that coincided with the general elections. Both Orsi and Delgado spoke out against approval of these constitutional reforms, which experts consider fiscally unaffordable, as did incoming Economy Minister Oddone. Still, the PIT-CNT sponsored it and campaigned forcefully in its favor. In the end, it was supported by just 40% of the electorate, but the unions have not accepted defeat, demanding that the new legislature and Orsi pass these measures through law and also reduce the length of the work week.

To maintain Uruguay’s fiscal sustainability and creditworthiness, Orsi will need to resist or dilute these union demands, rein in the FA’s most progressive factions in the legislature, and override his own labor minister, Juan Castillo, a longtime union activist, head of the Uruguayan Communist Party, and a vocal advocate for these reforms.

A fortunate inheritance

Orsi inherits an economy and country whose fundamentals are very strong. Uruguay ranks first in Latin America when it comes to per capita income, political stability, democratic strength, adherence to the rule of law, social mobility, civil liberties, and anti-corruption. It is so creditworthy that the government can sell bonds abroad at the lowest dollar interest rates of any Latin American government. Crime is one of the few indicators that have moved in the wrong direction, and that is why countering it is a priority for the Orsi administration—as it was for the outgoing government, but without much success. The homicide rate per inhabitant has doubled over a decade and a half, though from a low level.

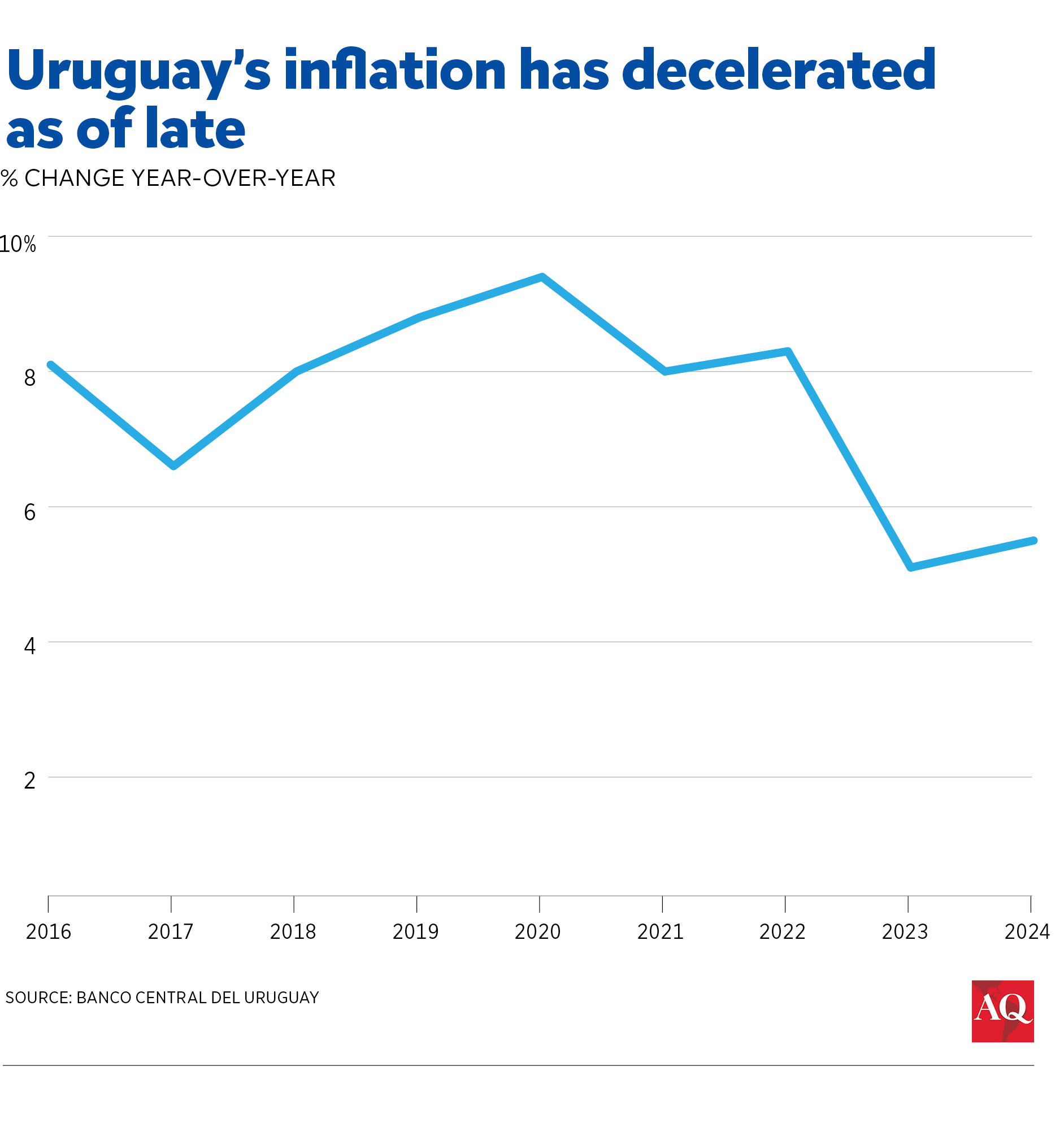

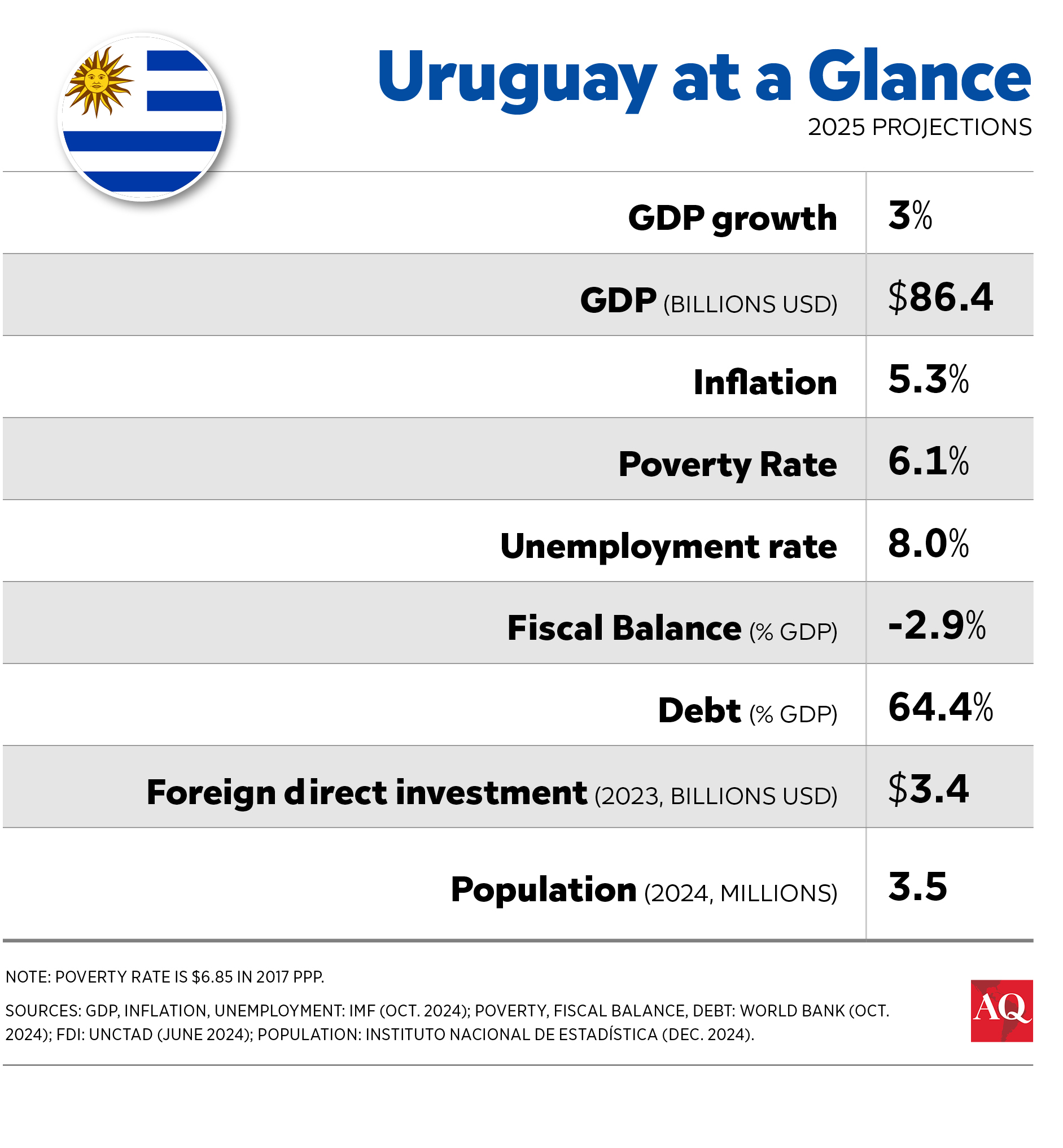

Even before inflation spiked around the world due to the COVID-19 pandemic and the war in Ukraine, Uruguay struggled to control price increases—but lately, progress has been made. Inflation averaged 8.2% annually from 2010 to 2022, but an unusually restrictive monetary policy has finally reduced inflation to 5.1% in 2023 and 5.5% last year. While surveys indicate that expectations of future inflation remain stubbornly close to 6%, the central bank recently raised the benchmark interest rate from 8.5% to 9%. Reassuringly, Orsi has nominated Guillermo Tolosa, an orthodox economist who has primarily worked at the IMF, to become the next president of the central bank. His main task is to reduce the inflation rate to the 4.5% target.

Unemployment has settled at a lower rate than before the pandemic (below 8% rather than close to 9%), and inflation-adjusted wages stand about 3% higher. The pace of economic activity picked up last year, with real GDP growing 3.2% and forecast to increase a further 2.5% this year. However, Uruguay’s GDP is only 6% higher than in 2019, versus 9% in the rest of Latin America, because in addition to the pandemic, agricultural production was curtailed in 2023 by a drought of historic proportions.

Little appetite for transformational reforms

As a candidate, Orsi promised modest increases to social welfare programs and some tinkering with the tax regime to benefit the disadvantaged without harming the business climate or the fiscal budget. However, he is already under significant pressure to deliver on budget-busting pension reforms, and his base expects him to hike the minimum wage and help overturn a law passed by the outgoing administration that banned the occupation of workplaces during strikes.

But bold reforms to augment Uruguay’s economic potential and enhance its competitiveness would truly benefit the country. These reforms would attract more investment and improve the productivity of its farmland and labor. Since 2011, the annual economic growth has averaged a meager 1.9%, and at that pace, Uruguay will never become a high-income nation by world standards.

The cost of doing business in Uruguay is excessively high. Duties and other import restrictions are significant, and taxes and permits are burdensome. State-owned and private monopolies have pricing power, and salaries, benefits, and severance pay are onerous and unrelated to labor productivity or enterprise profitability.

Rather than dealing with this challenging reality, previous governments have created a system of “free-trade zones” where new domestic or foreign companies, upon approval, can establish operations, produce goods, import, and export while enjoying exemptions from national taxes. Through this loophole, most new investments in industrial, commercial, and service activities have flowed, generating jobs, exports, and profits. Despite largely successful outcomes, there has been limited scaling up: the zones account for less than 2% of the country’s total employment.

This parallel investment regime cannot provide enough to address the issues faced by legacy companies, most of which are uncompetitive and barely profitable, with the exception of those that wield monopolistic power. If the outgoing center-right government was unwilling or unable to initiate an ambitious deregulatory effort aimed at lowering the cost of doing business throughout the economy, there is little hope that the Orsi administration will even attempt to do so. Uruguay is well known for its aversion to destabilizing change—even when such change can be beneficial.