U.S. strikes on Iranian nuclear infrastructure on Saturday—just days after Israel’s large-scale bombardment—sharply escalated tensions in the Middle East and rattled global energy markets. However, a ceasefire announced Monday by President Donald Trump between Iran and Israel has temporarily cooled fears of an extended regional conflict.

This growing instability may have unexpected implications for Venezuela. Home to the world’s largest proven oil reserves and located just south of the U.S. Gulf Coast, Venezuela could once again become a focal point in efforts to diversify global energy supply, despite its modest current crude output.

While the Trump administration has maintained a hardline stance toward Nicolás Maduro’s government—reflecting bipartisan concerns over human rights and blunt democratic backsliding—sharp changes in energy prices may prompt a recalibration of U.S. policy, particularly if the ceasefire falls apart and inflation and domestic energy costs become politically salient.

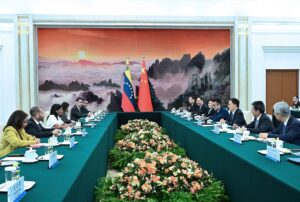

This would not be without precedent. Shortly after Russia invaded Ukraine in February 2022, U.S. officials traveled to Caracas to explore avenues for limited engagement with Venezuela. That outreach, motivated in part by a broader strategy to isolate Russia and stabilize global energy markets, reflected the kind of pragmatism that geopolitical crises can compel. Although those talks were limited in scope, they signaled that U.S. policy toward Venezuela is not immutable.

While energy futures have since retreated on news of a ceasefire, the episode is a sobering reminder of just how vulnerable global supply chains remain to geopolitical shocks. Following Israel’s initial strike, oil prices surged nearly 12%, and while they have since eased, the underlying risk remains.

In the aftermath of the U.S. joining Israel in targeting Iranian facilities, Iran threatened to close the Strait of Hormuz, a strategic chokepoint that it controls. Market analysts have warned of further volatility if the ceasefire falls apart and a protracted conflict in the Middle East ensues. The Strait of Hormuz alone handles roughly one-third of the world’s seaborne oil shipments and serves as a key transit route for liquefied natural gas exports, especially from Qatar, which accounts for 20% of global LNG supply. Some analysts project that a partial or full closure of the Strait could send oil prices to $130 per barrel or higher.

A historical parallel

While markets have since cooled in response to the announcement of a ceasefire, the speed and scale of the oil price surge served as a powerful reminder of the fragility of global energy systems. Futures rose sharply before easing, and the episode demonstrated how even brief escalations in the Middle East can ripple across markets. The relative calm should not obscure the structural vulnerabilities that persist—nor the fact that energy markets could be just one provocation away from renewed turmoil. In this light, developing a broader base of reliable suppliers—including those in the Western Hemisphere—should remain a strategic imperative.

These developments recall the 1973 energy crisis, when conflict in the Middle East triggered a sharp energy shock and ushered in a period of stagflation in the West. Policymakers now face a similar scenario—in which energy-driven inflation collides with sluggish economic growth. In fact, President Trump took to social media to tell the Department of Energy to “DRILL BABY, DRILL!!! And I mean NOW!!!”

In response, a coordinated international effort may be necessary to stabilize energy markets. Yet OPEC’s willingness to increase production is far from guaranteed, and it remains unclear whether President Trump would authorize significant drawdowns from the U.S. Strategic Petroleum Reserve to support global supply.

Amid this uncertainty, attention may again shift to producers outside the Gulf. Venezuela—despite years of underinvestment and U.S. sanctions—remains one of the world’s most resource-rich countries. Its current production stood at 863,000 barrels per day (bpd) in May, down sharply from a historical peak of 3.5 million bpd. However, according to OPEC data, the output topped 1 million bpd in May (see graph below). That decline is expected to accelerate following the Trump administration’s decision to grant Chevron a narrowed special license that allows the company to retain its assets in the country but prohibits it from producing and exporting oil to the U.S. Until recently, Chevron contributed roughly 230,000 bpd to Venezuela’s total output.

The Iran question

The Chevron decision followed political pressure from members of Florida’s congressional delegation, who argued that easing sanctions undermined efforts to support a democratic transition. Representatives María Elvira Salazar, Mario Díaz-Balart, and Carlos Giménez—backed by Secretary of State Marco Rubio—have consistently framed Maduro’s government as a principal obstacle to regional stability.

Any consideration of renewed U.S. engagement with Venezuela, against the backdrop of conflict with Iran, must acknowledge Caracas’ relationship with Tehran, which has deepened since the 2000s, when Hugo Chávez and Mahmoud Ahmadinejad were in power. While Venezuela and Iran have expanded cooperation in areas such as energy, defense and banking, much of the partnership has been driven by shared estrangement from the U.S. and its allies. Improved U.S.-Venezuela ties would not only serve U.S. strategic energy interests but could also reduce the space for Iran to operate in the Western Hemisphere. A calibrated U.S. approach—anchored in transactional diplomacy—could begin to weaken the incentives behind Venezuela’s alignment with Iran.

Still, the geopolitical calculus may be shifting. Although the current crisis appears to have de-escalated, the region is still on edge and vulnerable to renewed confrontation. For the U.S., this could mean reassessing long-standing assumptions about engagement with resource-rich but diplomatically complex partners. Venezuela’s alignment with Iran will give policymakers pause—but so too will the prospect of sustained energy volatility and growing inflationary pressures.

Navigating this moment may require a revised policy to find a balance between immediate strategic needs and long-term geopolitical risks.