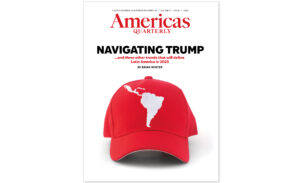

This article is adapted from AQ’s special report on trends to watch in Latin America in 2025

AQ: What’s ahead for green energy in Mexico and Brazil?

LP: For Mexico, the upcoming USMCA review is existential. Given this risk, I don’t think green targets are going to be the priority, especially because Mexico’s recent judicial and regulatory reforms are making the energy transition more difficult.

Mexico’s state-owned oil and electricity companies are now even more dominant in the sector, with less space for private sector players. These SOEs are also under financial difficulty, which means less ability to conduct the required investments to meet energy demand growth. This means that investment in renewable energy will probably be sluggish.

There is a risk that the even more limited role of private companies in the electricity sector could ironically lead to more electrical integration with the U.S. Some years from now, the U.S. may become a more important exporter of electricity to Mexico if domestic generation capacity fails to grow, building on what it sends to Baja California, for example.

Brazil is the opposite of Mexico. It has attracted huge amounts of climate finance and renewable investment by providing clear rules for private sector participation, even though it also has state-owned companies in the energy sector. Brazil is thinking about renewable energy and sustainability from the point of view of competitiveness, and so will continue to find success.

AQ: What region-wide trends will you be watching this year?

LP: Most countries in the region are net importers of petroleum products like diesel and gasoline. This is extremely expensive, but there’s a homegrown solution available: biofuels. Latin America can use its huge agricultural potential to cut costs and reduce emissions, which could help its biofuels sector to grow under the right policy framework.

I also expect more interest in voluntary carbon markets. The 2025 UN Climate Change Conference, COP30, is going to be in Brazil, where the Amazon rainforest is a huge carbon sink for the planet. There are major transparency and governance problems with the carbon offsets that are sold in the voluntary carbon markets. But just because offsets are difficult doesn’t mean they’re impossible to get right, and the region could benefit immensely from setting the right institutional framework for this market to grow.

Finally, methane will be increasingly important to how Latin America thinks about decarbonization. There’s a realization that reducing methane emissions from oil and gas infrastructure is one of the most cost-effective things you can do anywhere in the economy to cut emissions.

AQ: Any big takeaways from 2024?

LP: For Latin America, 2024 was a year of fires, drought and water problems, from Mexico to the Panama Canal to Brazil, and policymakers are very clear-headed now about the gravity of climate risks. This is changing how people are thinking about climate finance, energy infrastructure and climate adaptation. They are becoming priorities.

—

Palacios is Deputy Research Director at Columbia University’s Center on Global Energy Policy, adjunct faculty at Columbia’s School of International and Public Affairs, and a member of AQ’s editorial board.

This interview has been edited for clarity and length.