ENDNOTES:

1. MOFCOM in ISI emerging markets, 2011. Note: this includes South American countries only.

2. Theodore H. Moran, “China’s Strategy to Secure Natural Resources: Risks, Dangers and Opportunities,” Peterson Institute for International Economics, Washington, DC: July 2010.

3. “World Investment Report 2007: Transnational Corporations, Extractive Industries, and Development,” New York: United Nations Conference on Trade and Development.

4. ECLAC, “People’s Republic of China and Latin America and the Caribbean: Ushering in a new era in the economic and trade relationship,” Santiago: United Nations ECLAC. June, 2010.

5. “Estadísticas: stock por sector de destino”, ProInversión, Agencia de Promoción Privada, Peru 2011, <http://proinversion.gob.pe/Default.aspx?ARE=0&PFL=0>; and “Boletín Mensual de Minería,” Ministerio de Energía y Minas, Perú, 9 June, 2011, <http://www.minem.gob.pe/minem/archivos/file/Mineria/PUBLICACIONES/VARIABLES/2011/BOLETIN%209%2006.2011.pdf> (Both last accessed November, 2011)

6. Peru 2021. “Antamina logra nivel en A en Reporte de Sostenibilidad 2009,” <www.peru2021.org> (Last accessed August 9, 2011)

7. Comisión Investigadora de los Delitos Económicos y Financieros Cometidos entre 1990 y 2001. “Primer informe de investigación. Caso: El Proceso de Privatización de Hierro Peru,” <http://www.congreso.gob.pe/comisiones/2002/CIDEF/oscuga/InformeHierro.pdf> (Last accessed November 9, 2011)

8. Interview with former Peruvian official, July 11, 2011.

9. Michael Smith, “China Defies Peru Rescue of Miners Afflicted With Lung Disease,” Bloomberg, July 23, 2010.

10. “Premier Zhu Rongji’s Explanation of 10th Five-Year Plan Drafting”, <http://www.china.org.cn/e-15/15-3-g/15-3-g-1.htm> (Last accessed November, 2011)

11. Jiang Zemin, “Report at the 16th Party Congress,” Xinhua News Agency, November 17, 2002, <http://www.china.org.cn/english/features/49007.htm> (Last accessed November, 2011)

12. China’s Policy Paper on Latin America and the Caribbean, November 5, 2008. Accessed through the Xinhua website <http://news.xinhuanet.com/english/2008-11/05/content_10308117_1.htm> (Last accessed July, 2011)

13. Interview with David Splett, Vice President Finance and Administration, Compañia Minera Antamina SA. July 14, 2011, Lima, Peru.

14. Interview with Xiaohuan Tang, General Manager of Jinzhao Mining Group. August 27, 2011.

15. Interview with Richard Graeme, Senior Vice President, General Manager Lumina Copper SAC. July 11, 2011, Lima, Peru.

16. The Corruption Perceptions Index (CPI) is an aggregate indicator that ranks countries on a scale from 10 (very clean) to 0 (highly corrupt), according to perception of corruption in the public sector. The CPI draws on different assessments and business opinion surveys carried out by independent and reputable institutions.

APPENDICES:

Appendix I. Chinese FDI in Natural Resources: South America

Category I: Special relationship with major producer

Buyers and/or their home governments take an equity stake in a “major” producer to procure an equity share of production on terms comparable to other co-owners.

1. CNOOC and Bridas Corporation, Argentina, 2010

2. Shanghai Baosteel and Vale, Brazil, 2001

3. Chalco and Vale, Brazil, 2004

4. Chalco and Vale, Brazil, 2004

5. CNPC’s acquisition of the Intercampo and Caracoles oilfields from Petroleos de Venezuela SA, Venezuela, 1997

6. CNPC and Petroleos de Venezuela, Venezuela, 2008

Category II: Special relationship with competitive fringe

Buyers and/or their home governments take an equity stake in an “independent” producer to procure an equity share of production on terms comparable to other co-owners.

7. Shandong Gold Group and Energia y Minerales Soceidad del Estado, Argentina, 2010

8. Minmetals and Vale, Brazil, 2004

9. Minmetals and Cosipar Group, Brazil, 2007

10. WISCO and EBX, Brazil, 2009

11. Wuhan Iron & Steel Co. Ltd. And MMX Sudeste Mineracao SA, Brazil, 2010

12. Sinopec and Petrobras, Brazil, 2004

13. Sinopec and Repsol YPF SA, Brazil, 2010

14. Minmetals and Codelco, Chile, 2006

15. Shunde Rixin and government of Chile, Chile, 2009

16. CNPC’s development of Atacapi and Parahuacu blocks, Ecuador, 2003

17. Sinopec and ConocoPhilips, Ecuador, 2003

18. CNPC and Sinopec’s acquisition of Encanna, Ecuador, 2006

19. Bosai Minerals and the government of Guyana, Guyana, 2008

20. CNPC and PlusPetrol Norte SA, Peru, 2004

21. CNPC’s development of Block 6 and 7 or the Talara oilfields, Peru, 1993 and 1994

22. Shougang’s acquisition of Hierro Peru, Peru, 1992

23. Zijin Mining and Monterrico Metals, Peru, 2007

24. Shougang Hierro Peru’s expansion of the Marcona mine, Peru, 2007

25. Chinalco’s acquisition of the Toromocho Copper Project, Peru, 2008

26. Minmetals and Jiangxi Copper’s acquisition of Northern Peru Copper, Peru, 2007

27. Zibo Hongda Mining Industyr Co. Ltd.’s acquisition of Pampa de Pongo iron ore mine, Peru, 2009

Category III: Loan capital to major producer to be repaid in output

Buyers and/or their home governments make a loan to a “price maker” producer in return for a purchase agreement to service the loan.

28. China Development Bank and Petrobras, Brazil, 2009

29. Shanghai Baosteel and Vale, Brazil, 2003

30. China Development Bank and CNPC with the Venezuelan Social Development Bank and Petroleos de Venezuela, Venezuela, 2010

Category IV: Loan capital to competitive fringe to be repaid in output

Buyers and/or their home governments make a loan to a “price taker” producer in return for a purchase agreement to service the loan.

31. CITIC’s investment to build a pig iron plant, Brazil, 2004

32. China Development Bank and the government of Ecuador, Ecuador, 2009

33. CPEB and Petroecuador and the Ecuadorian Ministry of Energy and Mining, Ecuador, 2003

34. Shandong Gold Group and Corporacion Venezolano de Guyana, Venezuela, 2003

Sources: FDiMarkets.com; RHGroup

Key:

Chalco/Chinalco = Aluminum Corporation of China

CITIC = CITIC group (formerly China International Trust and Investment Corporation)

CNOOC = China National Offshore Oil Corporation

CNPC = China National Petroleum Operation Company

CPEB = Changqing Petroleum Exploration Bureau

Sinopec = China Petroleum and Chemical Corporation

WISCO = Wuhan Iron & Steel Co. Ltd.

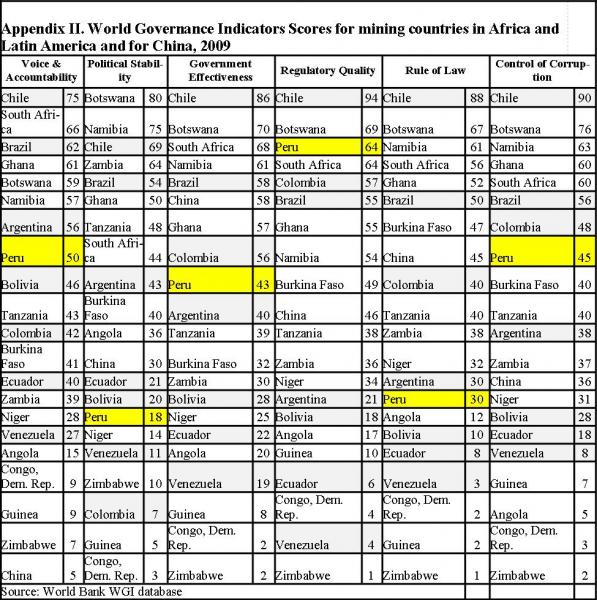

Appendix II. World Governance Indicators Scores for mining countries in Africa and Latin America and for China, 2009