Read NAFTA @20: Where We Go From Here by Ernesto Zedillo Ponce de León here.

Read NAFTA @20: The Perils of Partisanship by Thomas F. McLarty III here.

Read sidebars on aerospace, medical devices and the automotive sector.

The North American Free Trade Agreement (NAFTA) has never occupied a particularly secure place in the public political debate in the United States or Mexico, despite its two-decade life span. The 2012 presidential elections in the U.S. marked the first time that U.S. candidates did not declare their intention to reform NAFTA, which has been in effect between Canada, Mexico and the U.S. since January 1, 1994. In Mexico, left-wing presidential contender Andrés Manuel López Obrador made the reversal of NAFTA a key part of his campaign in 2006 and lost that race by less than 1 percent of the vote.

As 2014 marks the 20th anniversary of NAFTA, these political jabs reflect the mixed feelings and misperceptions that linger on both sides of the border over the sizable gaps that have emerged in expectations, implementation and outcomes.

Part of this stems from a rather simplistic idea from the start that held that rapid trade and investment liberalization would unleash market forces and propel Mexico into the ranks of the developed world, irrespective of the bureaucratic labyrinth and institutional distortions that existed and the woeful lack of infrastructure among the three member countries. This original assumption was clearly flawed, but the booms and busts of the individual economies and the entrance of China into the global market have also been a drag on the NAFTA bloc.

The good news is that despite many of these ongoing structural obstacles, the Mexican economy has begun to find its footing in a number of high-end sectors, taking advantage of its access to the much larger developed economies to its north and some long-overdue state incentives for human capital and technology upgrading—policies that have heretofore been anathema to the liberal spirit of NAFTA.

National Interests and Expectations

But let’s go back to the beginning. On paper, NAFTA was a major triumph for U.S. foreign economic policy and certainly a shining moment for President Bill Clinton’s administration. It broke entirely new ground with the willingness of the U.S. to negotiate a trilateral free trade agreement (FTA) that included a developing country. NAFTA itself blazed the trail with its coverage of agriculture, intellectual property rights (IPR), the liberalization of investment and trade in services, and the creation of mechanisms to resolve investment disputes based on binding international arbitration.

Thanks to the heavy pressures exerted by labor and environmental organizations, NAFTA was also the first agreement ever to address labor and the environment. The General Agreement on Tariffs and Trade (GATT)-plus accomplishments helped bring the lagging Uruguay Round talks to a successful close in 1994. It was followed by the creation of the World Trade Organization (WTO) in 1995 as a new institutional entity to oversee trade and investment disputes and better address those issues (services, investment, IPR) that now make up the new trade agenda.

In practice, however, NAFTA was a second-best option for the U.S., one that accounted for less than 1 percent of U.S. gross domestic product (GDP) at the time. A trilateral side deal like NAFTA became more plausible as the Uruguay Round talks dragged on with no apparent end in sight. Domestic private actors engaged in intra-industry trade and cross-border investment and services on both sides of the border lobbied hard for the reduction of barriers to cross-border production, and they eventually won. But powerful political actors in the U.S. were adamantly against the creation of supra-national institutions to oversee NAFTA implementation along the lines of the European Union, buying in to British Prime Minister Margaret Thatcher’s pejorative term for the latter as the “Brussels bureaucracy.”

Canada and Mexico colluded in resisting the creation of strong NAFTA institutions, as both feared this would empower the U.S. to steamroll over their respective concerns. This insistence that NAFTA remain a free trade area in the absence of sound institutional moorings stunted its maturation into a more compelling regional project.

The whole is still no greater than the sum of its parts, as two bilateral accords—Canada-U.S. and Mexico-U.S.—basically operate side by side. NAFTA’s opponents continue to begrudge the weak enforcement of labor rights and environmental regulations, mainly in Mexico, while its proponents decry the numerous exceptions that made it into the text. Tellingly, in their Spring 2013 Americas Quarterly article, Andy Baker and David Cupery find that “Mexicans are surpassed only by Argentines in their lack of good will toward the United States.” So much for the concept of a North American community.

Cast by its designers in the jargon of economic integration theory, it was expected that NAFTA would foster a growth boom that would benefit all three member countries, but especially Mexico, as the least developed of the three. First, the elimination of barriers at the border would promote scale economies related to greater specialization, increased technological capabilities and a more efficient deployment of those factors for which Mexico has a comparative advantage.

Second, it was argued that the blending of Mexico’s abundant factors (relatively cheap labor and natural resource inputs) with the capital, technology and know-how the U.S. brought to the table would trigger a dynamic pattern of economic convergence among the three members. According to this largely neoclassical trade narrative, Mexico would readily advance up the industrial and technological learning curve, substantially increase its per capita income, and more authentically approximate the macro- and micro-economic indicators of the OECD bloc. Reality check: Mexico’s per capita income today is still about one-third that of the wealthier countries in the OECD.

Keep in mind that at the time of NAFTA’s launch in 1994, China was a mere speck on the economic horizon. It was unimaginable that China would bump Mexico down a notch in its ranking as a U.S. trade partner, but this is precisely what occurred in 2003. Virtually no one envisioned that China would go on to become a de facto player in NAFTA—now one of the overriding characteristics of the North American market.

Implementation

Along with side agreements on labor standards and environmental protection, the NAFTA accord promoted the free flow of goods, investment and services within the North American bloc over a 15-year timeline. In line with WTO rules, most barriers came down in the first 10 years of the agreement. Tariffs and non-tariff barriers were eliminated on 65 percent of North American goods by the five-year point; tariff reductions on automobiles occurred over a 10-year period, with the rules-of-origin stipulation that such vehicles must meet a 62.5 percent local content requirement to qualify. In the agricultural sector, sensitive products were allotted a 15-year liberalization schedule that ended in 2009. This included, for example, corn, dry beans and powdered milk on the Mexican side; sugar, peanuts and orange juice concentrate on the U.S. side. By 2009, NAFTA had been implemented and was basically a done deal.

In Mexico, a new generation of neoliberal technocrats had sought NAFTA entry as a way to lock in recently minted market reforms and to purge the country once and for all of its protectionist past. It was implicitly understood that, to maximize on its NAFTA membership, Mexico would step up to the plate by modernizing its energy sector, restructuring its fiscal system, reforming labor markets, and stepping up with stronger technical support and credit access for those small and medium-size firms that employ the bulk of Mexicans.

Two decades later, these reforms are still pending. The delay is partially related to the unexpected difficulties that arose with the country’s transition to democracy in 2000, which ushered in minority government and authentic political party competition. After more than 70 years of soft authoritarian single-party rule under the Partido Revolucionario Institucional (Revolutionary Institutional Party—PRI), the learning curve for political brokering and reform compromise was steeper than expected. But those Mexican advocates and policymakers who supported NAFTA were also trapped by their own blind faith in neoclassical trade dictums and the power of geographical proximity to the U.S. market to trigger higher productivity growth and lift its population out of poverty. In many ways, though, these advocates were overlooking the structural bottlenecks, market distortions and numerous Mexican monopolies in such sectors as telecom, finance, petroleum, and tortilla production.

After blocking and undermining the reform efforts of two consecutive administrations led by the center-right Partido Acción Nacional (National Action Party—PAN) over the past 12 years, the longstanding center-left PRI is back in business with the election of its candidate, Enrique Peña Nieto, to the presidency in 2012. It is now up to the PRI to tackle a dire reform backlog that is largely of its own making. The modernization and recapitalization of the state oil company, Pemex, is most urgent for salvaging Mexico’s medium-term growth prospects, as politicians and policymakers have relied too long on oil revenues to fund the federal budget. In 2007, for example, Pemex registered $584 million in pre-tax profits but paid $583 million in state taxes!1 To fund his reforms, Peña Nieto must persuade the Mexican Congress to create new rules for the recently passed energy reform that will admit private investors into the gutted state oil firm before reserves run dry.

Outcomes

If judged according to its own narrowly defined goals of spurring growth based on higher levels of trade and investment, NAFTA has been a measured success. Its golden age was the period between 1994 and 2000, when the average annual growth rate of total U.S. trade with North America was around 17.7 percent and the average annual growth rate of North American foreign direct investment (FDI) in this sub-region was about 24.2 percent.2 In the 1990s, Mexico’s manufacturing sector attracted twice as much FDI as the manufacturing sectors of Argentina, Brazil and Chile combined.3 Even with the devastating losses due to Mexico’s 1994 currency crisis, per capita GDP and aggregate growth rates moved upward at respectable rates in all three countries.

Yet, these trends slowed markedly after 2001. The U.S. dot-com bust in 2000, the economic shocks from 9/11, and China’s entry into the WTO in 2001 all took a toll. But by 2003, as the world economy began to recover, Mexico faced profoundly different conditions in the North American market. Seemingly out of nowhere, Chinese exports were now burrowing through the more sophisticated sub-sectors of the U.S. electronics market (computer peripherals, sound and television equipment, telecoms), which Mexico had once claimed as its own. Between 2000 and 2005, Mexico increased its share of U.S. imports by 25 percent, while China’s share of U.S. imports grew by 143 percent.

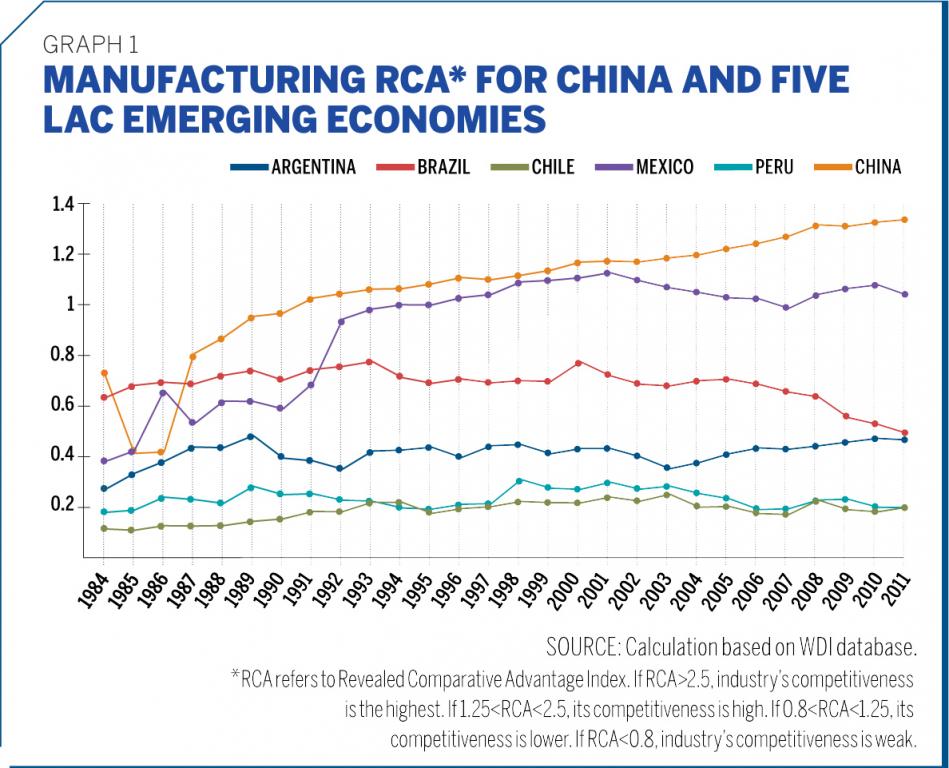

By 2011, 31 percent of all U.S. imports from Mexico were deemed to be under direct threat from Chinese competition in the U.S. market, and some 46 percent of Mexico’s manufacturing exports to the U.S. were classified in this same category.4 This is confusing, as Mexico is the one Latin American emerging economy that approximates China’s high level of “revealed comparative advantage” within its manufacturing sector. [See Graph 1]

The difference, it turns out, is that the technological strengths within Mexico’s manufacturing sector stem from intermediate inputs that are developed in the advanced economies, processed in Mexico, and shipped back out. China’s technological capabilities are home-grown and the result of assertive public policies and generous state funding.

For NAFTA, China’s rapid entry into the North American market meant a slowdown of North American FDI to an annual average growth rate of 8.8 percent between 2000 and 2011 (compared with the robust 24.2 percent mentioned earlier); total U.S. trade with North America similarly slowed to an annual average growth rate of about 5.3 percent during this same period.5 Corporate investors stampeded to China in search of cheaper production costs and greater access to the billion-plus consumer market.

For Mexico, the penalties for reform delay were ruthlessly kicking in. Especially fatal was the lack of technical support and credit access for those small and medium-size firms that provide the bulk of Mexican employment. In the bigger picture, China’s lower costs on utility inputs for industrial production, more favorable corporate tax rates, and its blitzkrieg educational investment in the higher-skilled professions confirmed that the laissez-faire development strategy embodied in NAFTA was simply missing the mark. To its credit, the Peña Nieto administration has hit the ground running and stuck tenaciously to the reform tasks at hand. Meanwhile, the rapid rise of China in the NAFTA market has expanded the to-do list of reforms to include the need for increased public investment and bank financing for productive activities, as well as the active deployment of public policy in the expansion, upgrading and infusion of technology into the manufacturing sector.

The Silver Lining

Some of Mexico’s more enlightened technocrats are taking baby steps toward tackling the reform gap. Especially since the 2008-09 global financial crisis, measures at the federal, state and local levels have sought to promote innovation, jobs and exports. And, as painful as Chinese competition has been for domestic manufacturers, it has also been a powerful incentive to restructure. Through this combination of intense external market pressure and targeted public policies, some impressive success stories are beginning to emerge.

In the lead-up to NAFTA in the early 1990s, the mantra for Mexico’s free trade technocrats was “the best industrial policy is no industrial policy.” State support in the manufacturing sector tapered off and the tough tasks of technology acquisition and adaptation were basically turned over to foreign companies operating in export production zones located in northern Mexico. The results of this strategy are reflected in the comparative rankings of Mexico and China in the World Economic Forum’s Global Competitiveness Report 2013-2014. With regard to those indicators (FDI and technology transfer, local supplier quality, and sophistication of production processes6) that reflect an industrial model like Mexico’s, with its strong orientation toward FDI operating in export processing zones, Mexico easily outshines China in the rankings. Conversely, on those indicators (capacity for innovation, company spending on R&D, availability of scientists and engineers, venture capital availability, and ease of access to business loans)7 that capture the development of an endogenous industrial model like China’s, China basically leaves Mexico in the dust. As China’s growth has demonstrated, that model is more strongly associated with steadily accruing value-added industry and with absorbing new technology. And that’s where Mexico needs to ramp up.

Mexico’s aerospace production is just one example where a more assertive and focused public policy has helped it compete in this sector. By forging new partnerships between aerospace firms and local universities in six targeted regions of the country and by training students for jobs that are specifically in demand in this sector, Mexico’s Ministry of the Economy is finally enabling producers to better cash in on the benefits of geographical proximity to the U.S. market. A similar process of transformation is under way in the medical devices industry, where incentives sponsored by Mexico’s Consejo Nacional de Cíencia y Tecnología, (National Science and Technology Council) are being used to nurture human capital and tailor skills acquisition to the actual jobs available within that sector. In the state of Baja California, where many of these high-tech firms are situated, companies are offered the opportunity to compete for up to $3 million in research grants geared specifically toward technological innovation. Those that create new jobs are given a multi-year holiday on payroll taxes for each new employee.

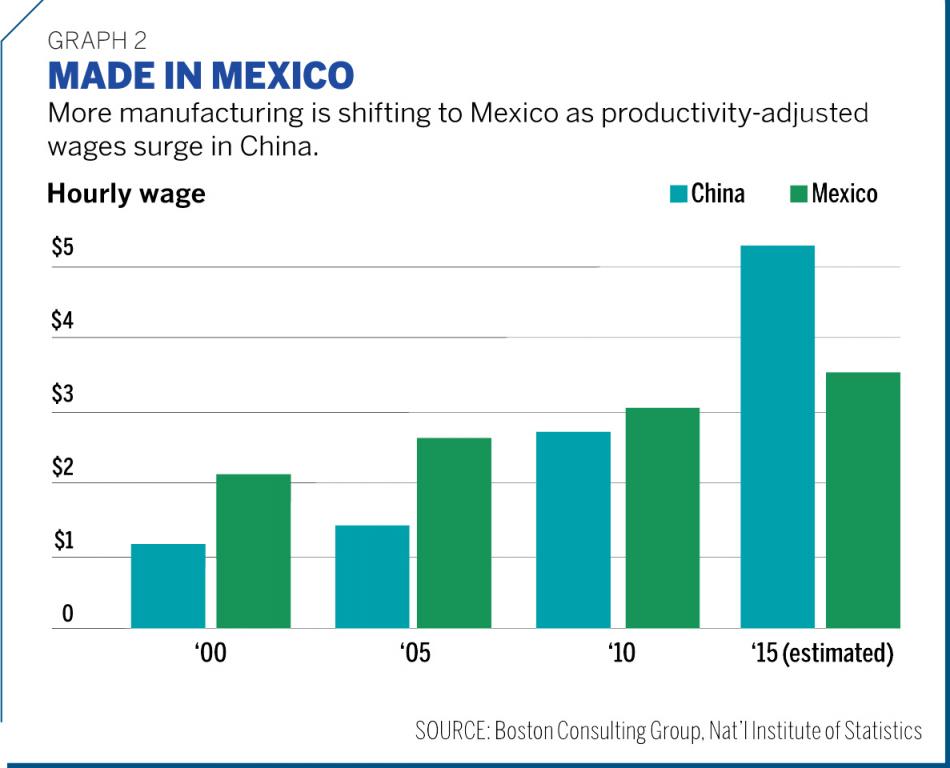

The auto/auto parts sector is a last frontier of sorts; it is the industrial sub-sector in which Mexico has maintained its strongest lead over China in exporting to the U.S. market. In 2011, Mexico accounted for nearly a quarter of U.S. imports in this sector, whereas China’s share was just 4 percent. Overall, Mexico is benefitting from a more competitive exchange rate vis-à-vis China during the past several years and, as Graph 2 shows, average wages in China’s domestic manufacturing sector are now running about 20 percent higher than those in Mexico. As these highly favorable macro-trends have kicked in, other selling points have enabled Mexico to further consolidate its hold over this sector. This would include, for example, lower transport costs, a high ratio of weight to value, and, in the case of auto parts, customized production and just-in-time delivery.8

Does all of this add up to a coherent, consistent policy for competitiveness? No, but it is definitely a step in the right direction. Pessimists and critics would no doubt point to the detriments of foreign ownership in aerospace, autos, and any number of other manufacturing sub-sectors in Mexico, and low wages are certainly nothing to brag about.

However, none of this excludes the possibility of developing a vibrant set of small and medium national firms to interface with and supply these sophisticated foreign companies now thriving in Mexico. These are the links that market strategies alone rarely forge in developing countries. It is thus incumbent upon the state to take the lead in fostering the kinds of innovation and technology adaptation necessary to productively expand output and incorporate domestic companies into the world-class value chains that now spread across the U.S.-Mexico border.