Nicolás Maduro is hanging on to power in Venezuela. How long he lasts may come down to how much support he gets from his non-hemispheric allies, including Turkey.

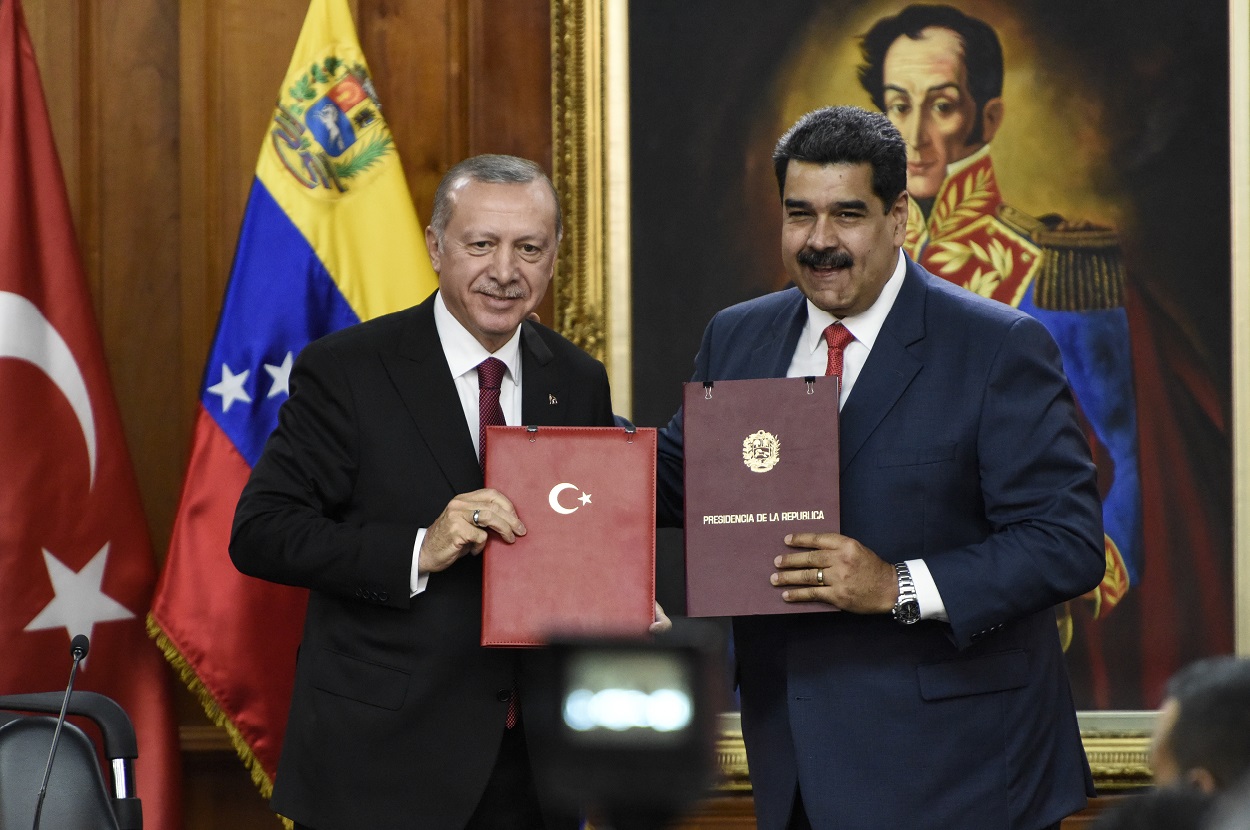

A NATO member and a longstanding but increasingly estranged U.S. ally, Turkey joined countries like China, Russia, Iran and India in backing Maduro’s legitimacy as president in January after more than fifty other nations recognized congressman Juan Guaidó as the country’s interim president. The close relationship with President Recep Tayyip Erdoğan offers Maduro a much-needed lifeline that might help his regime breathe under increasing isolation and sanctions.

But there is reason to believe Turkey’s ties to Maduro are breakable. The recent enthusiasm of Turkey towards Maduro is highly rooted in interests that are more pragmatic and less geopolitical compared to those of Russia and China, which have long sought to assert influence in the Americas. In fact, Venezuela’s crisis has been lucrative for Erdoğan’s government, assuring his support for the current government. The Maduro regime has sold a substantial amount of Venezuela’s gold to Turkey in exchange for basic food supplies. It was reported that a Turkish firm shipped nearly $900 million in gold from Venezuela to Turkey in the last year. In return, Turkey has become a key exporter for the Maduro government’s main clientelist food program (CLAP). According to reports, Turkey is currently supplying 69 percent of CLAP provisions in Venezuela.

Given this incentive to sustain the gold trade with Venezuela which provides Maduro support amid the oil sanctions, relations between Ankara and Washington appear to be heading toward a standoff. But there are several reasons to believe that the U.S.’s increasing pressure on Ankara could avert Turkey’s efforts to keep Maduro afloat.

First, Erdoğan’s defiance against Trump’s sanctions on Venezuela may push Washington to take new punitive steps against Turkey. Washington may even impose sanctions on Turkey as it did last year over the imprisonment of a U.S. pastor in Turkey who was accused of spying and aiding terrorists.

The early reactions of the Trump administration confirm this possibility. Recent reports claimed that the Turkish government is coming under renewed pressure by the U.S. to cease buying gold from Venezuela. U.S. Senator Marco Rubio warned Turkey and the United Arab Emirates not to be “accomplices” in the “outrageous crime” of shipping gold out of Venezuela. Moreover, Senator Ted Cruz of Texas is now pushing for legislation that would punish countries, industries or financial institutions caught moving gold from Venezuela.

Beyond that, the Trump administration recently warned foreign financial institutions and banks that they may face U.S. sanctions if they engage in transactions benefiting the Maduro government. This move also concerns the Turkish government given the fact that some state-led Turkish banks engage in transactions with the Venezuelan financial institutions. In addition, the Trump administration’s plans to terminate the status of India and Turkey as beneficiary developing countries under the Generalized System of Preferences indicates that the U.S. is seeking to put some pressure on non-hemispheric allies of Maduro.

Such economic pressure from the U.S. may be too much for Turkey’s unstable economy to handle. As Washington’s previous sanctions policy demonstrated, the United States could inflict serious damage on Turkey through sanctions and push Erdoğan to scale back his support of Maduro.

Further, any miscalculation in Venezuela could spell trouble for Turkey’s relations with other Latin American countries, which it has been working to strengthen in an effort to diversify its partnerships outside its traditional sphere of influence. Therefore, Latin American countries, especially Lima Group members, may increase their pressure on Erdoğan government to deter the latter’s engagement with the Maduro regime. Turkey would likely prefer not to risk its investments and cooperation in the region because of its closeness with the Maduro regime.

Finally, Guaidó may appeal to Turkey’s pragmatic stance by beginning direct negotiations with the Turkish government as it has with the Chinese officials. Guaidó and his team may convince Ankara to support a transition government in the country by providing some assurances to the Turkish government to sustain its investments in the post-Maduro era.

Against this backdrop, it is not unlikely that the Trump administration, Lima group members and the Venezuelan opposition could successfully put the brakes on Turkey’s fervent support for the embattled Maduro regime. Cutting Turkey’s financial lifeline to the Maduro regime could further corner his government in the face of rising isolation and pressure from the Western Hemisphere. Moreover, this move will show the determination of both the U.S. and Lima Group members not to tolerate any attempt to keep Maduro afloat through the alternative mechanisms by the non-hemispheric actors.

—

Oner is a senior policy analyst at Jack D. Gordon Institute for Public Policy at Florida International Institute. He served as a career diplomat in the Ministry of Foreign Affairs of Turkey. He was a political officer and deputy head of mission at the Turkish embassy in Caracas, Venezuela, from 2014 to 2016.