TORONTO — President Donald Trump’s protectionist policies and talk of annexation are forcing Canada to rethink its strategic posture, with implications for economics and politics across North America. Canada must confront its deep trade dependence on its southern neighbor as a 25% U.S. tariff on most Canadian imports—energy products will be tariffed at 10%—is scheduled to take effect on March 4. The United States-Mexico-Canada Agreement (USMCA) is set for review next year, bringing the region’s economic future into the spotlight as Canada gears up for a general election in October.

Tensions between Canada and the U.S. have escalated to an unprecedented level due to President Trump’s persistent “51st state” rhetoric. He even suggested that annexing Canada would serve U.S. national security and resolve what he claims is a $200 billion trade deficit.

The reaction in Canada has been swift. Calls for boycotts of U.S. products are gaining traction, favoring a “Made in Canada” policy. A recent poll found that one in four Canadians now views the U.S. as an enemy and that 74% hold an unfavorable opinion of Trump. According to another poll, Canadians’ favorability toward the U.S. peaked in 1995 at 81% and currently stands at 39%. The Canada-U.S. alliance, once one of the most stable in global politics, is now fraying.

The Trump effect on Canadian politics

Trump’s positions have fueled nationalist sentiment in Canada and placed pressure on its leaders to assert their economic security approaches as they prepare for a federal election set for October 20. The political landscape has shifted dramatically since Prime Minister Justin Trudeau’s resignation as Liberal Party leader in January triggered a leadership vote on March 9. This opens up the possibility of a snap election before October.

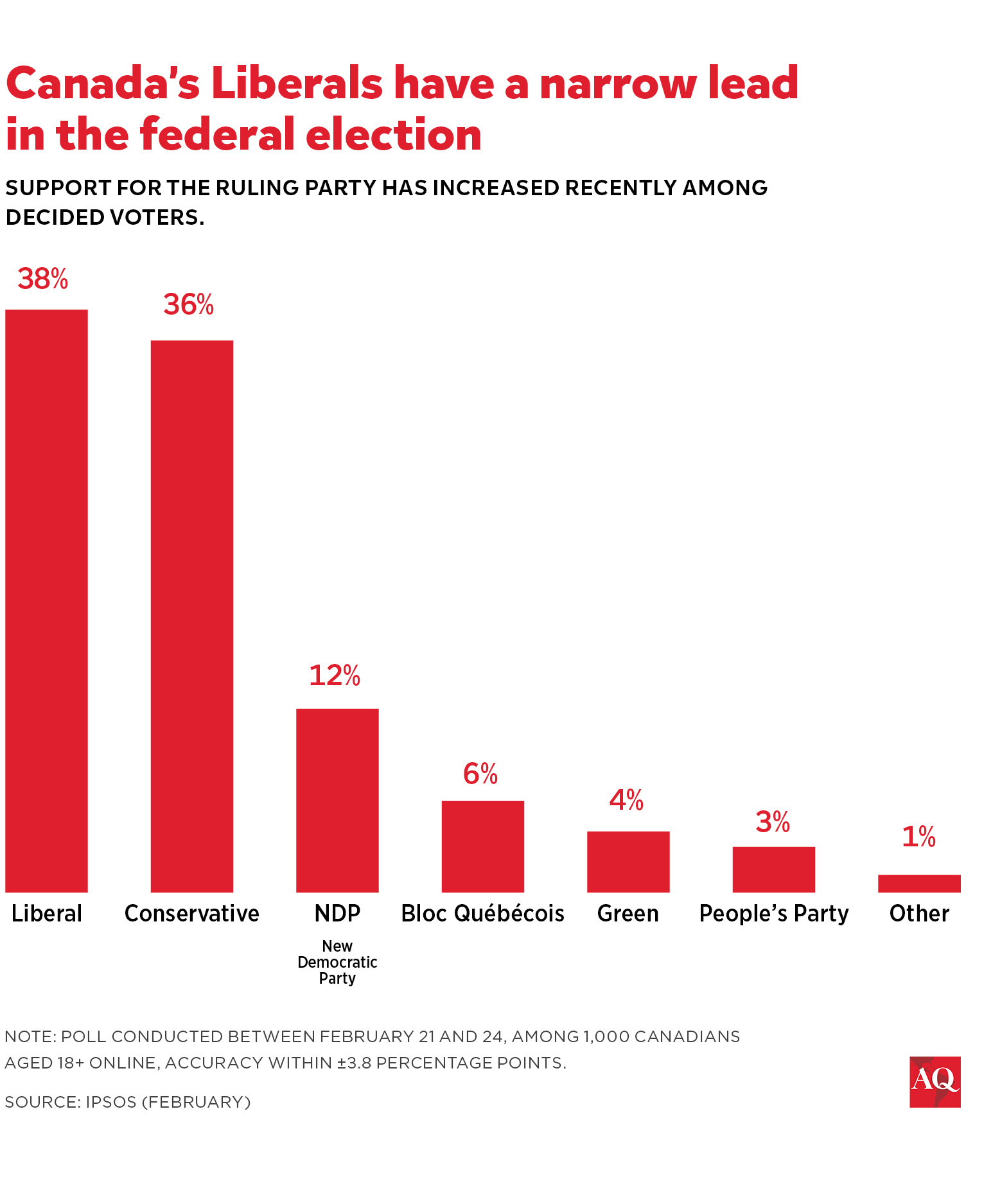

For much of the past 18 months, Pierre Poilievre’s Conservative Party seemed unbeatable, leading by 25 points in a poll from December. Widespread dissatisfaction with Trudeau’s leadership created an open path to victory for Poilievre. That changed as Trump’s aggressive stance fundamentally altered the election’s focus, turning it into a vote about who can best defend Canada against Trump’s threats.

Mark Carney, former Bank of Canada governor and a political outsider, has surged to the head of the Liberal leadership race. He has amassed $1.3 million in donations and secured endorsements from 83 Liberal MPs, positioning himself as the Liberals’ best hope.

Carney proposes to balance the budget in three years, cut taxes for the middle class, increase infrastructure investment, and reduce Canada’s reliance on the U.S. through diversified trade agreements. Last year, 75.9% of Canada’s exports were sent to the U.S., and 62.2% of Canada’s imports originated from the U.S.

He advocates for strengthening ties with nations that share Canada’s values, highlighting the UK, the EU, and “leaders in Asia” as potential partners. “What had been our closest friend and ally now is just our neighbor. The Americans are just our neighbor,” Carney said recently, denoting the change in tone of the bilateral relationship. A recent Nanos poll found that Canadians trust Carney over Poilievre by 14 points to negotiate with Trump.

In contrast, Poilievre, who has led the Conservative Party since 2022, finds himself in a delicate position. According to recent polling, 2% of Liberals approve of Trump, compared 46% of Conservatives, making it politically risky for Poilievre to take a hard stance against the U.S. president. Instead, he has focused on domestic issues, affordability, carbon taxes, and cost-of-living concerns. Only recently has Poilievre pivoted toward a “Canada First” platform, pledging to increase military spending, reinforce national identity, and reduce economic dependence on the U.S. But his delayed response may have already cost him momentum. Polls suggest that if Carney wins the leadership vote on March 9, Liberal support could surge to 40%, while Poilievre’s would be at 38%.

Economic impact and USMCA

Trump’s presidency is set to disrupt North American trade. In 2024, U.S. total trade in goods with Canada reached $762 billion, and the U.S. goods trade deficit with Canada was $63.3 billion. The USMCA is set for joint review in 2026, and Trump’s policies may indicate plans to expedite this review to this year. However, his recent comments criticizing the agreement could potentially lead to its cancellation. The USMCA includes a provision allowing any party to withdraw by providing written notice, with withdrawal taking effect six months later. The uncertainty surrounding Trump’s trade measures casts a long shadow over the economic outlook for both Canada and Mexico.

Mexican President Claudia Sheinbaum has pursued a more pragmatic strategy than Trudeau in dealing with Trump, emphasizing economic cooperation and investment incentives to maintain stability in U.S.-Mexico trade. Both Canada and Mexico secured temporary pauses on the new tariffs, but Sheinbaum has made significant concessions. Mexico deployed 10,000 National Guard members to secure the border, agreed to receive U.S. deportees, and prepared border cities for their arrival. In a historic move, Mexico sent 29 cartel leaders to the U.S. on February 27.

Trudeau announced 25% retaliatory tariffs on $107 billion worth of American goods, initiated a remission process for affected Canadian businesses, and encouraged Canadian businesses to diversify their markets beyond the U.S. He has warned that tariffs against Canada would have “disastrous consequences” for the U.S. In response to Trump’s January tariff threat, Trudeau implemented a $900 million border security plan, including appointing a fentanyl czar, deploying new technology, and launching a joint task force to address U.S. concerns about border security and drug trafficking.Canada also designated Mexican cartels as terrorist groups.

How can Canada stand up to Trump

Canada should act quickly to diversify its trade relationships beyond the U.S. The B7 Summit in Ottawa in May presents a crucial opportunity for Canada to forge new partnerships as business leaders from the G7 gather to discuss the political and economic outlook.

The country should also address security challenges and build diplomatic coalitions, as defense has now become a campaign issue. Canada spends only 1.37% of its GDP on defense, with spending projected to peak at just 1.49% in 2025-26—still below NATO’s 2% target. In response, Defense Minister Bill Blair has proposed to accelerate the 2% defense spending target to 2027 instead of 2032. Defense has become a central election talking point, shaping voter perceptions of national security.

Meanwhile, Canada’s role in NATO and the G7 is gaining significance. On Trudeau’s recent visit to Brussels, he met with NATO Secretary General Mark Rutte and reinforced Canada’s commitment to the bloc—Canada’s troop presence in Latvia continues to bolster NATO’s eastern flank. The country’s G7 presidency this year offers a rare opportunity to assert global leadership when U.S. unpredictability threatens to upend the international order.

Canada-U.S. relations are no longer just about diplomacy. This year’s federal election represents a pivotal moment for national security, geopolitical strategy, and sovereignty. How Canada addresses it will shape its future and the North American alliance.