Founded 2014

Annual revenue $18,000 (2019)

Jobs created

5 employees in factory and about 3,000 forest suppliers in 36 Amazonian communities

Global cocoa market

approximately $9 billion (2019)

Global chocolate market

$135.65 billion (2019)

Projected growth of chocolate market

4.6% from 2020 to 2027 annually, according to Grand View Research

This article is part of AQ’s special report on sustainable development of the Amazon.

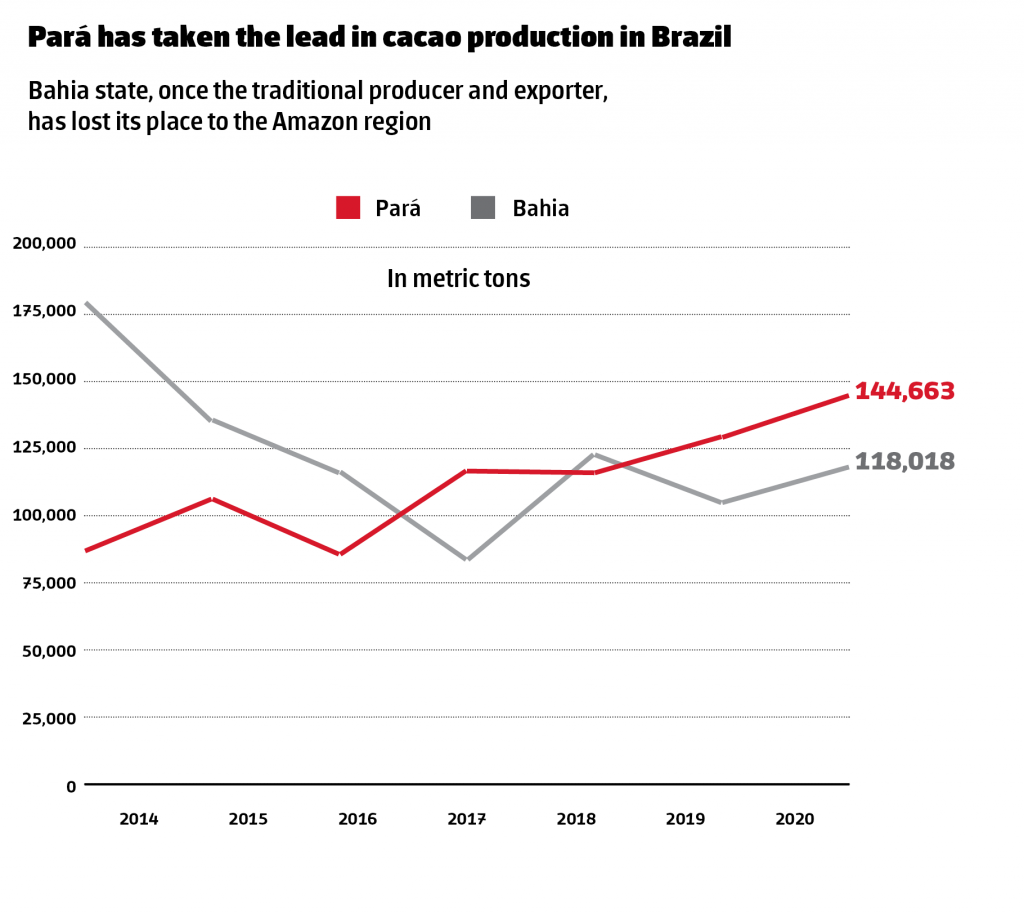

With chocolate becoming ever more popular (even as a stress-buster!), global consumption is outstripping production. Western Africa produces three-quarters of the world’s supply of cacao, but the Brazilian Amazon – a native region for this fruit tree – could become a new frontier. Production in the state of Pará has increased more than 70% since 2014 and productivity is double the national average.

“In the rainforest there are more than 35,000 varieties of cacao,” said Cesar De Mendes, a chemist who traded a doctorate at the University of Cambridge for a life of chocolate in the Amazon. In 2014, he founded a tree-to-table chocolate business in the Colônia Chicano community in Belém, betting on specialty flavors.

“Cacao trees that grow among other vegetation give chocolate different tastes,” De Mendes told AQ.

De Mendes has been working with traditional communities to meld his knowledge and theirs, creating blends like Yanomami chocolate. His company sources cacao exclusively from traditional communities and pays them up to six times the market rate for the fruit.

Although current profits are modest, De Mendes is breaking into international markets.

Today, De Mendes produces 1 ton of chocolate a month and decided he had to grow his business to have a greater impact on the rainforest. The first challenge was to find an investor who respected his relationship with local communities. In late 2020, he signed a partnership with CBKK, an impact investor based out of São Paulo, and now Chocolates De Mendes is looking for land to build a larger factory to increase production fivefold, upgrading standards for exports and implementing blockchain systems to manage cocoa traceability.

Pará today accounts for more than half of Brazil’s cacao production, from a mix of wild, agroforestry and monoculture plantations. Yet the real opportunity lies in specialty chocolate production, according to CBKK. And a growing trend of artisanal chocolate makers are following De Mendes’ footsteps.

“The region can become a destination for boutique blends, attracting tourists as well as exporting,” De Mendes told AQ. “I don’t want to be the owner of this, but to promote a chocolate-producing ecosystem.”