This article is adapted from AQ’s special report on closing the gender gap.

The evidence is clear: Investing in women is good business. If women in every country were to play an identical role to men in markets, McKinsey Global Institute calculates as much as $28 trillion, or an extra 26%, could be added to global GDP by 2025.

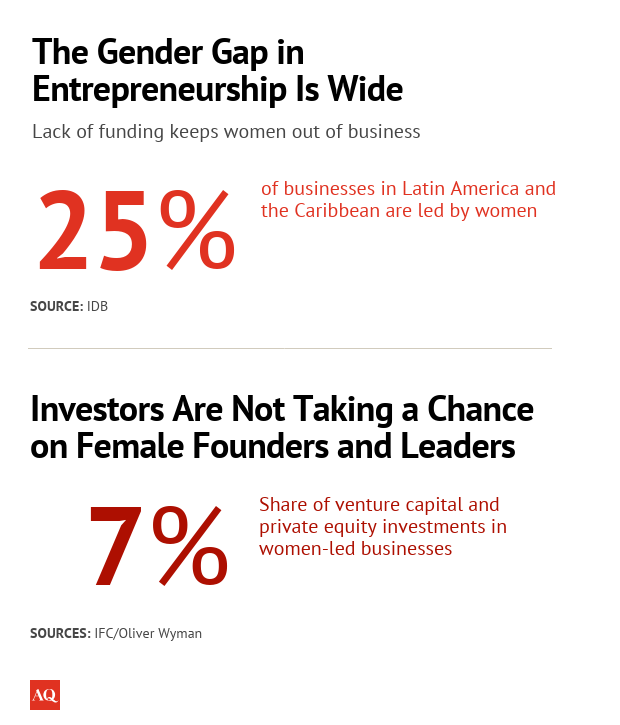

In Latin America and the Caribbean, one of the most entrepreneurial regions in the world, we also have one of the highest failure rates for female entrepreneurs. Without funding, women-owned businesses are unable to grow beyond the category of a microenterprise or move out of the informal economy, and this has an impact on economic growth.

Closing this gap depends not only on governments adopting favorable public policies but also on fostering an enabling environment with the active engagement of the corporate sector. There is an opportunity for the private sector to advance equality by incorporating a gender lens in innovative financing. This lens can help identify avenues for developing social and financial value, including innovations in fields in which women are traditionally underrepresented.

It is crucial that the profitability and impact of new financing mechanisms or investment vehicles that are relevant to the needs of women are, in fact, made visible.

To build the supply side, we must also expand and strengthen training and mentoring of women entrepreneurs, to get them ready to compete for opportunities. For example, international financial institutions can expand targeted credit lines for banks that offer training for women.

Peer-to-peer networks are very effective, but we need to strengthen investor networks. The European Union has their online platform, Wegate; the World Bank’s private-sector investment arm, IFC, has We-Fi; and UN Women is developing a proposal for a financial initiative to increase women-led innovation and business ventures between Latin America and the Caribbean and the European Union.

And finally, we must increase the participation of women as investors. Today, numbers from the IFC show that women-led business received a meager 7% of all private equity and venture capital investments. A recognition of the crucial role of women investors as agents of change and their impact in the economy is also needed. And research shows firms where there is gender balance among investment officers actually have higher returns.

Coupled with existing barriers, the COVID-19 crisis is having a disproportionate impact on women and girls. If we don’t act now, the overrepresentation of women in the informal sector means existing inequalities, especially the lack of access to productive resources, will increase, deepening the gender gap.

It is crucial that we do not allow the current economic and social crisis to move gender equality to the back burner, because now — more than ever — it is essential to invest in women.