On a recent summer afternoon, Carlos Gamez, a project manager at solar energy provider Enlight, was overseeing a home installation in the affluent Mexico City neighborhood of Lomas de Chapultepec. Workers prepared to tilt two dozen or so panels to 19 degree angles toward the equator, and position them far from the shade of a nearby pine.

“We used to do five installations in a week, and now we do more than 30,” said Gamez, who previously worked for a natural gas company installing boilers and pipes. “It’s the industry of the future.”

Gamez’s optimism is understandable. Enlight, which has installed 5.5 megawatts worth of solar capacity on rooftops in Mexico’s capital over the last six years, recently formed an alliance with French utility giant Engie with the aim of adding 40,000 customers by 2022. The company is one of hundreds of home installers and larger producers that are taking advantage of recent energy reforms that ended national utility CFE’s monopoly over electricity generation, boosting the solar market.

But whether solar energy – and the renewable sector more generally – can be Mexico’s “industry of the future” will partly depend on the government’s ability to deepen ongoing reforms and sell investors on logistically challenging development opportunities. And to that end, there are obstacles ahead.

The first may be CFE itself, which lost its monopoly over electricity generation as part of reforms signed into law by President Enrique Peña Nieto in 2014.

In a letter to Mexico’s Energy Regulatory Commission in May, representatives of the household, or “distributed”, solar industry voiced a complaint against the utility, claiming its subsidiaries CFE Distribución and CFE Basic Supply had stalled the connection of household solar panels to the nation’s electrical grid, slowing growth.

CFE, which loses revenue when homeowners switch to solar, has opposed regulatory commission guidelines that require it to give out subsidies to solar panel owners who stay below their consumption allowance, saying the current rules do not take into account transportation and distribution costs shouldered by the utility. CFE’s pushback is seen by some as part of understandable growing pains for Mexico’s refurbished electricity market.

“Mexico is adjusting from an industry dominated by one player to an open market,” said Alfredo Alvarez, an analyst at accounting firm Ernst & Young. “You don’t see those changes from one day to the next.”

But CFE may have no choice other than to adjust to its new reality. Ongoing regulatory changes point toward further renewable development in the future. Rules put in place this year, for example, increased the system size cap for net metering from 10 to 25 kilowatts for residential customers, allowing users to sell a larger amount of excess energy produced by rooftop solar panels back to the grid. With other financing options like bank loans limited for many Mexican consumers, net metering provides a crucial incentive for the country’s base of potential solar users.

Large utility-scale projects have also benefited from Mexico’s energy reforms. The country’s first two open auctions for electricity generation projects doled out the equivalent of 8.86 million megawatt hours of production to solar energy projects, compared to 5.26 million megawatt hours for wind and around 200,000 megawatt hours for geothermal projects, according to analysis from Ernst & Young. Solar per megawatt-hours also reached one of the lowest median prices in the world thanks to system pricing that is projected to be more affordable in Mexico because of cheaper labor costs and import tariffs.

Still, though Mexico’s solar potential is among the strongest in the world, its solar market remains small. As of January, electricity generated from solar resources in Mexico made up just 0.23 percent of the total, compared to 5 percent in California and 55 percent in Denmark, according to the Mexican Ministry of Energy. And while the country’s first two bid rounds were viewed favorably by international developers, much will likely depend on foreign investors’ continued appetite for projects that present financial and logistical challenges, like a lack of high voltage transmission lines. Such infrastructure would need to be in place for developers to tie their projects into the grid and make investments worthwhile.

“You can’t add capacity or generation without making sure that it gets where it needs to go,” said Manan Parikh, an analyst at GTM Research, noting that Mexico will need to ramp up transmission capability to avoid bottlenecks or curtailments at large power plants.

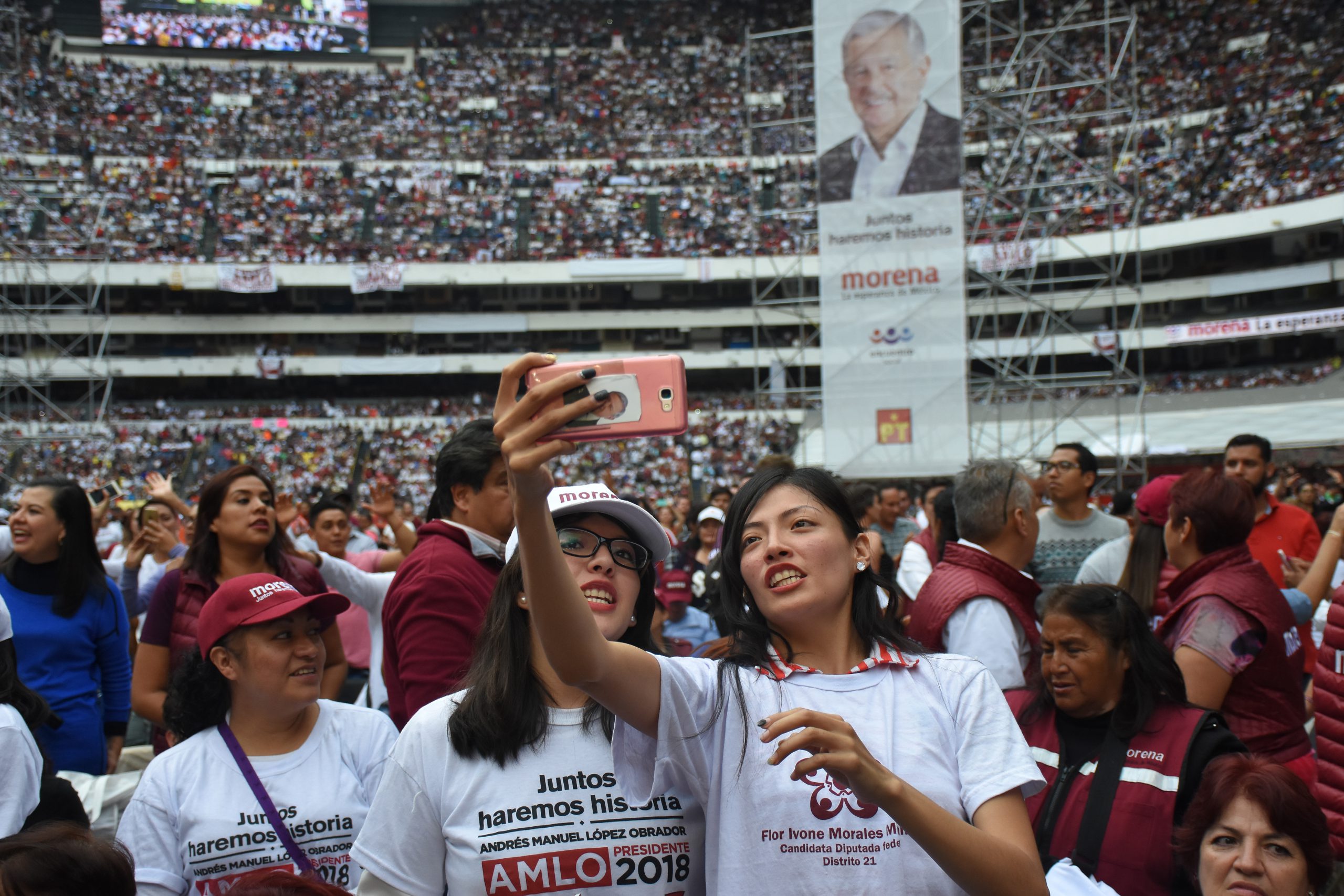

Politics is also a factor. Less than one year from a presidential election, Mexico’s energy opening remains a source of heated debate among the probable candidates – none more so than the populist former mayor of Mexico City, Andrés Manuel López Obrador. Among the leaders in most polls, López Obrador has signaled his commitment to renewable growth but has come out vociferously against Peña Nieto’s opening of the energy sector to foreign competition. His victory could inject uncertainty into an industry that already faces significant challenges to consolidation and development.

Despite such challenges, with the right policies in place there are few who doubt the growth potential of Mexico’s solar market. After developers won the rights to construct solar power plants in the first auction last year, GTM Research forecast solar in Mexico would grow by 134 percent in 2017, as opposed to an earlier estimate of 77 percent. The Mexican Ministry of Energy projects installed solar capacity to reach 6,890 megawatts by 2030, up from 1,031 at the end of 2016.

For now, Gamez, the project manager for Enlight, is just looking forward to his next job. After watching his work crew haul materials up the side of a large pink home on a recent afternoon, he hopped on his motorcycle and rode off to yet another installation.

—

Schachar is a journalist based in Mexico City