On March 5, news broke that senior officials in the Biden administration had landed in Caracas to meet with counterparts in Nicolás Maduro’s government. The United States broke diplomatic relations with Venezuela in 2019, and recognizes opposition leader Juan Guaidó’s claim to the presidency.

AQ asked observers to share their reaction to the visit and their thoughts on what lies ahead for diplomatic relations and Russia’s influence in the hemisphere.

Francisco Monaldi, Fellow and Director of the Latin American Energy Program at Rice University’s Baker Institute for Public Policy:

Can relaxing oil sanctions to Venezuela alleviate the “oil crisis” prompted by Russia’s invasion of Ukraine? In the short run, it would not have any relevant effect in the world oil market, but perhaps it could help some refiners in the U.S. Gulf of Mexico to replace Russian oil imports. Venezuela produces less than 800 thousand barrels per day (bpd) and has little remaining production potential, therefore, in the next few months, it would be challenging to sustainably surpass 1 million bpd. Russia produces 11 million bpd and exports more than 7 million bpd. So, Venezuela’s additional production would be irrelevant to compensate for a major disruption of Russian exports.

Nevertheless, when Venezuelan oil was banned from the U.S., Russian exports captured most of the market left by Venezuela’s heavy oil, particularly in the Gulf region. Thus, redirecting Venezuelan oil exports to the U.S. from Chinese markets, could help ease the difficulties faced by U.S. refiners to replace current Russian imports. That would also provide a rationale for extending licenses to Chevron and other Western companies to export oil from Venezuela, making viable their operations in the country. Would it matter for the price American consumers pay at the pump? Very little.

If sanctions impact Russia’s oil exports for a prolonged period, Venezuela could become an important source of supply diversification, but it would highly depend on the institutional environment in the country. Under the right conditions, Venezuela could add around 2 million bpd (or around 2% of the world’s supply) in about 5 years. That would require massive investment of upwards of $12 billion per year, which under the current investment environment (and government) is unlikely to materialize. Even with a change to the hydrocarbons law, allowing Western oil companies to have majority ownership and operational control, the above-ground risks, lack of credibility, and collapsed state capacity, could prove very significant obstacles. If the U.S. wants a reliable long term oil supplier, with vast reserves, in the hemisphere; institutional and political change would have to occur.

Maryhen Jiménez, PhD, postdoctoral research associate at the Latin American Center at the University of Oxford:

The U.S. has yet another great opportunity to “make a case for the West” in Venezuela. Weakening Russia’s influence in Latin America will require smart persuasion and powerful incentives, ideally with bipartisan support for it to be sustainable. Beyond any potential economic interests in the future, the current geopolitical context allows the U.S. and other Western allies to cut Venezuela’s dependency on foreign autocracies and reinsert the country in Western economic and political relations. Two questions remain. One, can this high level meeting help actors resume negotiations talks? Second, can both countries resume diplomatic relations to benefit citizens? If they do, the U.S. needs to focus on a clear road map that includes clear liberalizing steps and humanitarian assistance.

Eric Farnsworth, Vice President, Council of the Americas:

The context for this trip was clear enough: U.S. inflation at historic levels, a European ground war to contain, and gas prices that could contribute to a mid-term electoral wipeout and wreck much of the President Biden’s domestic agenda. As for the talks themselves, the potential benefits of a breakthrough are significant, especially since Venezuela enjoys the world’s largest proven reserves of oil.

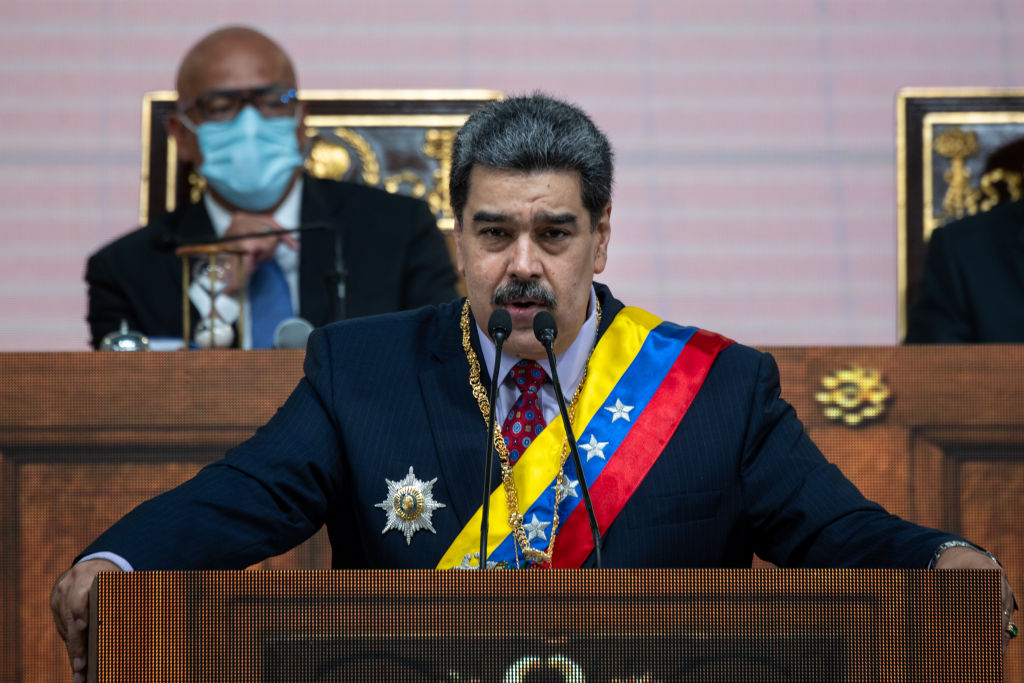

But the likelihood of a bilateral accommodation is virtually non-existent. Of course there were the obligatory maximalist demands from both sides, a performative dance with little chance of success. Reports indicate these included, from the United States, free and fair elections and the release of political prisoners including U.S. citizens held hostage by the regime. On the other side, a demand for full sanctions relief. In reality, though, this one quick in-and-out to Venezuela comes with a hefty price tag. At once, the United States returned to the transactional diplomacy so reviled by many observers during the Trump years. More to the point, the optics of traveling to Caracas to seek increased hydrocarbons from a brutal dictator under indictment by the U.S. Justice Department and under investigation at the Hague empowers Maduro and may also be all that’s needed to convince observers that in the end, it really is all about oil and not democracy. Indeed, Interim President Juan Guaidó, recognized by Washington as Venezuela’s legitimate leader, was kept in the dark. If Washington now seeks accommodation with the Maduro regime, perhaps on a temporary but indefinite basis, why would anyone including regional and European allies take risks to seek a democratic restoration in Venezuela?

And the thing is, the United States doesn’t actually require Venezuelan crude, even if Washington institutes a full embargo. Most Russian crude will go instead to China and India, likely at a discount, but will not long remain off global markets. Higher prices will induce more global production, including U.S. domestic and Saudi, which can come on line quickly. Massive deposits of Canadian crude are also available, and, despite the flap over the Keystone XL pipeline, are no dirtier or worse for the environment than Venezuela’s own heavy, dirty oil. On the other hand, Venezuelan crude, the product of a decrepit national industry, would require many months and billions of dollars and scarce drilling rigs and increasing numbers of petroleum engineers to ramp up in any meaningful way, just at the same time when the rest of the world will be seeking the same. It all adds up to a curious and risky White House gambit for a commodity the United States does not even need.