Since election day on July 1, Mexico’s President-elect Andrés Manuel López Obrador has taken several steps to calm market nerves, promising fiscal discipline, naming moderates to key economic positions, and pledging not to meddle in Central Bank policy.

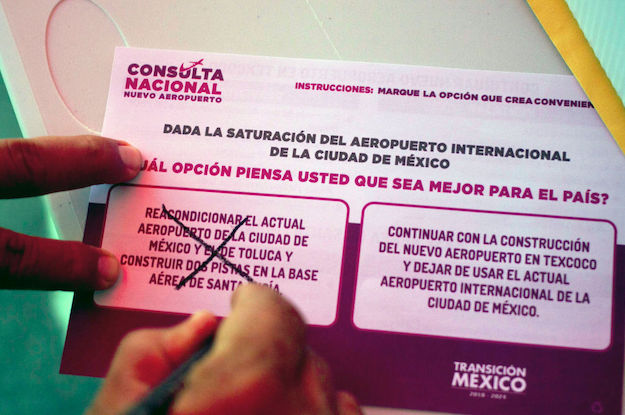

Then came the airport. On Oct. 28, following a contentious “public consultation” on the subject, AMLO, as he is widely known, said he would cancel a $13 billion airport project underway outside Mexico City in favor of a cheaper alternative championed by his team. The decision to cancel the project – which is already around 30 percent complete – shook investor confidence. With a month to go before he takes office, can AMLO regain their trust?

To find out, AQ spoke with Mariana Campos, director of the public spending and transparency program at México Evalúa, a think tank based in Mexico City. This interview has been edited for clarity and length.

Americas Quarterly: The consultation and López Obrador’s pledge to cancel the new airport project has riled financial markets, weakened the peso and led to a potential deterioration of Mexico’s credit rating. Why this reaction, considering AMLO’s opposition to the project was already well known?

Mariana Campos: The main issue is the decision-making process itself. What worries markets and ratings agencies the most is that such an important decision was made in a very informal, irrational way.

The development of the new airport has never been free from controversy, even before AMLO. Many experts say the current project could limit Mexico City’s ability to increase and improve its water supply, which is a very grave problem: the city is one of the most populous urban centers in the world and it’s running out of water. But there are other experts who say the project doesn’t pose that kind of threat. What is missing from both the current administration and the incoming one are formal answers to that uncertainty.

There’s also uncertainty over the cost of canceling the current project. The incoming government made a decision without a full study of the fiscal and budgetary impact. And there is even less information about the alternative, which involves converting the Santa Lucia military base for commercial use. No one right now can say how much Santa Lucia will cost because it isn’t a developed project that we can budget. The International Air Transport Association has also said that, though the Santa Lucia project is technically viable, it won’t solve Mexico City’s airspace congestion problem.

AQ: Do you foresee a long-term impact on Mexico’s ability to finance other projects and its own debt going forward?

MC: Some ratings agencies have already put Mexico’s credit rating on a “negative” outlook. Three years ago, we were in the same position, a result of bad management of excessive debt and mediocre economic growth. The government for the next two years had to take extreme measures to avoid losing our investment grade. We are only just now rebuilding.

In this case, whether Mexico’s credit rating goes down or not, the country premium risk has already been affected. I believe the question the markets and investors are asking themselves now is: Is this how things will be decided from now on? I think that’s the most significant cost of this decision. It affects confidence and trust, and when you don’t generate trust, it affects governability. You only need to look at the current administration for proof of that.

AQ: What are the options to restore confidence?

MC: Before anything, the incoming government needs to get studies done, both on the technical and financial impact of this decision. López Obrador shouldn’t simply shut down the project on Dec. 1, when he takes office. Mexico has many challenges when it comes to developing infrastructure, but we don’t have an infrastructure law. We need to create a legal framework that defines proper timing for construction, leaves less space for discretion and can also regulate the closing of projects, even under these circumstances.

AQ: One of the arguments against the project is that it was expensive and the money could have better use elsewhere. But part of it was financed with loans and bonds that have to be repaid.

MC: The government borrowed money because they could guarantee this debt repayment with the revenue from the airport tax. That’s a smart way to do it. But people voted in the consultation without really knowing about that or how this debt will now be repaid. Much of that is due to a lack of transparency. Say, for example, that the project is canceled as of Jan. 1. The public doesn’t know if we have to repay all of the debt in 2019, or whether it can be repaid over a longer period. That’s part of the problem: people made a decision without knowing the impact.

AQ: Beyond financial markets, there are corporate players investing in energy, looking at public-private partnerships. Can this have an impact in other infrastructure projects? Is it going to impact Mexico’s ability to finance its infrastructure?

MC: It will depend on what happens on Dec 1. On one hand, the new government could react to this situation by renegotiating contracts, or trying to maintain the current project through a concession or by making it entirely private. But if the project is scrapped without much more transparency on the reasons why, then it could indeed affect other projects.

We’ve always had this Achilles’ heel in Mexico, where we don’t have a clear infrastructure investment portfolio with developed projects to show private investors. Now we’ve jeopardized their trust. That’s why we need to develop a clear policy for infrastructure. If this really is going to be the fourth transformation of Mexico, as López Obrador says, then his government will need to develop a sound infrastructure policy, one that attracts private investment in public infrastructure and, most importantly, that provides for adequate development of projects before construction gets underway.

—

Tornaghi is managing editor at AQ